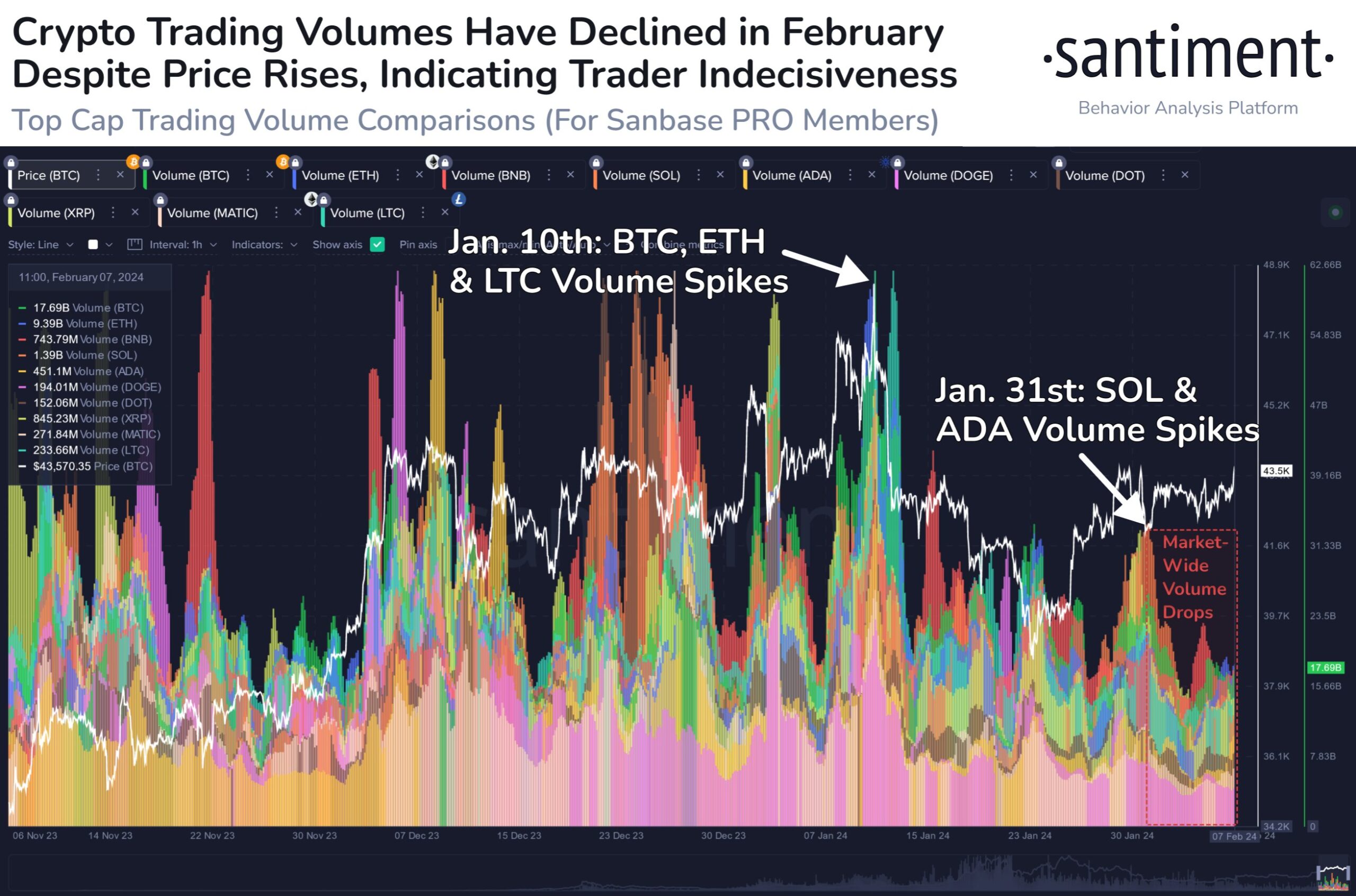

Santiment’s latest data reveals that the transaction volume in the crypto market, covering 2,842 tracked assets, has reached 288 billion dollars in the last seven days. However, this figure reflects a significant decrease of 22% compared to the previous week. What does such a situation mean for Bitcoin and the cryptocurrency market?

Market Analysis and Potential Trends

Such a significant drop in transaction volume indicates a decision paralysis among investors. The market seems to be experiencing a stagnation with no decisive movements. This phenomenon usually signifies uncertainty and caution among investors, leading to a temporary slowdown in trading activities.

Crypto Traders Are Rushing to This App – Here’s Why You Should Too

Crypto Traders Are Rushing to This App – Here’s Why You Should Too

The prevailing sentiment among investors is crucial for understanding the dynamics of the crypto market. The Fear of Missing Out (FOMO) and Fear, Uncertainty, and Doubt (FUD) are often two opposing forces that influence market behavior. Currently, the absence of significant fluctuations in the market contributes to a calm atmosphere where FOMO and FUD seem to be dormant.

Predicting Future Market Behavior

However, the calmness in the market is unlikely to last forever. Historically, periods of low volatility are often followed by significant market movements. Therefore, it makes sense to expect a resurgence of either FOMO or FUD when the next major market fluctuation occurs.

For investors navigating these uncertain waters, adopting a cautious yet proactive approach is recommended. Monitoring market indicators and staying informed about relevant news and events can help anticipate potential shifts in sentiment. Moreover, maintaining a diversified portfolio and implementing risk management strategies are essential to minimize losses during periods of increased volatility.

In conclusion, the recent drop in crypto transaction volume points to a period of stagnation in the market. While this may indicate decision paralysis among traders, it also presents an opportunity for strategic planning and preparation. Investors, by staying alert and adaptable, can position themselves to benefit from future market movements, whether driven by FOMO, FUD, or other factors.

As this article is written, the price of Bitcoin has just breached the 44,000 dollar mark again. However, the direction of its new trend remains uncertain.

Türkçe

Türkçe Español

Español