The crypto market continues its eager wait. Accordingly, the first week of the year will be somewhat calm for Bitcoin investors, focusing on ETF applications amid macroeconomic concerns. The first turning point of the year, the Federal Reserve’s decision on interest rates, will only be announced at the end of the month, with very little data coming from the US on the subject.

FED Decision and Bitcoin

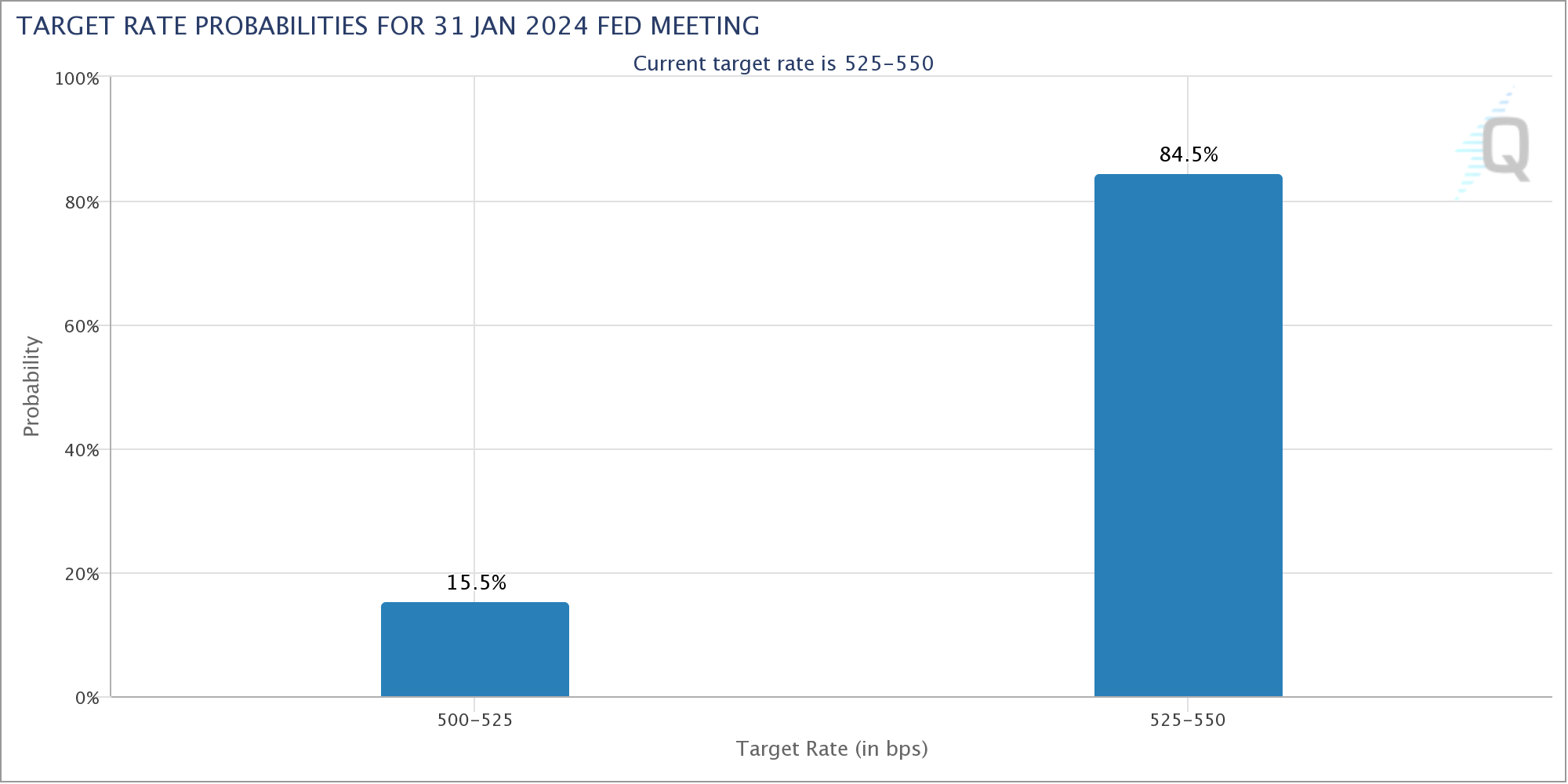

Inflation in the US is trending downward, and market expectations suggest that preparations for the Fed to pivot are increasing, which also starts to end two years of interest rate hikes. According to data from CME Group’s FedWatch Tool, the probability of this decision happening this month is still just over 15%, which is low. Markets say it is more likely that current levels will continue until March.

Jim Bianco, the president of the institutional research firm Bianco Research, considered how the rest of 2024 might unfold, taking into account the effects of the US presidential elections, and shared the following statements:

“Since 1994, the Fed has explicitly targeted the federal funds rate. Therefore, the reductions made in the years of presidential elections over the last 30 years mainly occurred because everything hit the fan and the Fed had to act.”

Bitcoin’s Halving Process

The foundations of the Bitcoin network are starting in an upward mode for much of the previous year, as in 2024. The upcoming halving event will push competition among miners to unprecedented levels. According to data from the monitoring platform BTC com, the difficulty level will rise by about 1.5%, reaching 73.1 trillion.

December was a particularly high month in terms of miners’ revenues. The Ordinals hype helped fees exceed the multi-year average, leading to daily earnings exceeding 1,500 Bitcoins on December 16th. The halving event will be on every miner’s radar, and in April, block rewards will drop overnight by 50%, falling to 3.125 Bitcoins per block.

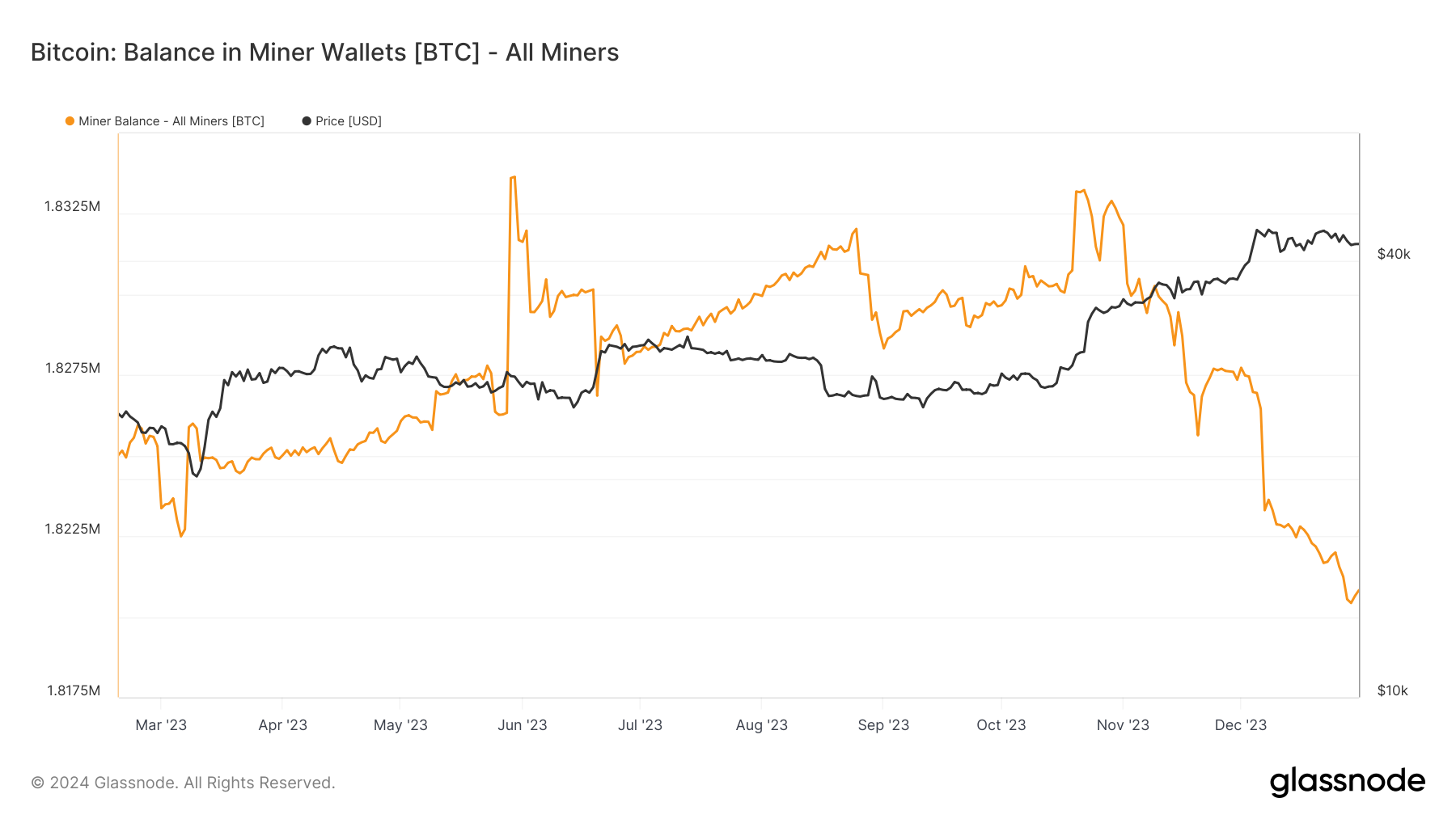

As confirmed by data from blockchain data analysis firm Glassnode, miners began to make a profit towards the annual close. Since mid-October, the balance in miner wallets has dropped by approximately 12,000 Bitcoins.

Türkçe

Türkçe Español

Español