The cryptocurrency market seemed to reverse its downward trend in the last days of the week following the non-farm employment data released on May 3. After days of a prevailing short-selling outlook, some cryptocurrencies are now showing potential for rapid price increases due to short selling.

Current State of the Crypto Market

Looking at the total crypto market value index, there has been a price increase of over $277 billion from the local bottom on May 1 to date. The index saw an increase of over 13% in about three days, reaching a periodic peak of $2.318 trillion on May 4.

Crypto Traders Are Rushing to This App – Here’s Why You Should Too

Crypto Traders Are Rushing to This App – Here’s Why You Should Too

However, past fear, uncertainty, and doubt (FUD) seemed to have largely directed investors in cryptocurrency transactions to short Bitcoin (BTC) and other cryptocurrencies.

As a result, as we mentioned in recent days, the likelihood of short selling events on the BTC side seems to be increasing, and this could drive prices higher.

On the other hand, two cryptocurrencies were notable for similar liquidations linked to negative funding rates and accumulated short positions.

BNB Chain (BNB) Outlook

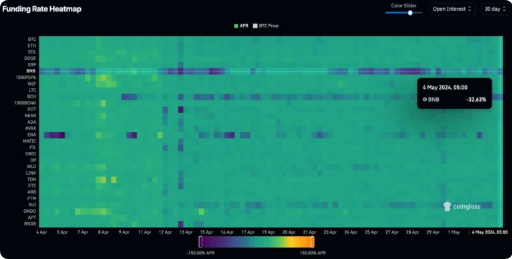

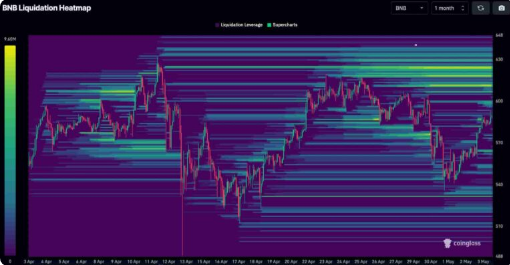

The current funding rate of BNB Chain (BNB), the native token of the Binance exchange, is drawing attention as the first indicator of a potential short squeeze. This is evidenced by the 30-day funding rate heat map from CoinGlass as of May 4.

Especially, those short selling on the BNB side are making a 32.63% APR payment to investors taking long positions, which could end these short positions. According to data that emerged for the BNB token, it appears to have the sixth largest open interest in the derivatives market.

Looking at price targets, liquidity pools for short positions for BNB are seen between $600 and $630, and as of today, it is trading at $588.

Will Bitcoin Cash (BCH) Rise?

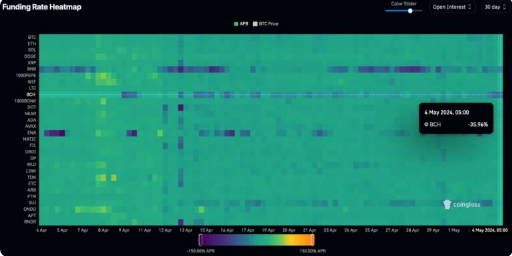

On the other hand, Bitcoin Cash (BCH) reflects a higher negative funding rate of 35.96% and ranks among the top 10 cryptocurrencies in terms of open interest.

The liquidity pools of BCH, although not as intense as those on the BNB side, appear to be far behind the regions where liquidation is intense when looking at the current price of the coin.

Interestingly, multiple regions indicating between $500 and over $700 are seen. This situation shows that a short squeeze on the Bitcoin Cash side could host movements that could result in gains of over 40%.

Türkçe

Türkçe Español

Español