The trading volume of the cryptocurrency market in both spot and derivatives sides decreased by 11.5% to $2.09 trillion in August. The trading volume on the spot side alone dropped to its lowest level in 4.5 years, reaching $475 billion. Grayscale Investments’ victory in the lawsuit against the U.S. Securities and Exchange Commission (SEC) has increased volatility and prompted investors to take action, leading to a slight increase in spot trading volume. Despite rapidly declining market share, Binance managed to maintain its top position in both segments.

Market Makers’ Profit Margin Decreases by 30%

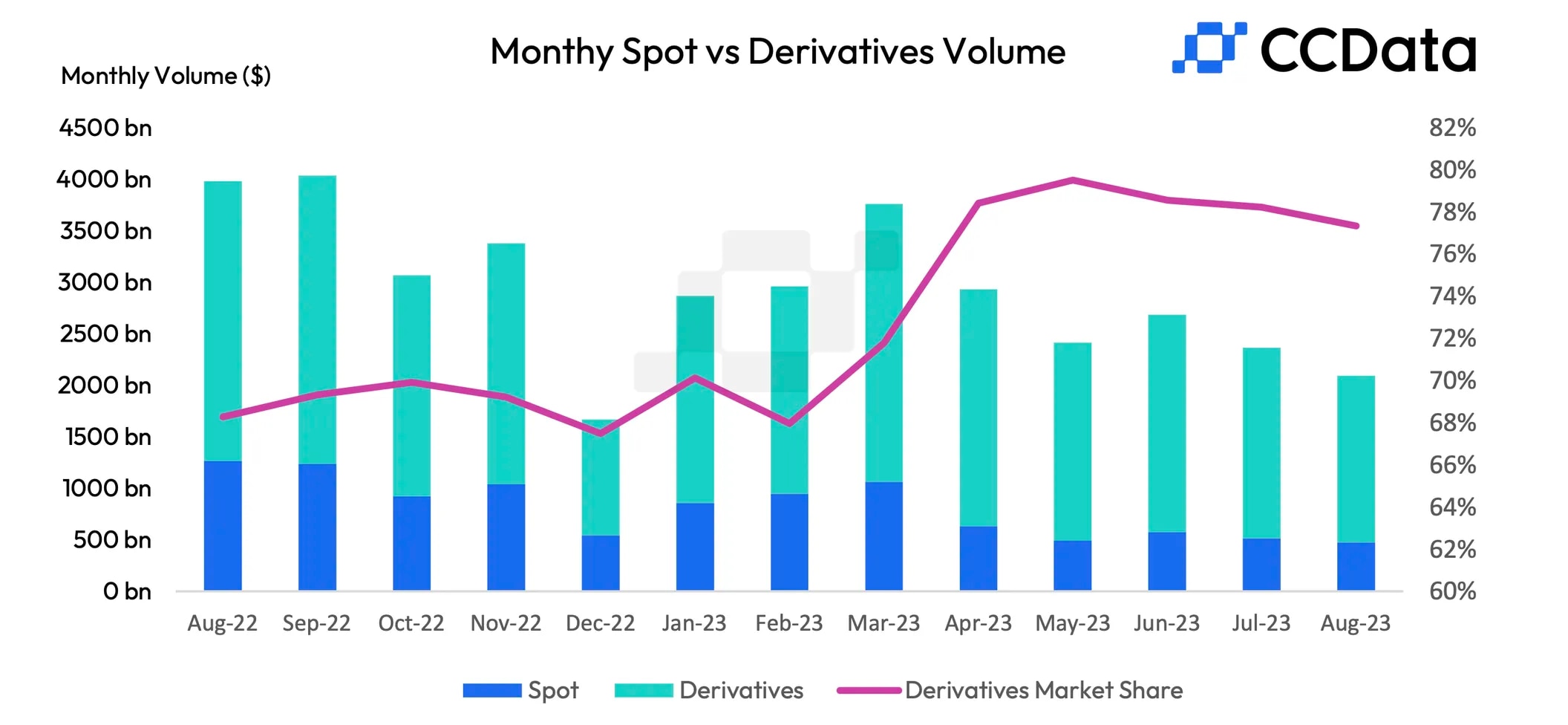

According to digital asset data and index provider CCData, the spot trading volume on centralized cryptocurrency exchanges decreased by 7.78% to $475 billion for the second consecutive month, reaching the lowest level since March 2019. The volume of derivatives decreased by over 12% to $1.62 trillion, reaching the second lowest level since 2021, and the share of derivatives in the total market volume decreased for the third consecutive month to 77.3%. The locked value of U.S. dollars in open derivative contracts decreased by 19.5% to $17.1 billion, and $4.13 billion of open interest was wiped out from the tracked cryptocurrency exchanges. This represents the largest decrease in open positions this year.

The ongoing decline in volumes has created a challenging environment for cryptocurrency exchanges and market makers who have been struggling since the collapse of FTX, Sam Bankman-Fried’s cryptocurrency exchange, in November of last year. This collapse undermined investors’ confidence in centralized cryptocurrency exchanges and reduced market depth. According to Bloomberg, market makers’ profit margin has decreased by 30% since the collapse of FTX.

In its report, CCData stated, “The spot and derivatives trading volume on centralized cryptocurrency exchanges decreased by 11.5% to $2.09 trillion due to the expected reflection of the increased volatility after Grayscale Investments’ victory against the SEC did not materialize to the extent expected. The low spot trading volume and volatility in open interest data indicate that the market is currently being driven by speculation.”

The volume figures could have been even worse if it weren’t for the short-lived volatility on August 17th and at the end of the month. Bitcoin, the largest cryptocurrency by market capitalization, dropped by over 10% to $25,000 on August 17th, following the risk aversion trend in traditional markets. The price of the crypto king briefly rose to $28,000 on August 29th, celebrating Grayscale Investments’ legal victory against the SEC.

Binance Maintains Its Leadership

Binance, among the cryptocurrency exchanges, saw its spot market share decrease for the sixth consecutive month to 38.5%, reaching its lowest level since August 2022. Its share in derivatives also dropped to 53.5%, reaching the lowest level since June 2022. Nevertheless, Binance managed to maintain its top position with a spot trading volume of $183 billion and a derivatives trading volume of $865 billion.

On the other hand, the global spot market share of cryptocurrency exchange Huobi increased by 2.26% and accounted for 6.09% of the total spot market volume. This made it the second-largest centralized spot cryptocurrency exchange in terms of volume. The share of Bitget and Bybit in the total volume of derivatives increased to 8.66% and 12.7%, respectively.