Cryptocurrency investors may have started the new week on a positive note, yet the coming days could see increased volatility. There’s a halving event in 11 days, and eagerly awaited US inflation data will be released on Wednesday. So, what levels should BNB, SOL, and XRP Coin investors focus on to take advantage of volatility?

Binance Coin (BNB)

The price continues to move within a symmetrical triangle formation, reflecting the balance between supply and demand. BNB Coin, which recently raised hopes for an ATH journey, remained the focus of investors during this week’s rise. BNB Coin, consistently outperforming at every opportunity for weeks, is now finding buyers at $589.

The 20-day EMA ($570) is gradually rising, with bulls poised to take control. The RSI is in the positive zone. If the triangle’s resistance is breached, we could see the price climb to $645. Conversely, if the price turns down from the downtrend line, a deep correction could begin. In this scenario, significant losses could also be seen in the BTC price.

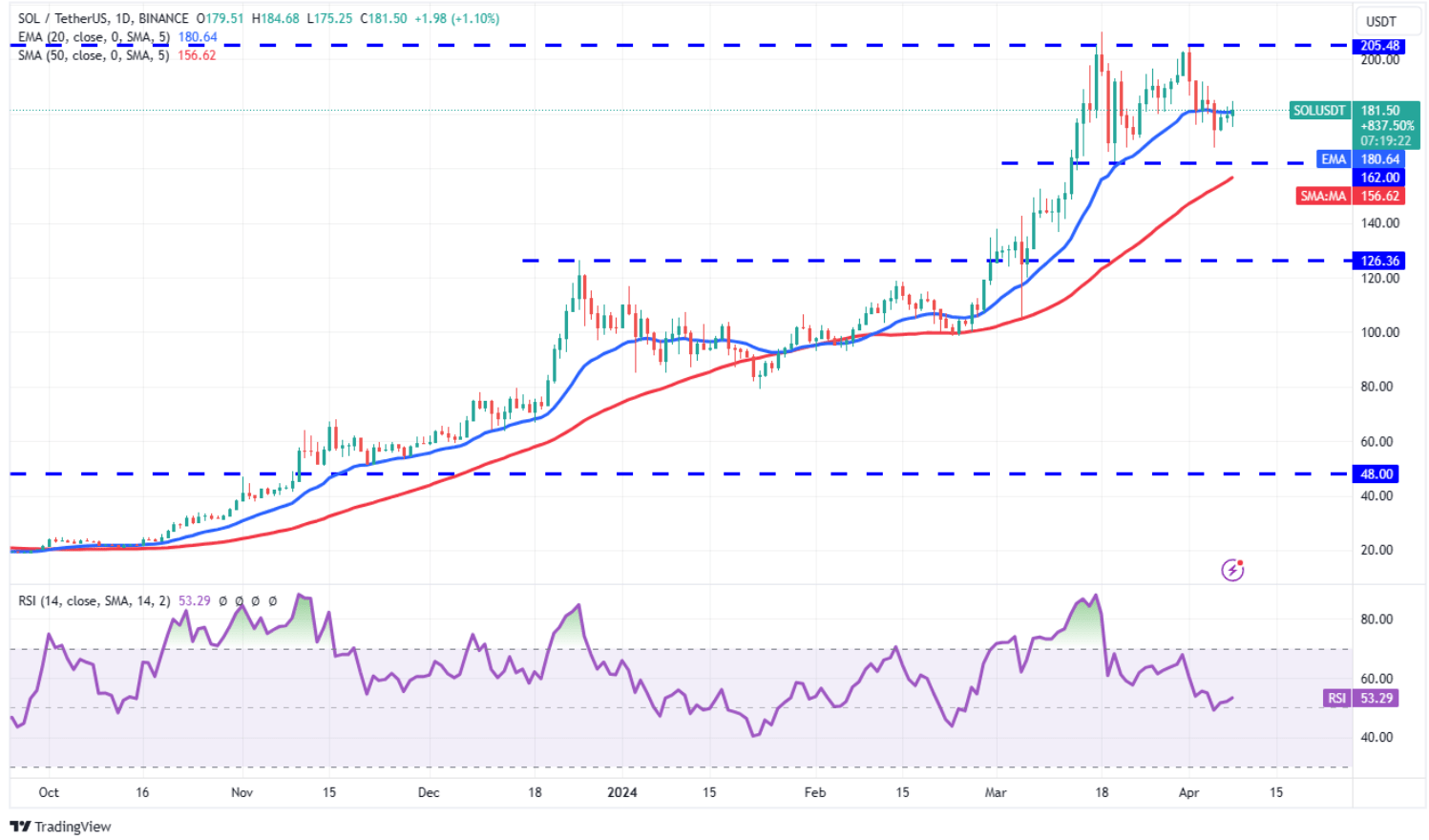

Solana (SOL)

Despite the market recovery, SOL Coin has not been able to climb above its weekend level. The long-standing strong interest now seems to be waning. SOL Coin experienced significant upswings and made substantial gains in a short period. This cannot be expected to last forever. It is now showing signs of weakness just below the 20-day EMA ($181).

In a bearish scenario, the SOL/USDT pair could fall back to the $162 support level. The next targeted level would be $126. Alternatively, if the price recovers from $162 and rises above the 20-day EMA, it could return to $181 and then $205. A scenario where the rally accelerates would be above the $205 level for a new ATH.

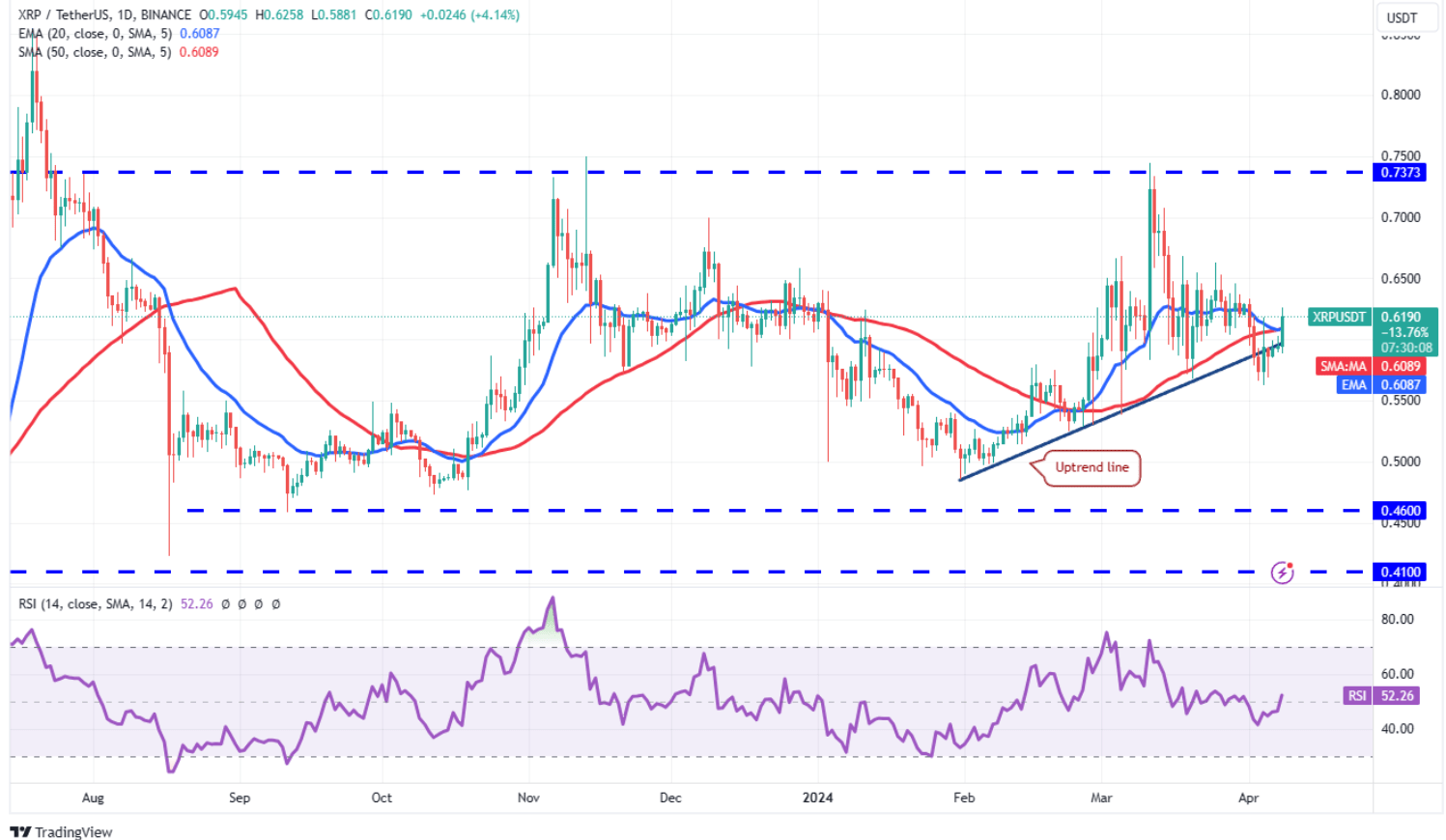

Ripple (XRP)

The inability of bears to capitalize on XRP’s drop below the uptrend line attracted buyers yesterday. Flattening moving averages and an RSI exceeding the neutral zone currently suggest the uptrend could continue. With potential volatility increases, the price could continue to fluctuate between the extremes of $0.56 and $0.69.

If bulls can surpass $0.69, we might witness the rally extending up to $0.74. However, in a negative scenario, bears aim below $0.58, targeting $0.48.

Türkçe

Türkçe Español

Español