The cryptocurrency market faced a significant decline, with the price of the largest cryptocurrency, Bitcoin (BTC), falling below $55,000, triggering widespread panic selling in altcoins. The altcoin king, Ethereum (ETH), saw dramatic price drops ranging from 10-20% along with most of the top ten altcoins. Notably, Ethereum lost a critical support level, falling below $3,000.

Ethereum Faces Major Liquidations

The past 24 hours have been turbulent for Ethereum and its investors. According to Coinglass data, Binance’s ETH/USDT trading pair recorded liquidations worth $18.48 million, pushing over 230,000 investors out of the market. Ethereum’s liquidations surpassed Bitcoin’s on the hourly chart, reaching $44.5 million in the last hour and $107 million in the last 24 hours. This trend significantly impacted other altcoins, worsening market instability.

Despite ongoing discussions about the potential launch of a spot Ethereum ETF by the end of July, ETH‘s price continues to decline, reflecting the broader market correction. Ethereum developer Anthony Sassano expressed concerns about current market conditions for ETH. He pointed to potential exits from Grayscale’s ETHE, which has been trading at less than a 2% discount for months but is now at a premium. This indicates investors’ intentions to sell when ETHE converts to an ETF.

Sassano also highlighted uncertainty regarding ETHE’s fee structure post-conversion. There is speculation that fees could be significantly reduced or even temporarily zeroed to attract more investors to Grayscale’s mini trust. This uncertainty adds another layer of complexity to the already highly volatile market environment.

Wave of FUD in the Cryptocurrency Market

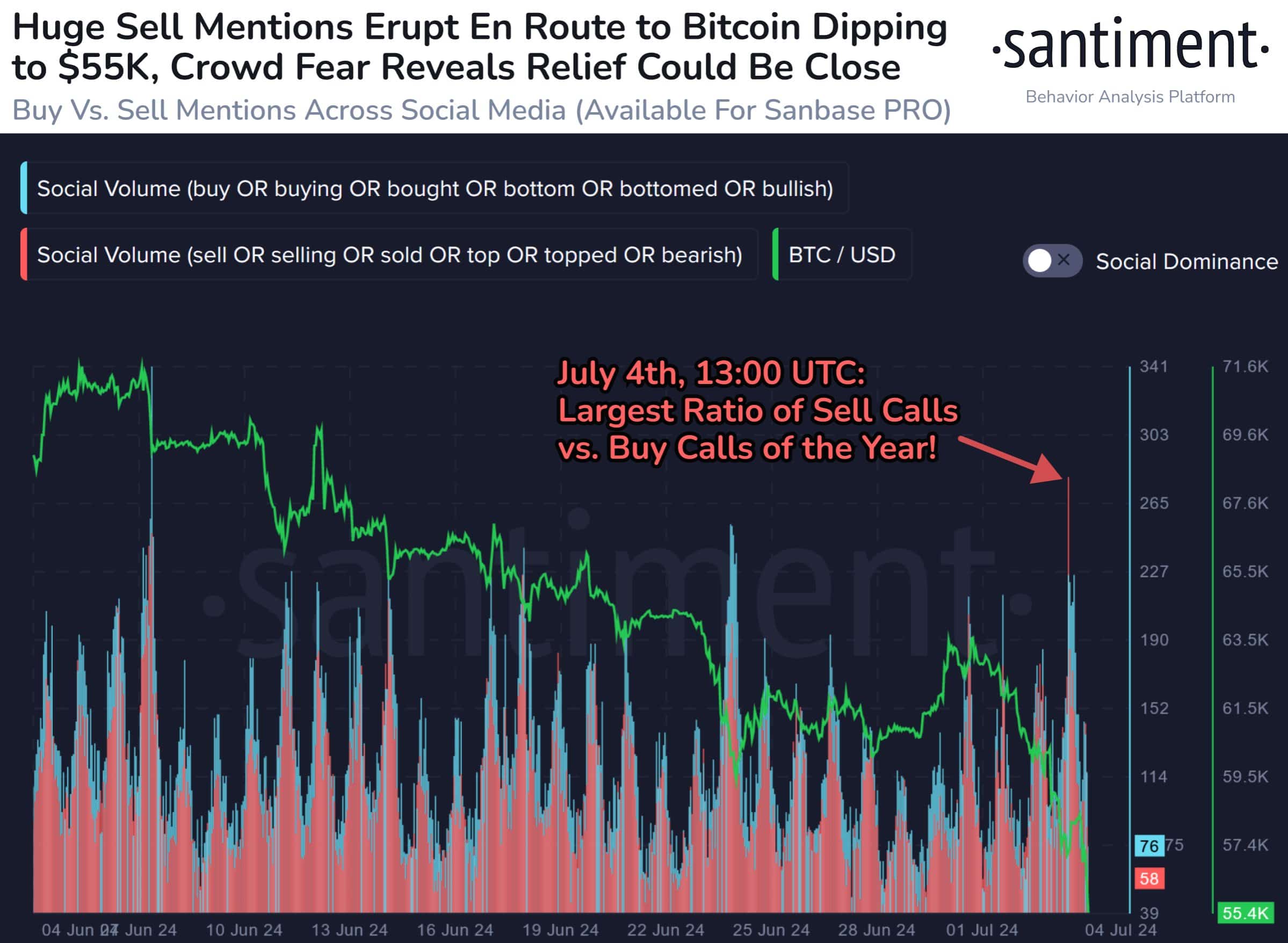

The ongoing market decline has led to rising levels of fear, uncertainty, and doubt (FUD) on social media platforms. On-chain data provider Santiment reported an increase in negative sentiment, with “sell” expressions far outnumbering “buy” expressions. This trend is expected to peak in 2024, indicating a highly pessimistic market outlook. However, Santiment suggested that this widespread negativity could present a significant opportunity for bold investors to adopt a contrarian strategy and invest amidst the general despair.

Meanwhile, the memecoin market took a particularly hard hit, with many leading memecoins suffering losses between 17-25%. The short-term future of memecoins remains uncertain, and it is unclear whether they will recover or if this marks the end of the memecoin hype.

Türkçe

Türkçe Español

Español