The upcoming elections in Turkey have carried over into a second round, and the anticipation for the end of May is tangible. It’s an undeniable fact that the outcome of these elections will have a direct impact on Turkey’s cryptocurrency market. But how could the elections influence the cryptocurrency sector and, most importantly, prices?

The Current Situation in Turkey

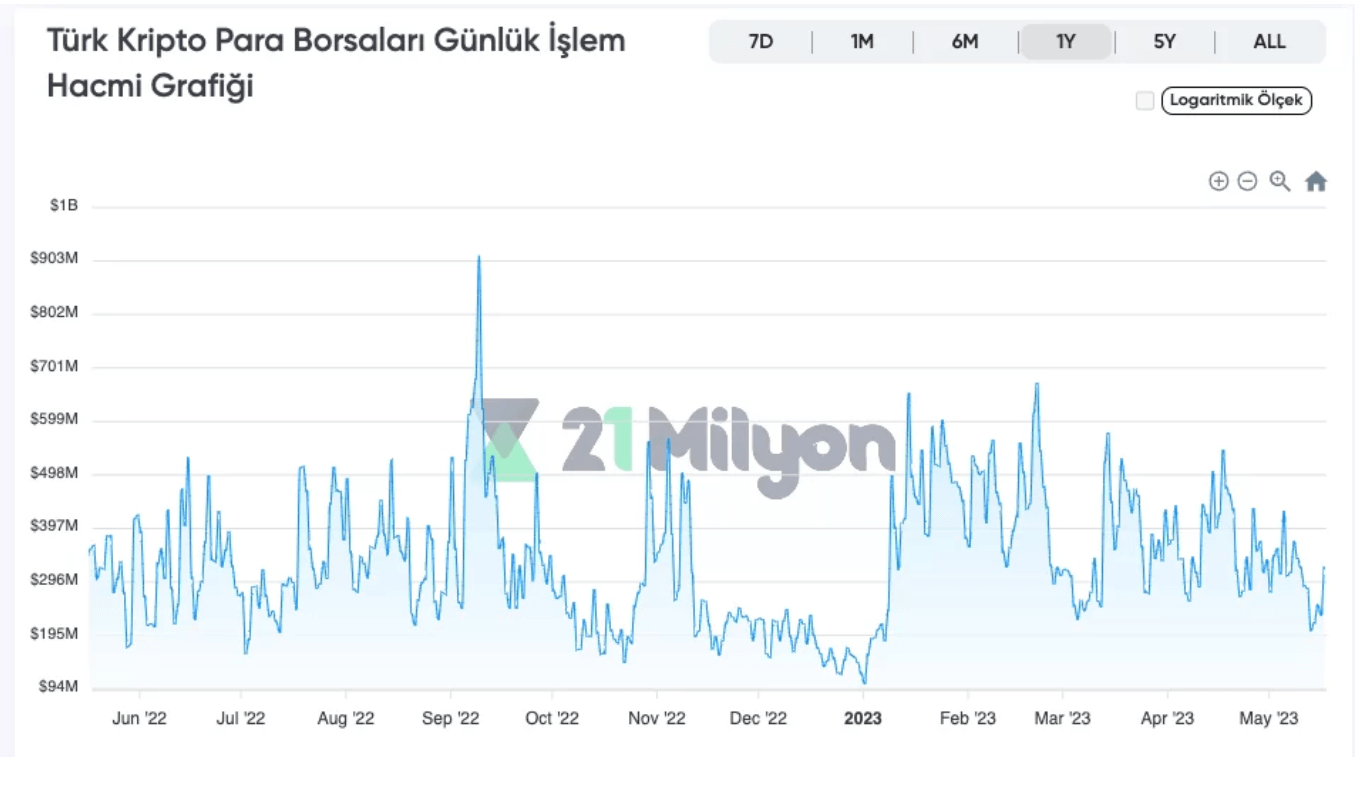

While there appears to be a global slowdown in the volume of the cryptocurrency sector, the situation in Turkey is decidedly more drastic and negative. Cryptocurrency pairs with the Turkish Lira (TRY) and Turkish-focused cryptocurrency exchanges have suffered an unprecedented volume decline.

According to data shared by 21 Million, Turkish cryptocurrency exchanges witnessed their lowest trading volume in recent months on May 13 and 14. This could be due to the excitement of the elections, as people put other activities aside to focus on the event.

On a global scale, there was no severe decline in exchange trading volume specifically for these two days, indicating this was a local phenomenon.

How Did the Results in Brazil Affect the Crypto Sector?

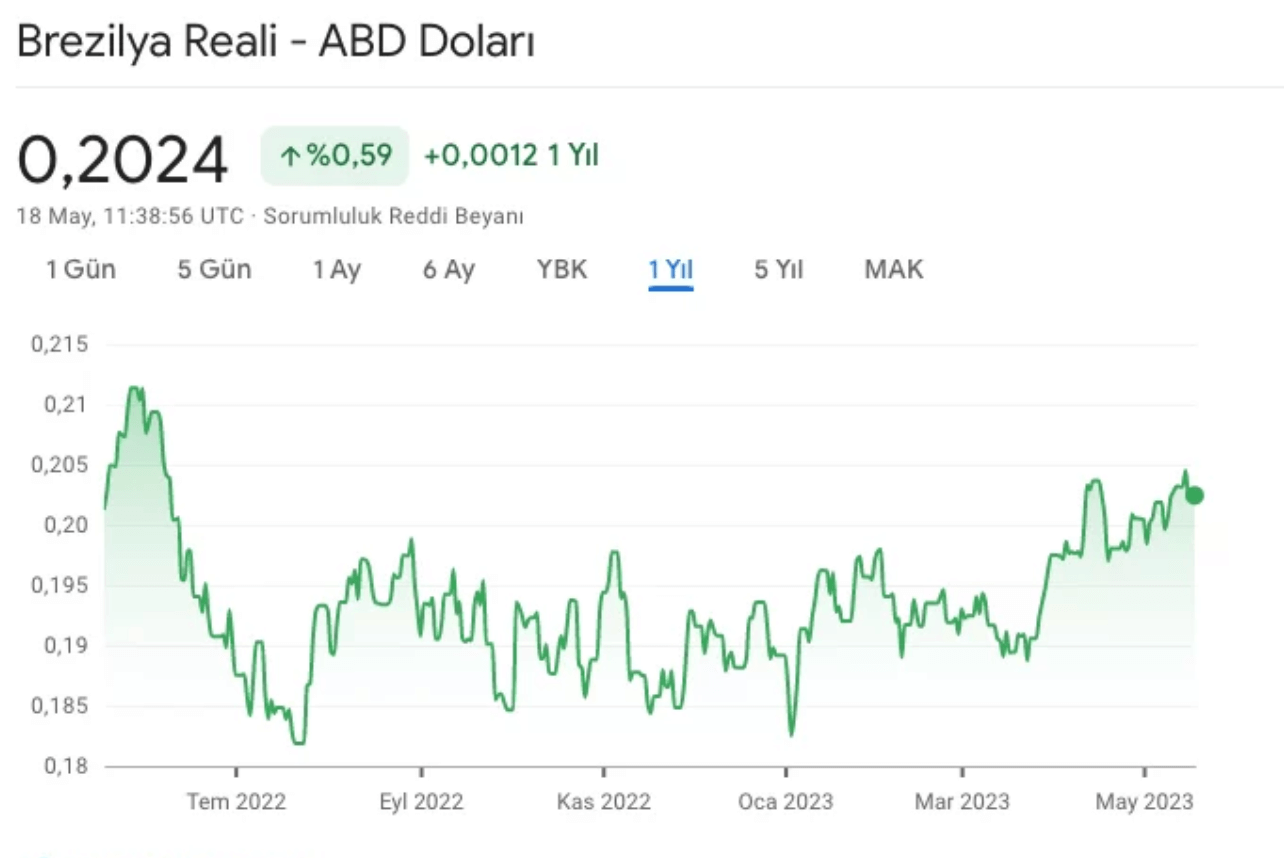

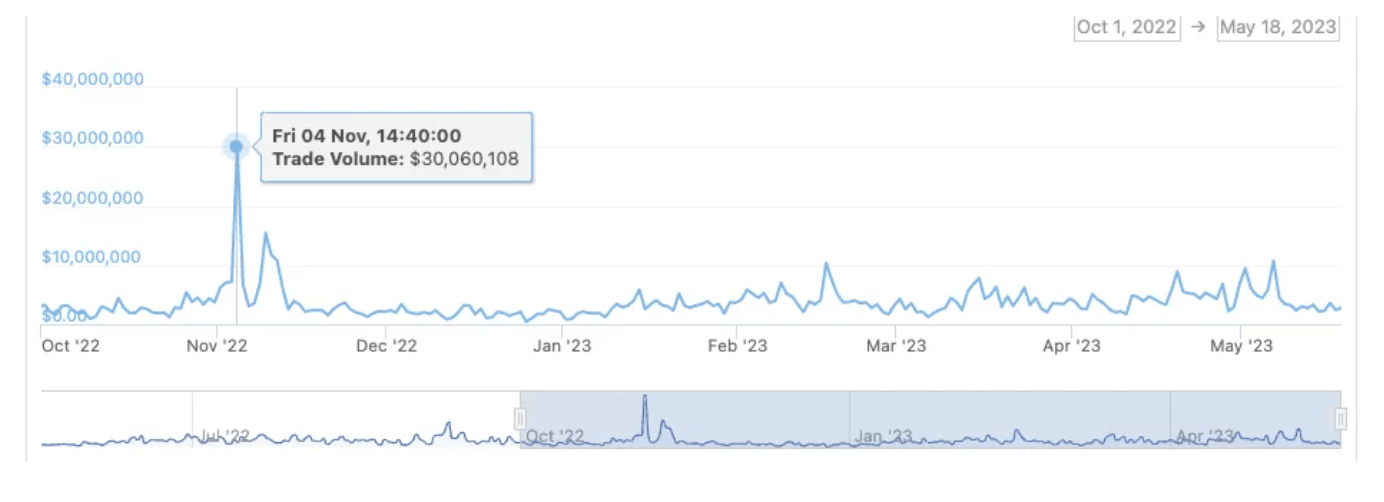

Looking at Brazil, which has experienced similar situations, could provide valuable insights into the potential effects of the Turkish elections on the crypto market. Brazil’s renowned President Messias Bolsonaro, who was in office from 2019 to 2022, was widely criticized, with his economic policies being scrutinized by global economists. As the elections approached, there was a significant fluctuation in the BRL/USD pair. Luiz Inacio Lula, who succeeded Bolsonaro, brought about a severe change, evidenced by a sharp decline in the BRL/USD pair, followed by a gradual increase.

One of Brazil’s largest crypto exchanges, NovaDAX, reveals post-election crypto market trends. Before the election, there was an incredible increase in the BTC/BRL pair and a horizontal movement after the election. This pattern seems to explain the surge in the USDT/TRY pair and the interest before the elections. The uncertainty surrounding the elections definitely seems to push investors towards more BTC and USDT purchases.

Similarly, in Argentina, after the November 2021 elections, the value of Bitcoin and other cryptocurrencies increased locally as the Peso devalued. Argentinians turned to cryptocurrencies to safeguard their investments against economic uncertainties and rapidly rising inflation. A similar situation could potentially lead to a Turkey-specific BTC premium, just like in Argentina.

Crisis and DeFi

Before the upcoming elections in Turkey, crypto markets are likely to be sensitive to uncertainty. The high inflation rates in Turkey and the devaluation of the local currency, the Lira, could push investors towards cryptocurrencies.

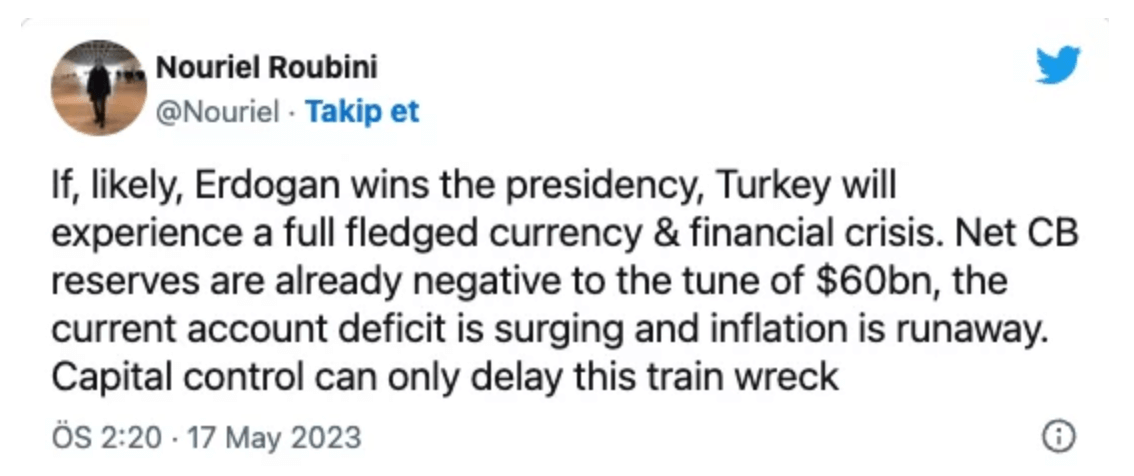

Famous economist Nouriel Roubini, who predicted the 2008 crisis, made a critical comment regarding Turkey, including cryptocurrencies. Roubini argued that if the ruling party wins the election again, the economy would head towards a crisis.

In such a case, as expected, interest in cryptocurrencies would increase. Additionally, recent allegations that banks are tightening credit taps and even removing cash advances could invigorate the DeFi world.

The Turkish Lira, represented 1:1 by BiLira (TRYB), can be bought and sold on many DeFi platforms, and a significant increase in TRYB volume could be observed after the elections. In countries like Argentina and Brazil, rising inflation has pushed citizens towards different alternatives, leading to an increase in DeFi volume.