The cryptocurrency market awoke to a thoroughly red day, plunging by more than 7% to a value of $2.55 trillion. Bitcoin (BTC) and Ethereum (ETH) prices experienced a drop of over 7%, while other altcoins such as BNB, XRP, and Cardano (ADA) also continued to lose value. Despite the ongoing meme coin frenzy, the prices of Dogecoin (DOGE) and Shiba Inu (SHIB) also fell by 12%, reinforcing the sentiment that investors might be taking profits.

Bitcoin and ETH Options Expire

The market saw a downturn possibly as a result of the expiration of over $3 billion in Bitcoin and Ethereum options on Friday, March 15. The cryptocurrency market generally hosts volatile price movements at the expiration of options.

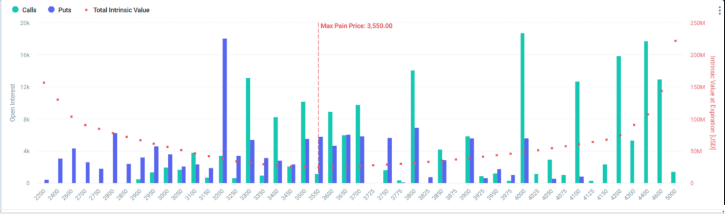

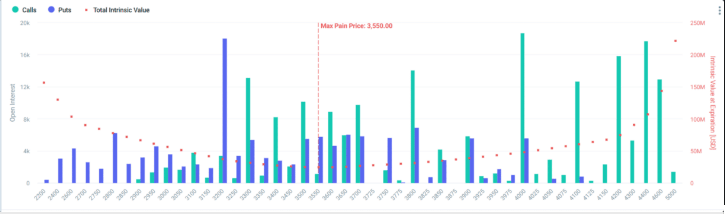

In particular, 30,568 BTC options with a nominal value of $2.09 billion are expiring today. The put-call ratio is 0.79, and the maximum pain point is at a critical level of $66,000.

BTC price has dropped to $66,770, a level not seen in days, which is still outside the maximum pain zone. However, this drop in Bitcoin could be creating a new buying opportunity for investors looking to capitalize on the downturn.

Meanwhile, the options for 332,094 ETH with a nominal value of $1.24 billion will expire alongside a put-call ratio of 0.69. The level indicated as the maximum pain point is at $3,550.

Traders, particularly in Ethereum, were acting with an expectation of a rise, but they successfully took profits above the level indicated as the maximum pain point. After ETH price dropped to its lowest level in 24 hours at $3,656, it rebounded to $3,748.

Will the Fed Cut Interest Rates?

Jerome Powell, the head of the US Federal Reserve, gave a statement to Congress. In his statement, he indicated that the Fed’s interest rate cuts would largely depend on key economic data such as inflation and employment.

Following the initially announced high CPI data earlier this week, PPI data also came in high. Consequently, retail sales and unemployment figures may indicate higher inflation and that the US economy is facing resistance.

Considering this, it could be suggested that the Fed is contemplating postponing interest rate cuts until the end of the year. There is also talk that the Fed may hold interest rates steady in March and May.

According to data provided by CME FedWatch, the probability of a 25 basis point rate cut in June is only 54%, and in July, it is only 47%.

Crypto Assets Liquidated Amidst Liquidity Surge

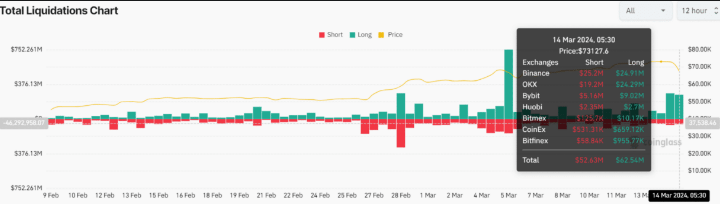

Following the recent downturn in the cryptocurrency market, over $680 billion in market value has disappeared. According to data from Coinglass, more than 192,000 traders’ transactions were liquidated in the last 24 hours. The largest single liquidation occurred on OKX in the BTC-USDT trading pair, valued at $13.30 million.

Approximately $543 million in long positions and $137 million in short positions were liquidated, with Bitcoin and Ethereum hosting over $242 million and $115 million in liquidations, respectively.