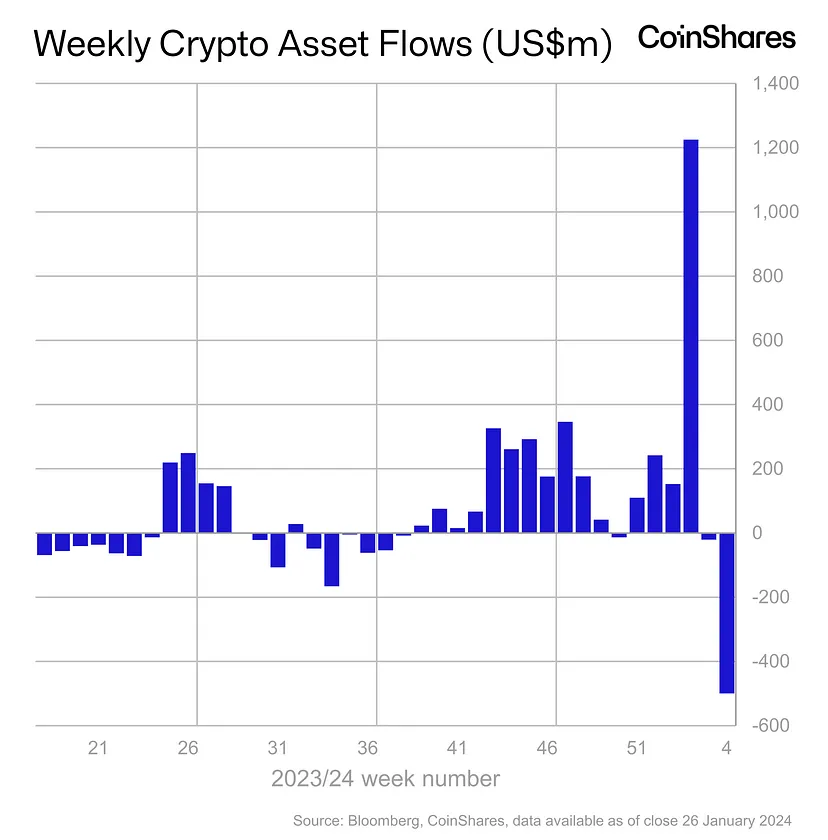

Bitcoin‘s price continues to linger around $42,200, marking a nice start to the new week. A few minutes ago, a report on institutional interest in cryptocurrencies prepared by CoinShares was released. The details in this report are extremely critical for investors.

Cryptocurrency Report

From a global perspective, cryptocurrency investment products have seen a total outflow of $500 million. The United States, Switzerland, and Germany accounted for a significant portion of these outflows. Grayscale has experienced over $5 billion in outflows since January 11, which seems to be the primary reason for the overall exodus.

Just last week, there was an outflow of $2.2 billion from the GBTC product alone. Daily data indicates that outflows are slowing down, which is promising. On the contrary, newly issued US ETFs saw an inflow of $1.8 billion last week, reaching a total inflow of $5.94 billion since their launch. Thus, all ETFs still have a net positive inflow of around $807 million.

Short Bitcoin funds saw an inflow of $10 million last week, indicating increased pessimism. Last week, altcoins predominantly experienced outflows; Ethereum saw $39 million, while DOT and LINK had outflows of less than $1 million.