The tumult in the cryptocurrency market continues. Despite numerous developments over the past 24 hours, Bitcoin’s price remains under $26,000. The Federal Reserve is due to announce its interest rate decision at 21:00 today, and yesterday’s inflation data was as expected. However, the dark cloud that the SEC has cast over the market has cut investors’ risk appetite sharply. Not even good news can boost Bitcoin.

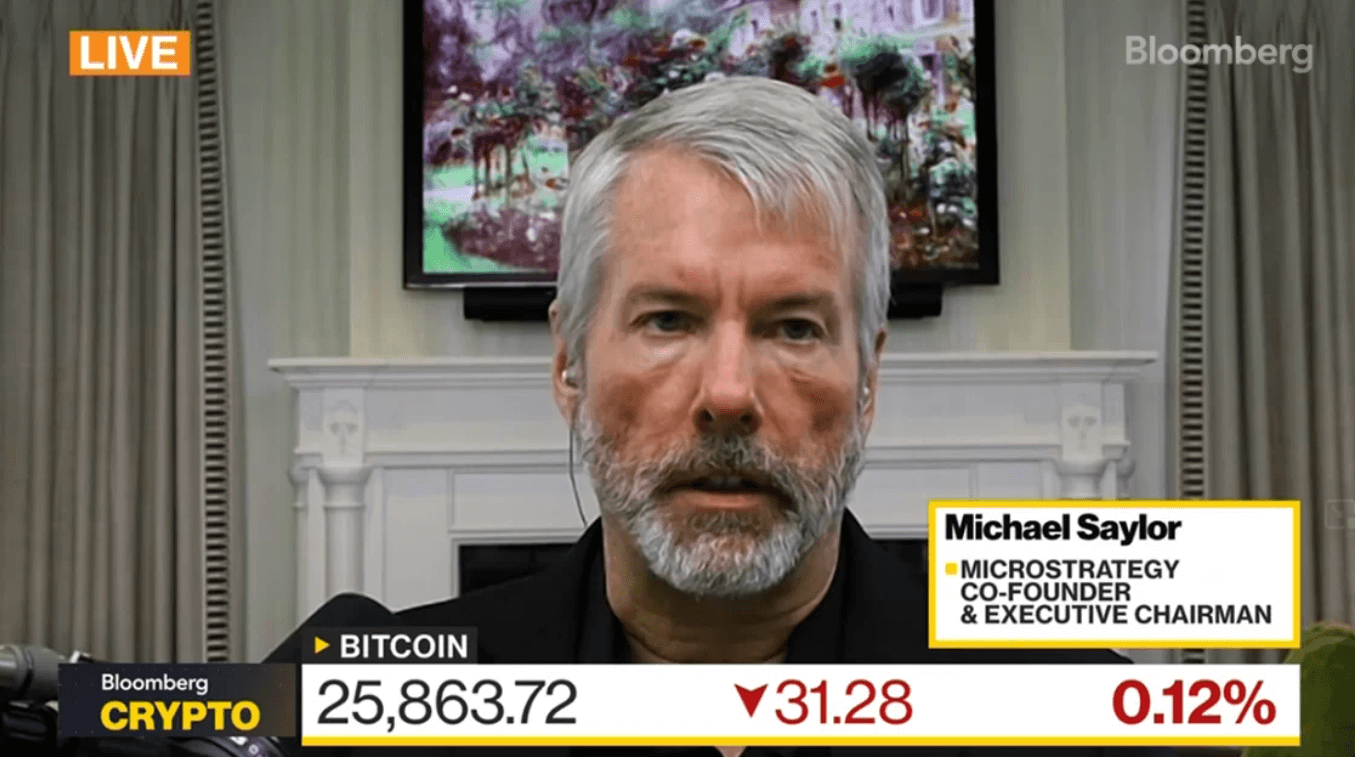

Pro-Bitcoin Remarks from Michael Saylor

Michael Saylor, co-founder of MicroStrategy and a Bitcoin maximalist, believes that the only way for the king of cryptocurrencies is up. In his recent interview, he did not neglect to belittle altcoins as usual. Saylor confirmed that MicroStrategy views Bitcoin as the only investable asset at a corporate level in the crypto field.

I think the public is starting to understand that Bitcoin is the next Bitcoin (I expect them to start moving away from alternatives). The next logical step is for Bitcoin to go up 10x from here and then again 10x. Eventually, I believe that the crypto exchanges will realize that Bitcoin is the dominant asset in this field.

If Saylor is right, we could see Bitcoin‘s price exceed $250,000. Many experts expect the BTC price to make a new peak between $120,000 and $250,000 in the next bull season, if there is one.

Bitcoin and the Rest

For Bitcoin maximalists, crypto is all about BTC and the others. Saylor is one of them. Saylor, a billionaire who has tied billions of dollars to Bitcoin, also pointed out that Bitcoin’s dominance has risen from about 40% to 48% just this year. Bitcoin’s dominance represents its market share compared to all other cryptocurrencies. He believes that this ratio will reach a skyrocketing level of 80% as interest in Stablecoins and tokens wanes in the long term.

Saylor has long been a Bitcoin maximalist and used this term to describe himself last year. Maximalists actively separate altcoins from Bitcoin, often seeing them as pale imitations of the original cryptocurrency, if not outright scams. Saylor also attributed the lack of institutional investment in this field to “confusion and anxiety.”

When this disappears, you will see mega amounts of money flowing into this field. And the business models of the crypto exchanges will be fine. Just focus on Bitcoin.

Saylor, a former Bitcoin antagonist, switched sides before the last bull season. Now, he invests all his money in Bitcoin, even if it means his company goes bankrupt. Moreover, this strategy has turned MicroStrategy shares into spot Bitcoin ETFs.

Türkçe

Türkçe Español

Español