As May draws to a close in 11 days, cryptocurrency investors have been left wanting. Bitcoin, which closed in the green for the previous four months, has seen its monthly candle painted red. Not surprisingly, we observed an acceleration of sell-offs from the beginning of May, with a significant number of investors relinquishing the Bitcoins they bought in January. So, what can we expect from June?

Cryptocurrency Bear Season

During the Cryptocurrency Bear Season, Bitcoin is currently trading at $26,800, having spent considerable time below the $27,000 mark. Crypto pressures are compounded by the easing of the Federal Reserve and the potential US default risk. While the stock market surges, Bitcoin suddenly enters an inverse correlation. Unexpectedly, lawsuits opened against cryptocurrency exchanges and tokens also exacerbate the negative atmosphere within the crypto front. Should we be surprised? Those who recall past bear market periods are well aware that every second seems to work against crypto.

During bear market periods, just as every event seems to be detrimental to crypto, it is exactly the opposite in the bull season. It’s no coincidence that a small number of investors who manage to pass the challenging bear season exam encounter generous rewards during the bull market.

June Cryptocurrency Prediction

In the June Cryptocurrency Prediction, as the harsh conditions of May’s bear market become more apparent, popular crypto analyst Justin Bennett points to further decline. According to him, stagnant prices will necessitate Bitcoin’s drop to $25,000. Several experts recently have voiced expectations for a new regional bottom between $24,300 and $25,000.

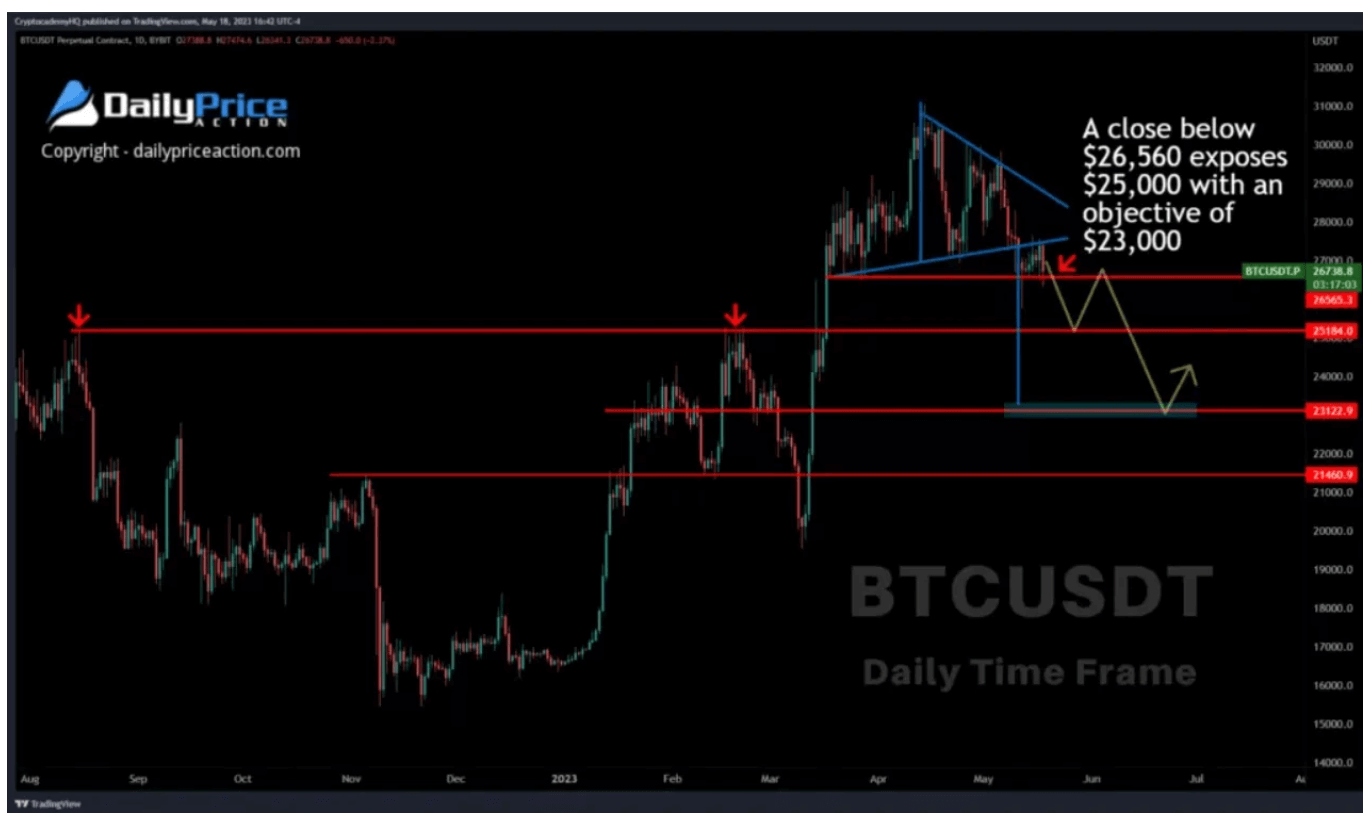

BTC is still holding at the $26,560 level, but if this level fails, next up is $25,000,” explains Bennett. “Bitcoin is testing the primary horizontal support of $26,560 once again after being rejected from the mid-March trendline at $27,500. For a long time following the reclaiming of $26,560 on May 12, our target had been the $27,500 area. Bitcoin bulls failed to close BTC above $27,500 this week, which leaves me in a bearish stance for now.

Bennett then sets out his condition for shorting. “However, to set lower targets such as $25,000, I need to see a daily close below $26,560. This was BTC‘s resistance range between August 2022 and February 2023. Many will buy Bitcoin in the $25,000 region and wait for $30,000. However, I believe we will see a drop below $25,000 after a period of consolidation. My target for the next few weeks is the $23,000 area, the measured target of the triangle shown below.”

So under what condition will the bullish scenario kick in? “Alternatively, a daily close above $27,500 would invalidate my bearish stance and allow me to target $28,500.”