The price of Curve (CRV) plummeted to its lowest level in three years, reaching $0.39 on September 13th, due to unusual transactions from a wallet address associated with Michael Egorov. Reports suggest that the entry of 609,000 CRV into Binance may be linked to Egorov’s $100 million debt.

Massive CRV Transfer!

Curve (CRV) is the native token of CurveDAO, an integral part of the DeFi ecosystem responsible for the issuance of the CrvUSD stablecoin. The controversial $50 million Curve Finance Exploit in July 2023 raised concerns about the founder’s $117 million loan. Is the Curve ecosystem facing another DeFi liquidation event?

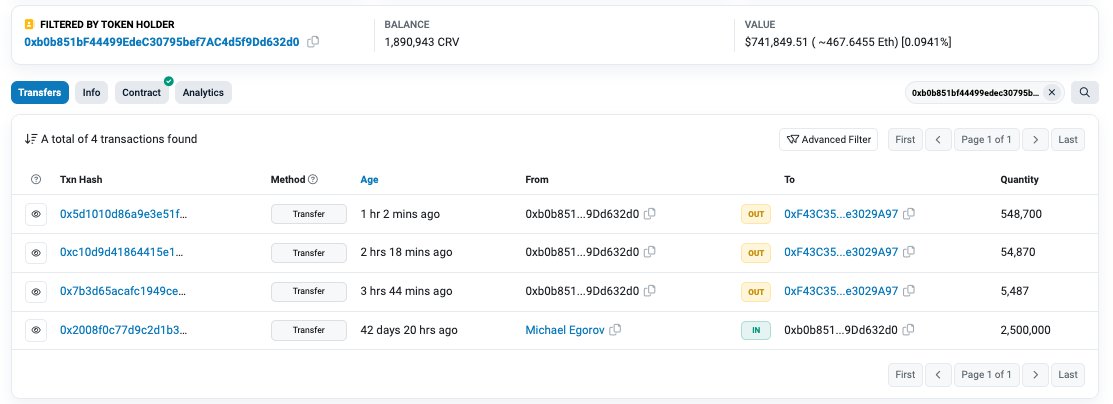

Blockchain malicious software and security research company PeckShieldAlert has exposed unusual on-chain transactions from wallet addresses linked to founder Michael Egorov, putting CRV price at risk. In his statements, the founder mentioned the following:

CRV dropped below $0.4. Michs OTC counterparty, who allegedly bought 2.5 million CRV (supposedly locked for 6 months) 43 days ago, transferred 609,000 CRV to Binance from address 0xb0b8.

CRV Token Price Movement!

This situation indicates that the CRV token price has dropped below $0.39 for the first time since October 2020. However, reports suggest that there may be further losses for CRV token holders. In July 2023, it was reported that approximately 300 million CRV tokens would be liquidated from the Aave ecosystem when the price drops to $0.371. According to Ryan Adams, a prominent participant in Ethereum, most of these 300 million tokens are directly related to Egorov’s $100 million stablecoin debt, owed through multiple DeFi lending protocols including Aave.

Recent on-chain events show that CRV investors are already preparing for a potential liquidation event. Following Egorov’s unusual transactions, CRV investors responded by increasing their sell orders. According to data obtained from order books of 17 renowned exchanges including Binance, Kraken, and Coinbase, investors placed the majority of sell orders before the liquidation price of $0.371. The charts show the status of 53.2 million active sell orders. Investors want to sell 27.7 million before the price reaches $0.36, which is the -10% threshold. Additionally, this figure may outweigh the active buy order of 23.5 million CRV at these price levels.

Türkçe

Türkçe Español

Español