Solana‘s decentralized futures exchange Cypher Protocol has successfully frozen $600,000 worth of stolen crypto assets from a security vulnerability on August 7. Expert blockchain detectives and white-hat programmers will distribute the affected users with the crypto assets through a disclosed event.

Assets Frozen on Centralized Exchanges

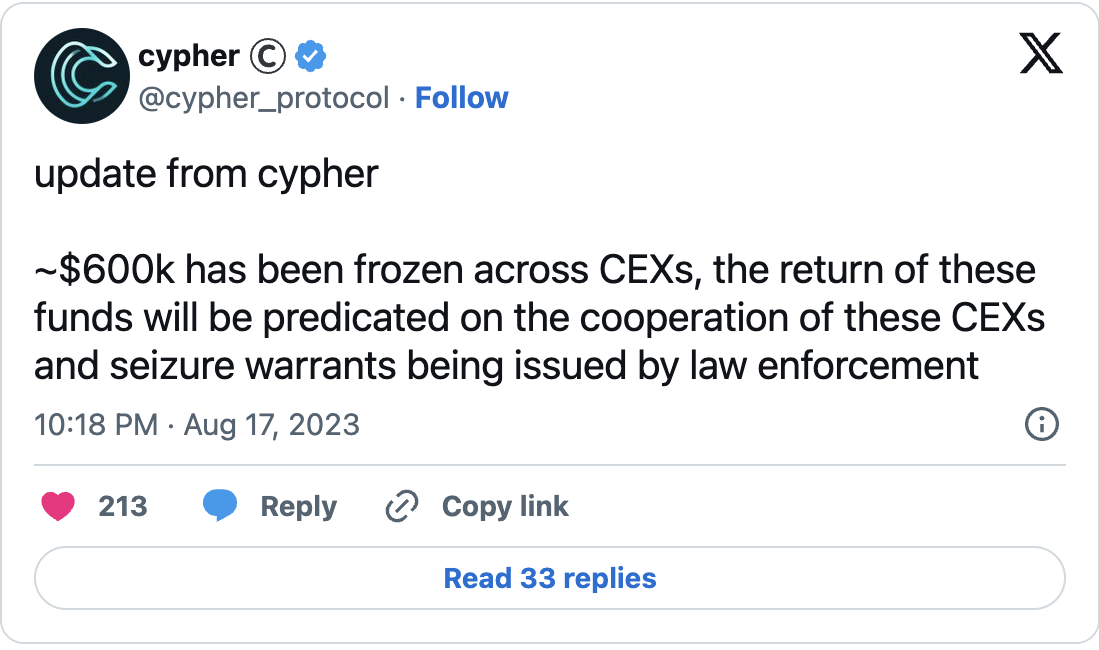

Cypher Protocol reported in a Twitter post dated August 18 that more than half of the stolen funds have been successfully frozen on centralized exchanges with the help of independent blockchain researchers.

“The return of these funds will depend on the collaboration of these CEXes and confiscation orders issued by the authorities.”

Cypher suffered an attack on August 7, resulting in the halt of the protocol’s smart contracts, which caused approximately $1 million in damages. The DeFi exchange enables lending and borrowing through primary accounts with multiple cross-collateralized sub-accounts. However, blockchain security firm Halborn revealed that security vulnerabilities prevented proper monitoring of isolated sub-accounts and inadequate margin controls before lending.

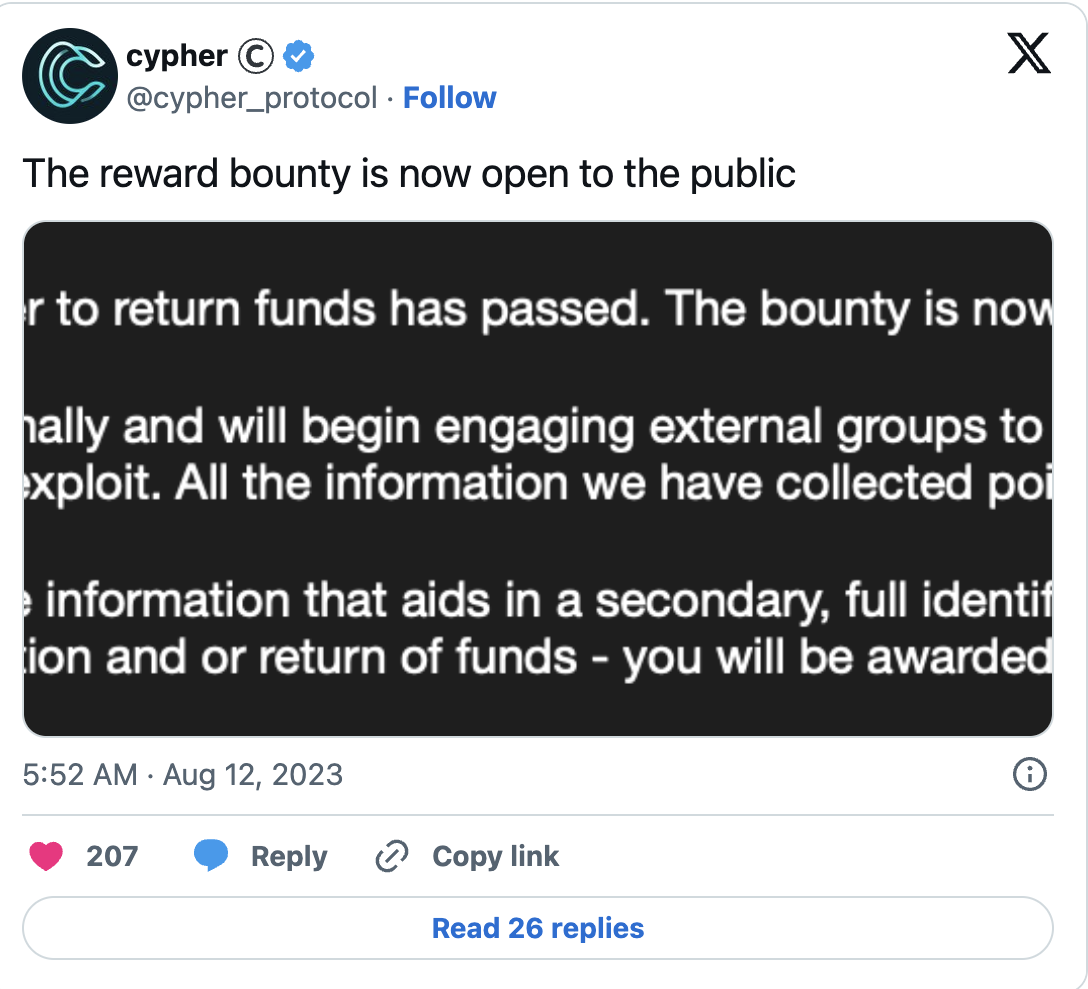

The attacker exploited these code vulnerabilities by using multiple accounts to empty an estimated $1 million across various crypto assets, including USDT, USDT, SOL, wETH, and a handful of other altcoins. On August 10, the team managed to contact the hacker after offering a 10% white-hat reward worth approximately $120,000. Two days later, they stated that the hacker missed the deadline to return the funds and made the reward public. They also implied that they knew partial information about the exploiter’s identity.

Repayment Share Revealed

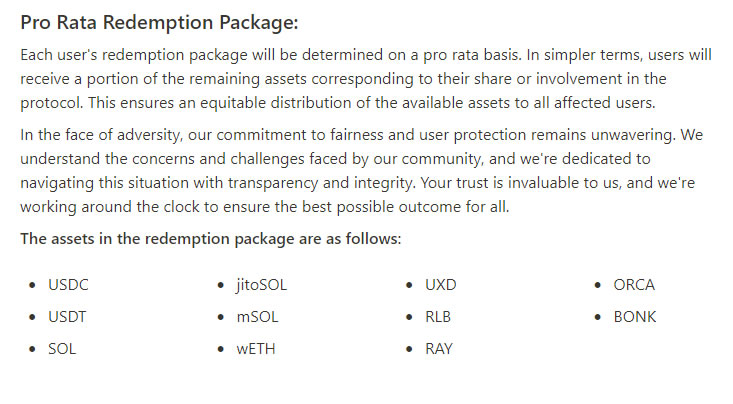

On August 16, Cypher announced a repayment plan and a “socialized loss policy” to distribute remaining assets to affected users. It was stated that a package containing the protocol’s assets would be distributed proportionally to users based on their share.

“The value used for repayment regarding a margin account will be based on a snapshot of the account’s assets at the time of Cypher protocol freeze, and the repayment share is approximately 31 cents per dollar.”

In its recent statement, Cypher thanked blockchain detective ZachXBT, stating, “It was very valuable for the Cypher team and made a significant contribution to freezing the funds in multiple CEXes and also helped track the attacker.” The Cypher exploit is the third-largest so far in August, with the DeFi protocol Zunami falling victim to a $2.1 million flash loan attack on August 13, and the leveraged yield aggregator platform Steadefi exploited for $1.1 million on August 7.