As the decision time for the United States’ first spot Bitcoin ETF approaches, the price of the largest cryptocurrency rose to $47,000. The price of Bitcoin (BTC) has since retracted somewhat and is now consolidating around $46,500, which may indicate that the recent rally is showing signs of cooling.

Bitcoin Option Market Sends Mixed Signals

According to data provided by Greeks.Live, recent developments have fueled expectations for the approval of the US’s first spot Bitcoin ETF, especially during US trading hours, which saw Bitcoin rise to $47,000 along with an increase in FOMO sentiment. However, the option market is sending mixed signals for the crypto market, which has risen on these expectations. Short-term IVs (Implied Volatilities) have dropped sharply, with the current ATM (At-The-Money) option IV for June 11 falling below 90%, recording a loss of 30% in just a few hours. Significant declines are also present in other option maturities.

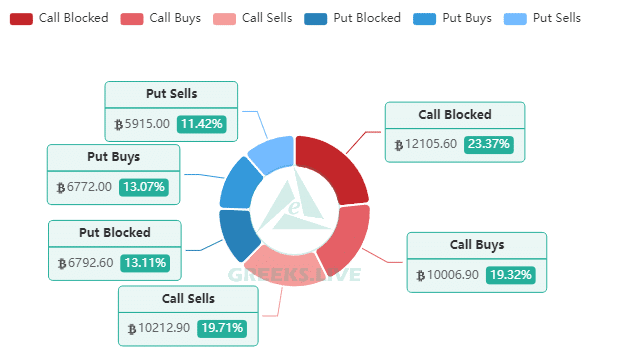

Furthermore, despite reaching new highs, block trades have relatively decreased, and there is a noticeable predominance of sales in both call and put options. This trend suggests that institutional investors, during the peak of the spot ETF narrative, are now taking a cautious stance by opening short positions, or in other words, short selling.

These significant signals from the option market and the strategic moves of institutional investors create an element of uncertainty about the future direction of the ETF market, prompting market participants to closely monitor developments for sensitivity and potential changes in market dynamics.

Are Whales Selling Bitcoin?

Many analysts predict that the approval of the US’s first spot Bitcoin ETF could result in a “buy the rumor, sell the news” scenario, potentially driving the price of BTC below $40,000. It is important to note that particularly the movements of whales are providing concerning signals.

As a significant development, Lookonchain reported a strategic move by a smart whale in the cryptocurrency market. According to data compiled by Lookonchain, a whale deposited 1,000 BTC worth $22.47 million to Binance after Bitcoin’s price rose above $45,000. This move followed the whale’s deposit of 4,000 BTC worth $178.7 million to Binance over the last two weeks.

Notably, these strategic deposit transactions were made at an average price of $44,673 during the specified two-week period. What stands out about this whale’s transactions is the tendency to strategically sell at high prices each time, displaying a calculated and opportunistic approach to take advantage of favorable market conditions.

Türkçe

Türkçe Español

Español