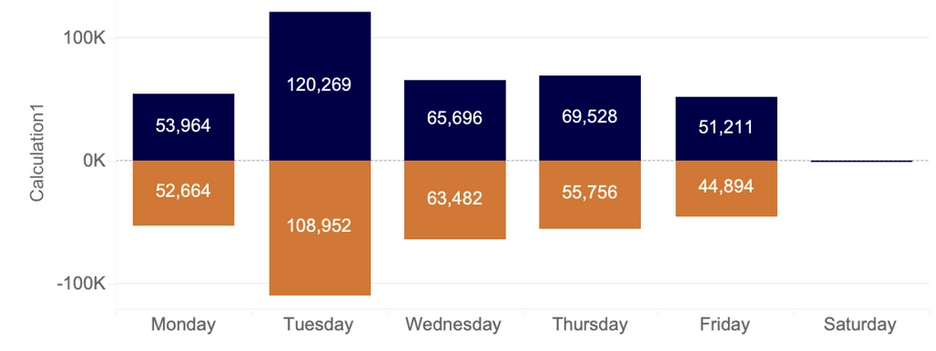

Crypto research firm Kaiko announced that the Bitcoin trading volume on Saturdays and Sundays has continued to decline this year, with weekend market liquidity weakening as institutional involvement in Bitcoin increases. According to Kaiko’s statement on February 26, while about one-fourth of Bitcoin’s trading volume occurred on weekends between 2018 and 2021, this rate has since experienced a steady decline, falling to 13% so far in 2024.

Bitcoin Trading Volume Experiences a Downturn

Kaiko mentioned that the mismatch between the 24/7 crypto trading space and the working hours of traditional financial institutions, as well as the needs of major crypto investors and market makers, has been a long-standing challenge for exchanges in managing liquidity on weekends. The firm made the following comment regarding the issue:

“This decline indicates worsening liquidity conditions on weekends, which can be attributed to both increased institutional participation and deteriorating market infrastructure.”

Kaiko pointed out that this was firsthand evidence when several crypto-friendly banks in the United States closed. The firm observed that the decline in weekend transactions occurred in both the United States and offshore exchanges.

However, weekend transactions remained somewhat higher on offshore exchanges like Binance, HTX, OKX, Bybit, and Upbit. Compared to the 11% volume on US exchanges like Coinbase, Kraken, and Bitstamp, weekend transactions on offshore exchanges had a volume of 15%.

ETF Process and Bitcoin Trading Volume

Kaiko observed weaker liquidity conditions at the US-based Coinbase compared to Binance on weekends and noted that since the second quarter of last year, trading costs at Coinbase have increased, while they have decreased at Binance during the same period.

The research firm also remarked that Bitcoin liquidity has strongly recovered since the launch of spot Bitcoin exchange-traded funds (ETFs) in the US. However, Kaiko also noted that very few transfers occurred between spot Bitcoin ETF issuers and exchanges on weekends. The Kaiko team concluded that this gap could widen as ETF issuers continue to increase their Bitcoin holdings.

Türkçe

Türkçe Español

Español