Demand for spot Bitcoin  $105,367 and Ethereum

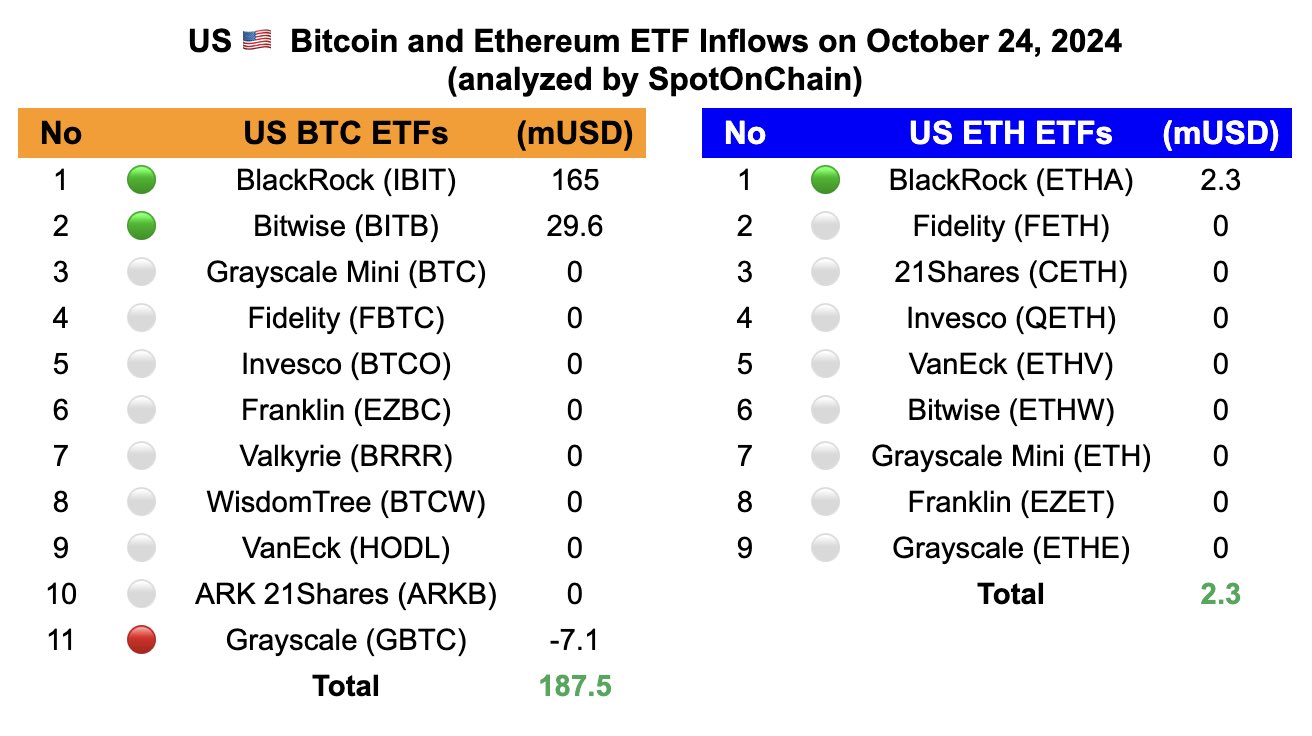

$105,367 and Ethereum  $2,662 ETFs in the United States continues to grow, characterized by significant net inflows. As of October 24, 2024, there have been total net inflows of $187.5 million into spot Bitcoin ETFs and $2.3 million into spot Ethereum ETFs.

$2,662 ETFs in the United States continues to grow, characterized by significant net inflows. As of October 24, 2024, there have been total net inflows of $187.5 million into spot Bitcoin ETFs and $2.3 million into spot Ethereum ETFs.

Strong Increase in Bitcoin ETFs

As of October 24, the 11 spot Bitcoin ETFs in the United States have registered positive net inflows for the second consecutive day. BlackRock’s iShares Bitcoin Trust (IBIT) ETF has sustained its lead as the most inflow-generating fund for eight consecutive days, pulling in 2,436 BTC (approximately $165 million) yesterday. Currently, IBIT holds 399,355 BTC (worth $27.16 billion), representing more than 2% of the total supply.

While eight of the remaining ten ETFs did not experience net inflows, the total net inflow for spot Bitcoin ETFs has reached $21.57 billion after 199 trading days.

Limited Interest in Ethereum ETFs

Positive net inflows continue for spot Ethereum ETFs, but there has been a weak increase over the past two days. Only BlackRock’s iShares Ethereum Trust (ETHA) ETF recorded net inflows, while the other eight Ethereum ETFs saw no net inflows. The total net inflow for spot Ethereum ETFs in the United States stands at a negative $478 million after 67 trading days.

Meanwhile, spot Bitcoin ETFs in the U.S. are on track to reach approximately 1 million BTC within 10 months of trading. Currently, these funds hold a total of 967,459 BTC. If demand persists, these ETFs are projected to surpass the holdings of Satoshi Nakamoto, estimated at 1.1 million BTC. BlackRock’s iShares Bitcoin Trust ETF currently possesses 396,922 BTC, while Binance holds 636,000 BTC on behalf of its clients.

Türkçe

Türkçe Español

Español