Binance exchange’s local cryptocurrency, Binance Coin (BNB), may have managed to stay above $300 despite the market’s recent red days. However, the demonstrated resilience may not necessarily be a proof that BNB is in the best position for an upward trend.

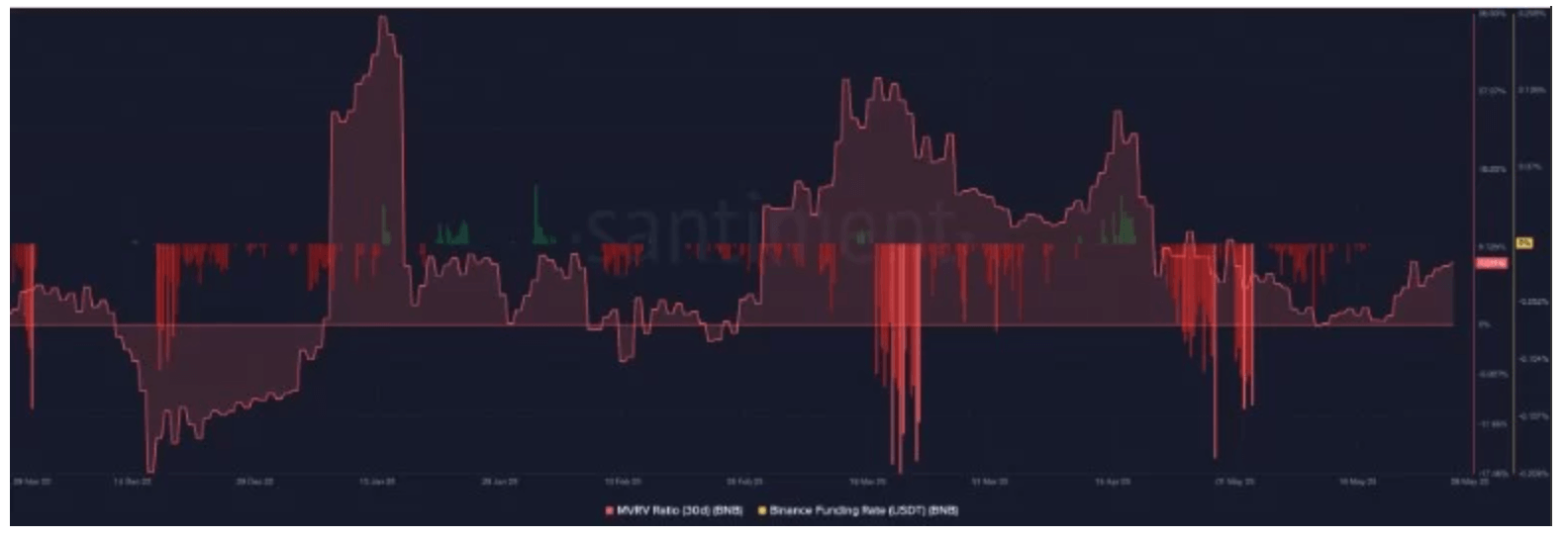

According to Santiment, the coin’s Market Value to Realized Value (MVRV) ratio has been increasing since May 20th. At the time of writing, this ratio stood at 7.211%.

What’s Next for BNB?

Typically seen as a macro oscillator, the MVRV ratio indicates how overvalued or undervalued an asset is by showing the ratio between its current price and the average realized price. When this ratio increases, it signifies investors’ inclination to sell, depending on the market cycle. As this has been the case with BNB, the increase had the potential to lead to further depreciation in value.

In conclusion, traders appear to be indifferent about BNB’s price movements, as indicated by the revealed funding rate. At the time of this article’s writing, the BNB funding rate was at 0%. This neutral situation explains the lack of interest among both long and short position holders to make payments to each other to keep futures or options contracts open.

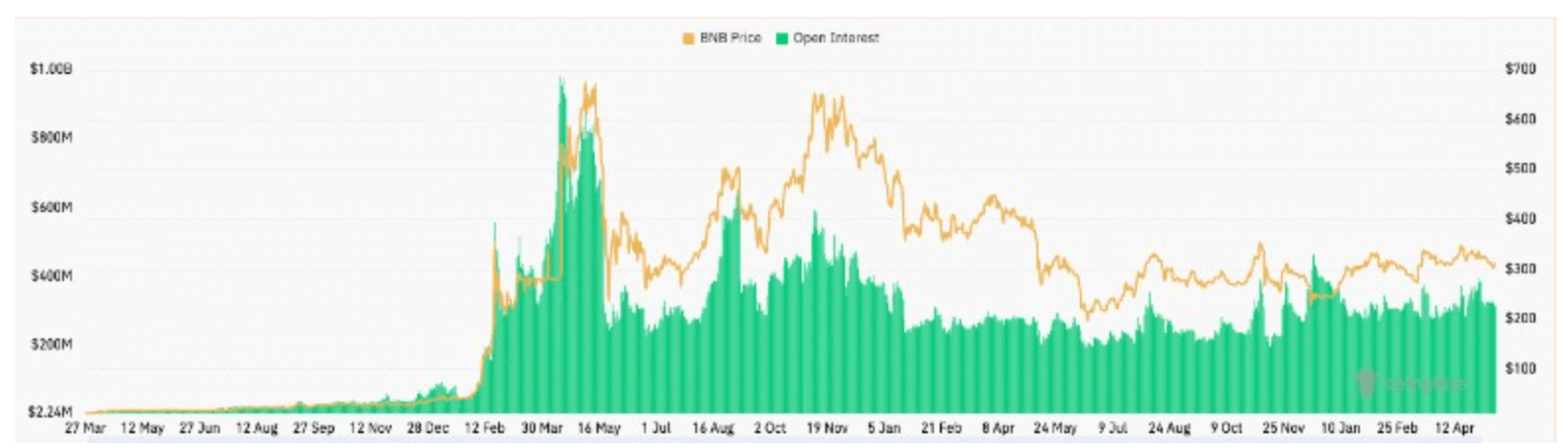

Another evaluation of derivative market activities showed a decrease in Open Interest (OI) during the same period when the MVRV ratio started to increase. OI measures the amount of money invested in contracts related to a specific coin.

Therefore, the drop in OI indicates that both buyers and sellers are actively closing their positions. Had it been the opposite, it would have meant that traders were jumping on BNB price movements for potential gains.

A Stalemate in BNB

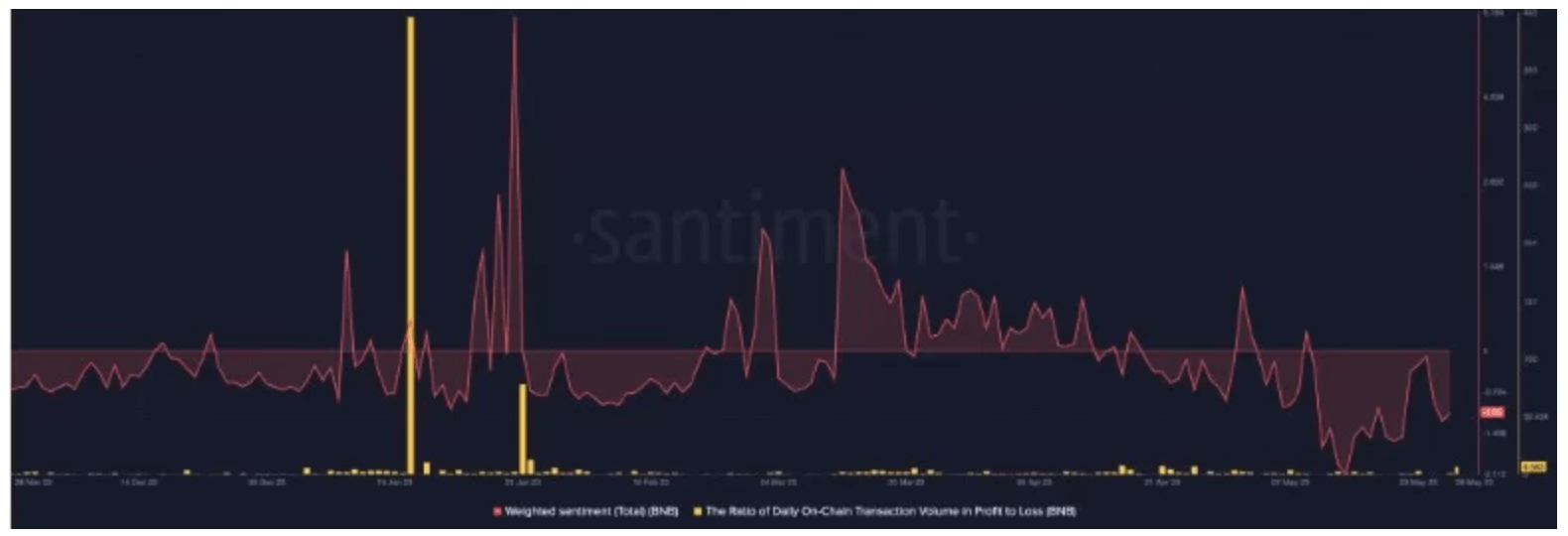

Although the average sentiment towards the coin showed a slight increase over the past two weeks, it failed to move out of the negative zone. At the time of writing, on-chain data showed BNB’s weighted sentiment standing at -1.05, taking into account both positive and negative comments on social networks.

Thus, when the metric is above the zero midpoint, it means the perception surrounding the asset is predominantly positive. However, staying in the red zone may indicate that the broader market is not optimistic about BNB‘s short-term price movements.

At the time of writing, the ratio stands at 6.583. Despite this being the highest value for the entire month of May, it is still considered low. Consequently, market participants made more profits than losses throughout the month. However, it did not even pass close to the peak recorded in January.