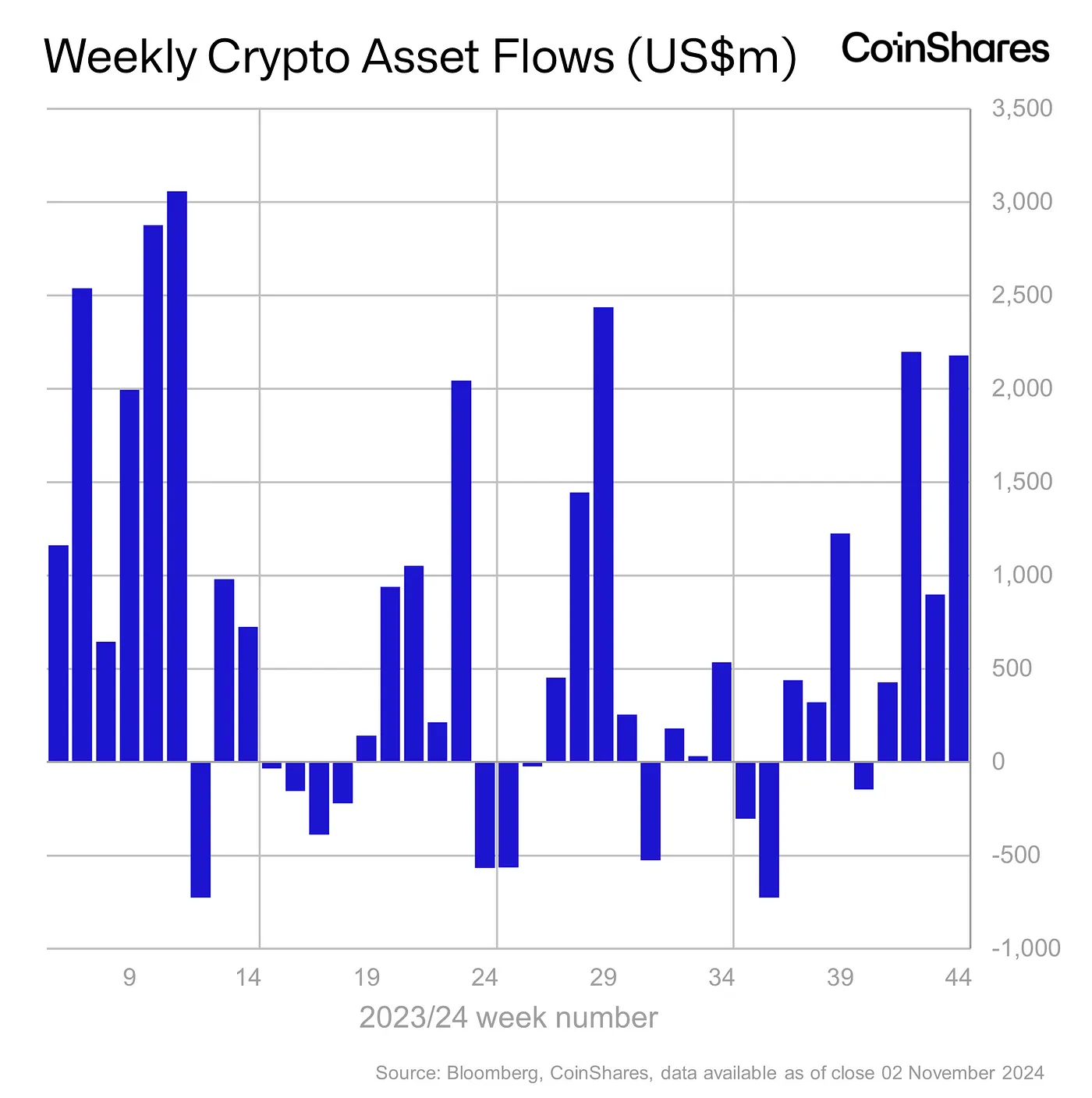

Last week, digital asset investment products received an influx of $2.2 billion. This surge in investments raised the total for the year to a record $29.2 billion and helped the assets under management (AuM) surpass $100 billion for only the second time.

Trading Volume Increases by 67%

The market reached the $102 billion level seen in June 2024, with trading volume increasing by 67% compared to the previous week, totaling $19.2 billion. This figure represents 35% of the total Bitcoin (BTC)  $108,580 trading volume on reputable exchanges.

$108,580 trading volume on reputable exchanges.

In the United States, the $2.2 billion influx was significant, while Germany saw a smaller entry of $5.1 million. Analysts attribute this support to the expectation of a Republican candidate winning the 2024 U.S. presidential elections and the excitement surrounding the election.

Bitcoin Remains Resilient to Election Uncertainty

Bitcoin emerged as the primary winner in digital asset investment products last week, attracting $2.2 billion in entries. With the price increase, interest in short products also rose, with observed entries of $8.9 million into short Bitcoin investment products.

As the 2024 U.S. presidential elections approach, minor outflows occurred at the end of the week due to shifting sentiments in polls. This highlights Bitcoin’s sensitivity to U.S. election dynamics.

Different Investment Trends Between Ethereum and Solana  $156

$156

Ethereum (ETH)  $2,583 lagged behind Bitcoin with a limited influx of only $9.5 million. The strong interest in Bitcoin did not translate equally to Ethereum. In contrast, Solana (SOL) demonstrated notable performance with a weekly entry of $5.7 million. Additionally, smaller altcoins saw movements, with Polkadot (DOT) and Arbitrum (ARB) attracting $670,000 and $200,000, respectively. This suggests that Bitcoin and Solana are receiving greater confidence and demand from investors.

$2,583 lagged behind Bitcoin with a limited influx of only $9.5 million. The strong interest in Bitcoin did not translate equally to Ethereum. In contrast, Solana (SOL) demonstrated notable performance with a weekly entry of $5.7 million. Additionally, smaller altcoins saw movements, with Polkadot (DOT) and Arbitrum (ARB) attracting $670,000 and $200,000, respectively. This suggests that Bitcoin and Solana are receiving greater confidence and demand from investors.

Türkçe

Türkçe Español

Español