Despite surpassing $30,000 twice today, the price of Bitcoin turned downwards again around 19:00. The king of cryptocurrencies may be losing value due to the anxiety caused by the thousands of BTC sent to exchanges. At this stage, the risk is increasing for altcoins as well. Many altcoins that have experienced a surge and significant gains may suffer heavy losses, and DODO Coin seems to be one of them.

The Rise of DODO Coin

The price of DODO rallied by 80% following the launch of Perpetual Contracts on the Binance exchange’s trading platform last week. On-chain data analysis provides signals about whether DODO’s price can recover from its ongoing decline.

DODO is a liquidity provider platform that uses a unique Proactive Market Maker (PMM) mechanism to enhance price stability. After achieving double-digit gains within 72 hours, DODO token caught the attention of investors this week. On Monday, August 7th, the cryptocurrency exchange giant Binance announced the launch of a DODO/USDT trading pair for perpetual contracts. Perpetual Contracts are a special trading product that allows crypto investors to speculate on the future price of an asset and take significant positions.

On-chain data shows that DODO network activity reached its highest level in 7 months immediately after the Binance announcement. This laid the groundwork for a 60% rally in DODO’s price. After closing at $0.13 on Tuesday, DODO gradually stumbled towards $0.11, triggering a fear of selling across the network. However, the increase in active addresses (+290%) gave bulls hope.

Despite a 25% drop, the number of users on the network increased.

DODO Coin Price Analysis

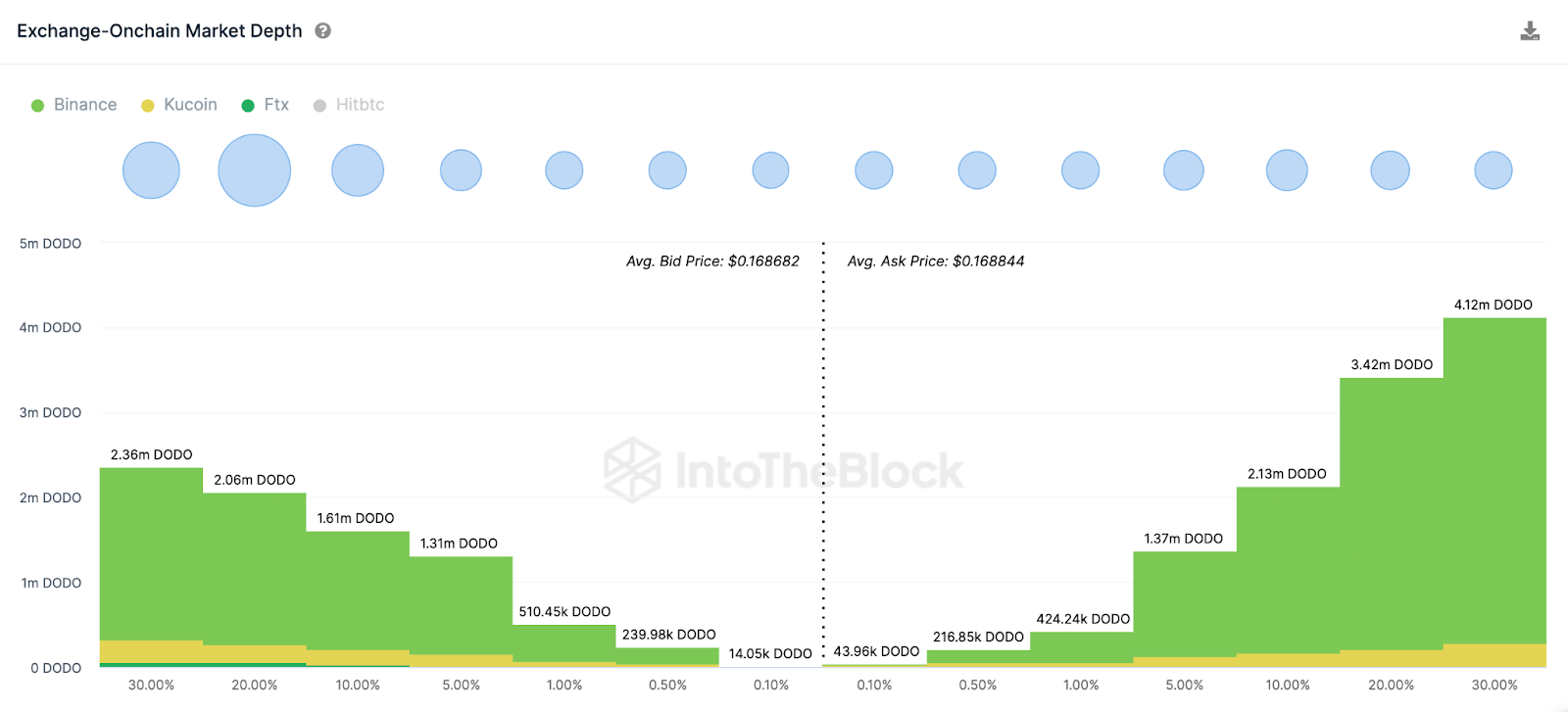

While active addresses suggest that the uptrend may continue, the selling liquidity on the exchange appeared to outweigh the buyers. When the active sell orders of an asset exceed market demand, a price correction is expected to begin soon. Taking into account the negativity in the price of Bitcoin, the price of DODO Coin may face a seller’s onslaught towards the $0.11 support level.

At the time of writing, with the price at $0.15, if it can close above $0.16, we can discuss the possibility of a renewed momentum in the upward movement.

Türkçe

Türkçe Español

Español