Trillion-dollar companies anticipating a surge in demand for cryptocurrencies in the coming months/years are taking various steps. From ETF applications and crypto custody service licenses to even concrete steps towards establishing a crypto exchange for corporations, the moves are being made. EDX Markets, the first exchange initiated by these trillion-dollar giants, took a significant step.

EDX Market’s Latest

Launched a week ago with the support of traditional finance heavyweights such as Citadel Securities, Fidelity Digital Assets, and Charles Schwab, the crypto exchange EDX is reportedly preparing to change its custody providers, leaving Paxos Trust in favor of Anchorage Digital. EDX operates on a business model designed to eliminate conflicts of interest, and it does not provide custody services.

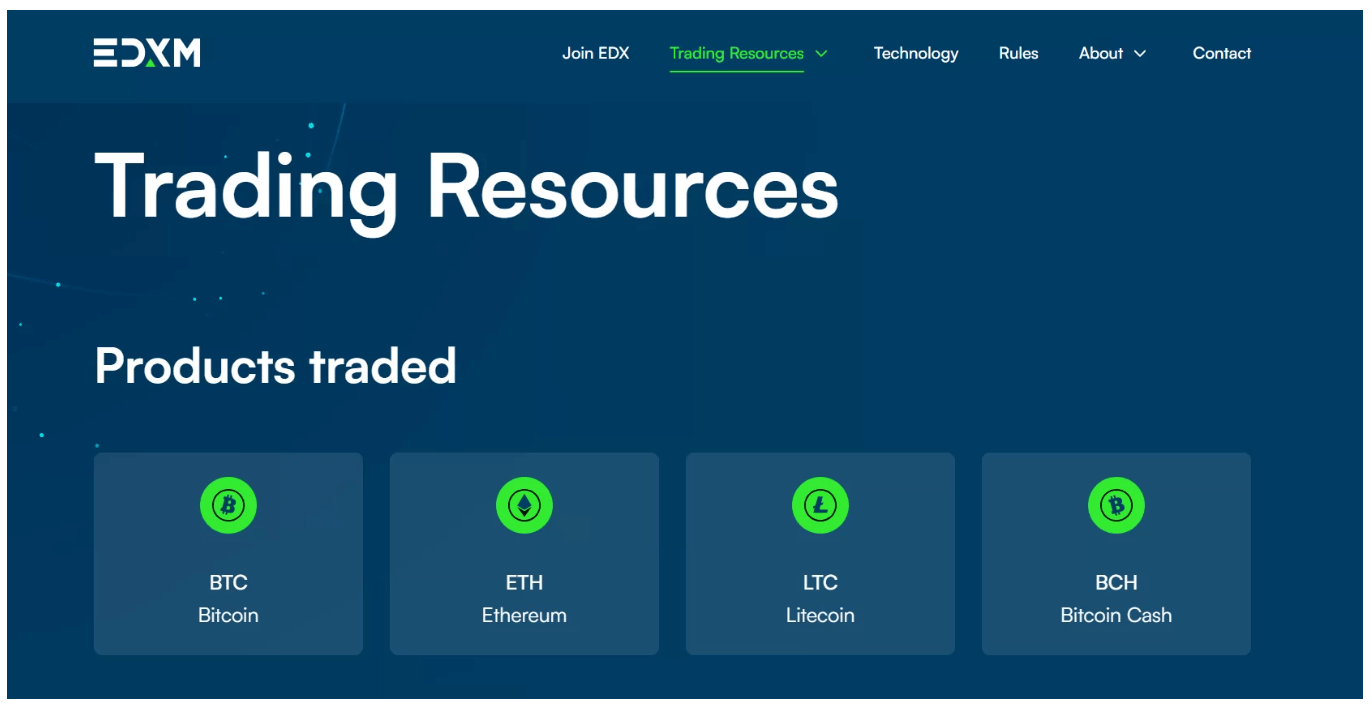

The platform supports trading in four cryptocurrencies: Bitcoin, ETH, LTC, and BCH. As of the writing of this article, BCH has risen by 70.43% over the past week since EDX became operational and 101.36% over the past month.

Parting Ways with Paxos

Shortly after the announcement of the exchange’s operation, EDX announced its partnership with Paxos in October to “facilitate the storage and wallet infrastructure of digital assets.” The U.S. Securities and Exchange Commission later announced a proposal for stricter custody rules for crypto companies. A Paxos spokesperson stated;

EDX shifted its focus to a non-custodial offer at launch. We are very excited about what EDX is building and hope to support EDX customers with our regulated custody when banks and brokers join the platform.

Blockchain infrastructure platform Paxos holds a license called BitLicense from the New York Department of Financial Services. The agency reportedly investigated Paxos earlier this year for unspecified reasons. Paxos received “conditional approval” for a U.S. bank charter from the U.S. Currency Comptroller (OCC) in 2021, but this approval reportedly expired at the end of March.

Anchorage Digital was the first crypto firm to receive a national trust bank charter from the OCC in January 2021. A year later, it clashed with this regulator due to Anti-Money Laundering shortcomings and accepted a consent order. Shortly after, Anchorage Digital established a custody network with crypto exchanges BinanceUS, CoinList, Blockchain.com, Strix Leviathan, and Wintermute.

EDX plans to introduce EDX Clearing, a clearinghouse, to settle transactions performed on the EDX Markets platform later this year. EDX declined to comment on the custody provider, and Anchorage Digital did not comment on the matter.