The Ethena (ENA) community has taken a significant step by proposing the use of Solana  $154 (SOL) as a reserve asset for the synthetic dollar, USDe. This development has led to a 17% increase in the protocol’s native asset, ENA, which has risen to $0.39, surpassing a market capitalization of $1.06 billion.

$154 (SOL) as a reserve asset for the synthetic dollar, USDe. This development has led to a 17% increase in the protocol’s native asset, ENA, which has risen to $0.39, surpassing a market capitalization of $1.06 billion.

Developing Reserve Structure with Solana

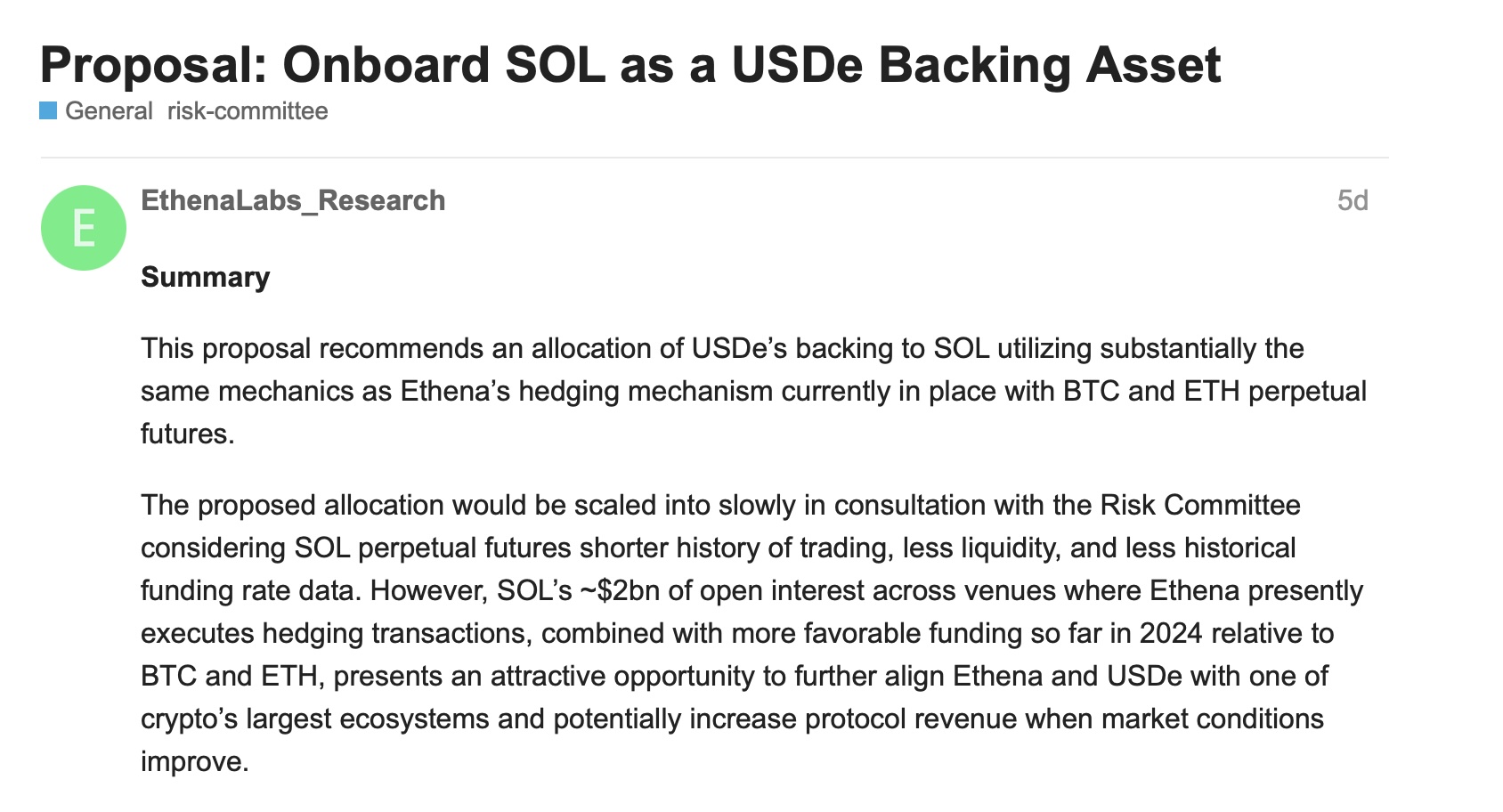

The new proposal aims to incorporate Solana as a reserve asset to ensure the protection of USDe. This approach closely resembles the hedging strategies previously employed by Ethena for Bitcoin (BTC)  $103,706 and Ethereum (ETH)

$103,706 and Ethereum (ETH)  $2,511. The primary goal of the proposal is to diversify the collateral backing USDe, enhancing its utilization in the DeFi space and providing greater overall market liquidity.

$2,511. The primary goal of the proposal is to diversify the collateral backing USDe, enhancing its utilization in the DeFi space and providing greater overall market liquidity.

In addition to SOL, the Ethena community has also recommended using Binance Liquid Staked SOL (BNSOL) and Bybit Liquid Staked SOL (bbSOL) as reserves for USDe. This will strengthen the support structure for the synthetic dollar while enhancing liquidity and market efficiency.

Impact of the Proposal on Altcoin Prices

Ethena launched the USDe stablecoin on the Solana blockchain in August of this year using LayerZero’s OFT standard. The Ethena Foundation stated that a careful scaling process would be implemented regarding the use of SOL as a reserve. This process will consider risks such as limited trading history of SOL perpetual futures, low liquidity, and insufficient funding rate data.

The announcement noted, “The proposed allocation will be implemented gradually and in a controlled manner following discussions with the Risk Committee.” This step aims to ensure a safer transition process.

With the new reserve plan, Ethena aims to boost protocol revenue and create an open trading capacity of $2-3 billion with Solana-backed positions. This increase will allow USDe to better respond to market demand beyond its current supply of $2.5 billion.

Following the launch of Ethena’s USDe stablecoin, it garnered significant interest and reached a total supply of $2.5 billion. USDe is notable for being the first scalable and censorship-resistant stablecoin that maintains dollar stability using delta hedging derivative positions in the DeFi ecosystem.

Ethena is also expanding its ecosystem with the UStb stablecoin, launched in partnership with BlockRock and Securitize. This move supports USDe’s positioning as a strong competitor in the stablecoin market.

The ENA coin has positively responded to these developments, gaining 17% last week to reach $0.39, bringing its market value back above $1 billion. Technical analyses indicate that this altcoin could rise to price levels of $0.50 and $0.69, with potential further targets reaching $1.50.

Türkçe

Türkçe Español

Español