Onchain participation is rapidly increasing in 2024, with blockchain networks like Ethereum showing significant growth in user base size and other factors. According to research, the increase in on-chain activity on Ethereum and Layer-2 networks in the first half of 2024 was driven by significant increases in activity on leading Layer-2 networks.

Intense Interest in the Web3 Space Continues

Ethereum or Layer-2 network-based blockchain ecosystems aim to keep network commissions and fees low for the Layer-1 or Ethereum network while speeding up the transaction process.

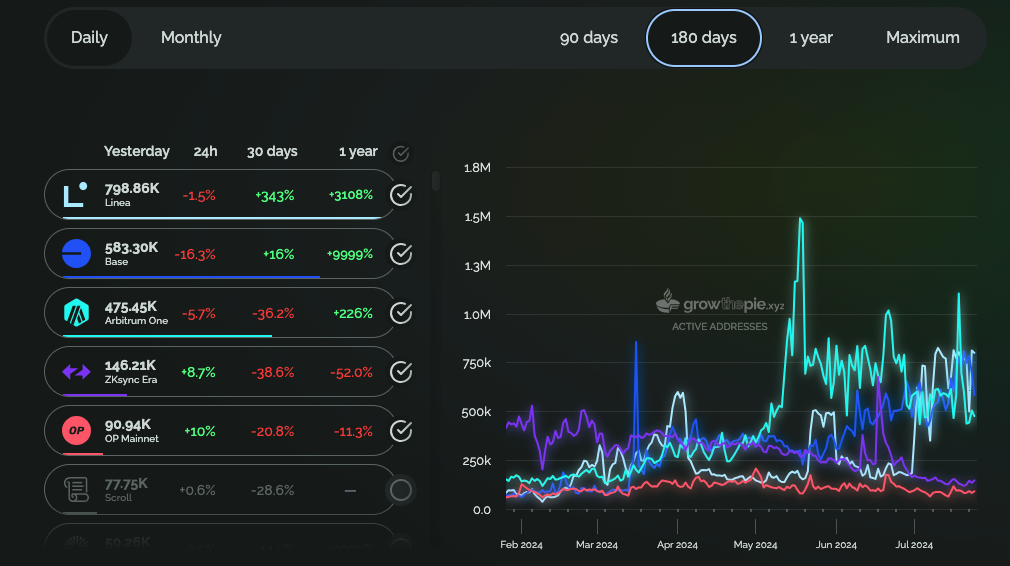

These Layer-2 solutions allow low-cost transactions to be processed after validation on parallel blockchain networks by transferring records to the main blockchain network to provide immutable records. According to data from Ethereum analysis platform Growthepie, Linea, Base, and Arbitrum were the top three Layer-2 networks with a total of 1.8 million daily active addresses at the time of writing.

In May 2024, Ethereum co-founder Vitalik Buterin claimed that Ethereum Layer-2 networks had become the ultimate playground for institutional profit-driven groups and individuals purchasing assets like NFTs.

Details on the Subject

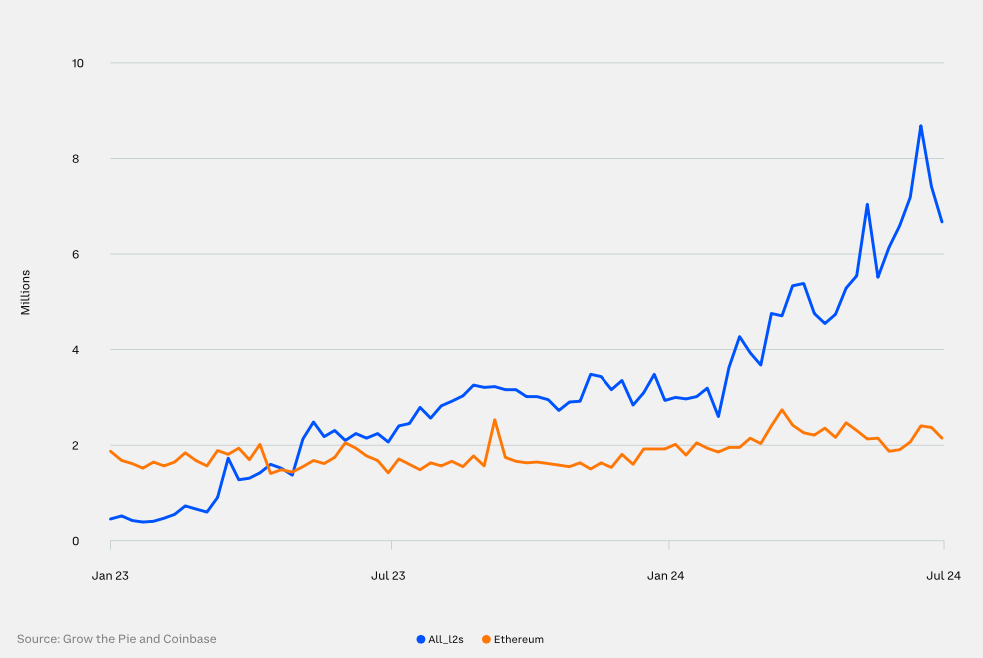

According to Coinbase and Glassnode, with the rapid development of new, faster, and cheaper Layer-2 networks, the increase in users on Layer-2 blockchain networks has significantly outpaced growth on Ethereum.

The report states that the number of Ethereum and Layer-2 transactions increased by 59% in the second quarter of 2024, with most of the growth occurring on Layer-2s. The study included the following statements on the subject:

“On-chain data is driven by various use cases, from lending to staking and trading, and we expect adoption to increase as current use cases mature and innovative new ones emerge.”

Additionally, while the number of transactions increased by 59%, total transaction fees on Ethereum decreased by 58% in the second quarter of 2024. The drop in network fees came after Ethereum’s Dencun upgrade in March 2024, which significantly reduced transaction fees.

According to the report, while Ethereum recorded a significant increase in on-chain activity, crypto users were less active with Bitcoin in the second quarter of 2024. As a result, the average number of daily active Bitcoin addresses fell by 20%, and the average number of daily active assets fell by 16% in the second quarter of 2024.

Türkçe

Türkçe Español

Español