2 Metrics Indicate Rise in Ethereum

Ethereum (ETH) continues to move between $1,950 and $1,850, a tight range with low volatility. Crypto data platform Santiment reported that multiple on-chain metrics of the altcoin king indicate a significant upward movement that is approaching rapidly.

One of the fundamental indicators that show a price movement in the upward direction for Ethereum is the profit/loss ratio of on-chain transactions. Currently, this metric is in a positive zone, but it can result in a slight decrease in price with high demand and lead to an upward movement. Crypto Traders Are Rushing to This App – Here’s Why You Should Too

Brian Quinlivan, the marketing manager of Santiment, pointed out that investors starting to trade more at a loss compared to when they made a profit could indicate that the price is potentially bottoming out. Currently, the profit/loss ratio of on-chain transaction volume still indicates that investors are in profit, but not by a large margin. Based on this situation, if the ETH price drops slightly and revisits the $1,700 to $1,800 level, panic selling in the future could lead buyers to enter the market.

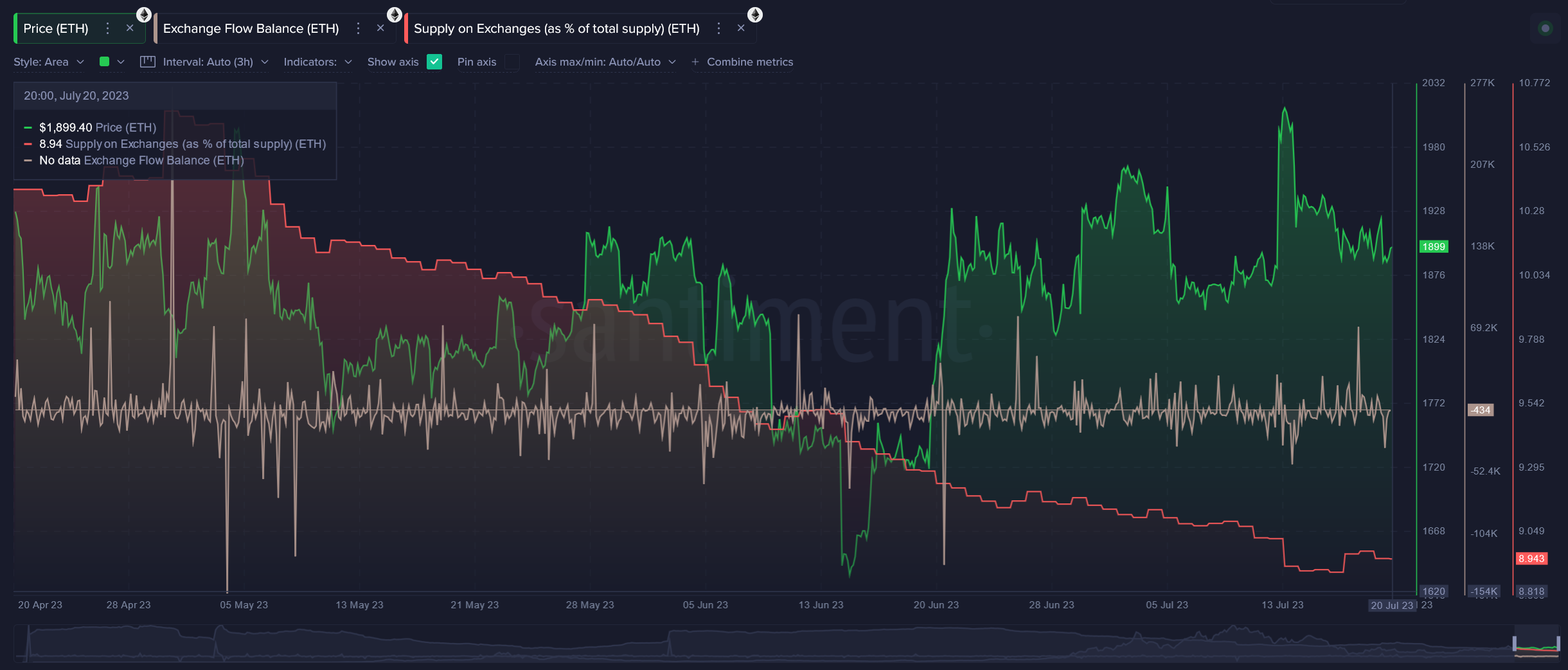

Another signal of a rise for Ethereum is the amount of ETH in cryptocurrency exchanges’ wallet addresses, which is below 10%. This indicates that a significant portion of Ethereum investors prefer to keep their ETH in their own private wallet addresses, and the likelihood of large sell-offs on cryptocurrency exchanges is quite low. Especially after Ethereum’s transition from Proof of Work (PoW) to Proof of Stake (PoS) in September 2022, trust in ETH as a long-term investment instrument has increased.

ETH Could Surpass $2,000 in August or Before the End of the Month

Quinlivan suggested that based on all these positive indicators, Ethereum could surpass the $2,000 level in August or before the start of the new month. The marketing manager of Santiment also emphasized the importance of patience in the cryptocurrency market, adding that waiting for the right moment in this market often results in high rewards.

Türkçe

Türkçe Español

Español