Thousands of cryptocurrency investors have fallen victim to mandatory liquidations following the recent market downturn. The price of the largest altcoin, Ethereum (ETH), has dropped over 7% in the past 24 hours, trading at around $1,650 after a slight recovery from the sharp decline. The next support level for ETH is around $1,600, and breaking below this level could trigger a major collapse.

$288 Million Collateral at Risk of Mandatory Liquidation

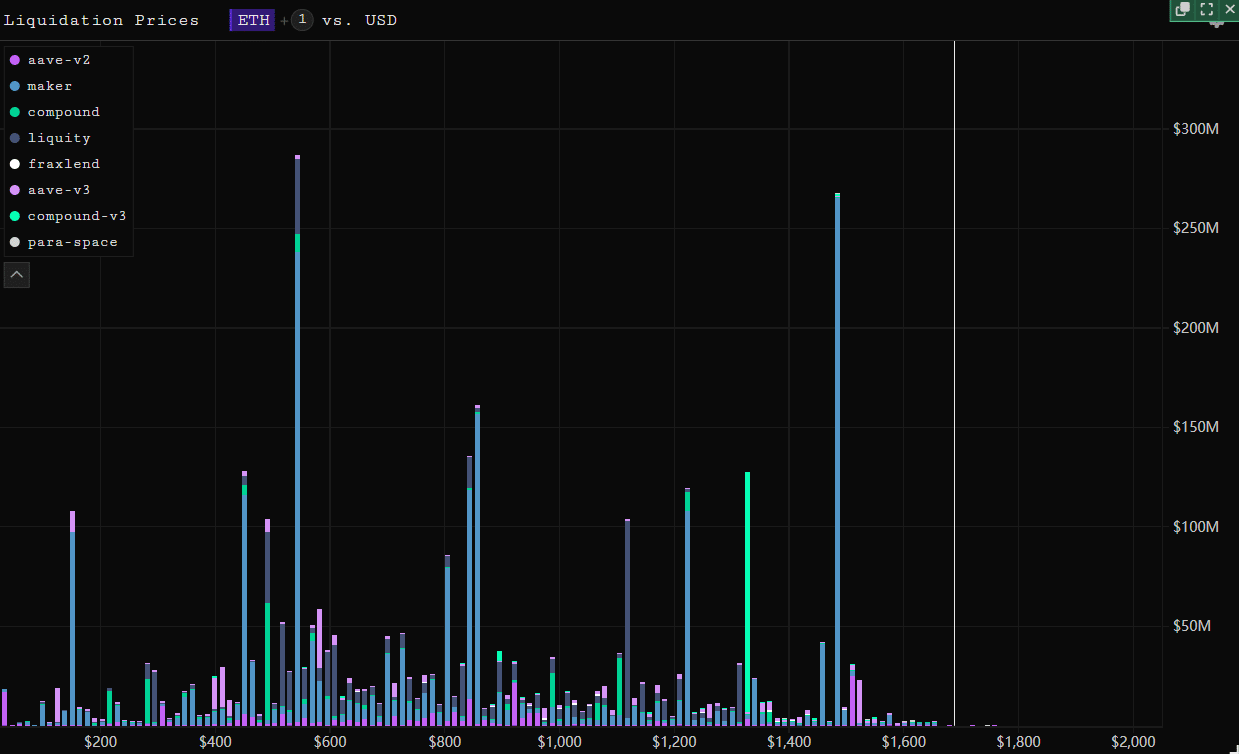

One prominent factor behind the price drop of ETH is the ongoing strong liquidations in the DeFi market. According to data from Parsec, the liquidation volume in DeFi protocols on the Ethereum blockchain has exceeded $75 million in the past 24 hours, and if the price of ETH falls below $1,480, this volume is expected to rise even higher.

The current level of liquidations in DeFi protocols on the Ethereum blockchain is at its highest level so far this year. Well-known blockchain journalist Colin Wu highlighted the attention to on-chain data and stated that if the price of the altcoin king continues to fall below $1,480, an astonishing $288 million worth of collateral will be liquidated in the DeFi market.

Two Scenarios for Ethereum DeFi’s Mandatory Liquidation

Nicholas Merten, the host of cryptocurrency-focused YouTube channel Data Dash and a renowned crypto analyst, predicted a major liquidation if the price of ETH falls below certain levels, pointing to two potential scenarios. According to Merten, investors who have leveraged their positions excessively with ETH and used DeFi protocols may face mandatory liquidation of their positions if the price of Ethereum drops.

Merten presented two scenarios, with the first scenario involving investors depositing their ETH into DeFi protocols to temporarily show collateral in order to obtain a certain amount of stablecoin, allowing them to potentially buy more Ethereum for speculative purposes. Investors would then repay the loan and reclaim their collateral.

The second scenario, described as a disaster, would occur if the price of the collateralized Ethereum drops significantly, causing the debt-to-loan ratio to become extremely high, and there is not enough collateral to secure the borrowed funds. In such a case, there would be a major liquidation unless more stablecoin is provided as collateral and the open loans are repaid, which most investors currently do not have access to.

Türkçe

Türkçe Español

Español