ETFs have visibly impacted the cryptocurrency world, particularly on the BTC side, over the past year. This situation has also influenced the rest of the market and paved the way for spot Ethereum ETFs. Currently, excitement continues unabated for the Ethereum ETFs, with results awaited for the S-1 documents. Additionally, Solana has joined the process.

Current Status of Ethereum ETFs

According to a source familiar with the matter, final approval from regulators is expected soon following the submission of documents by issuers of spot Ethereum exchange-traded funds (ETFs). Consequently, trading in spot Ethereum ETFs could begin next week.

The source, who shared information anonymously due to the confidentiality of discussions with spot ETF issuers, indicated that the approval from the U.S. Securities and Exchange Commission (SEC) could come next week, potentially concluding the process.

Issuers, including VanEck and 21Shares, have submitted the final versions of their updated S-1 documents to ensure no obstacles remain for the SEC’s final decision on listing spot Ethereum. They are now awaiting the outcome.

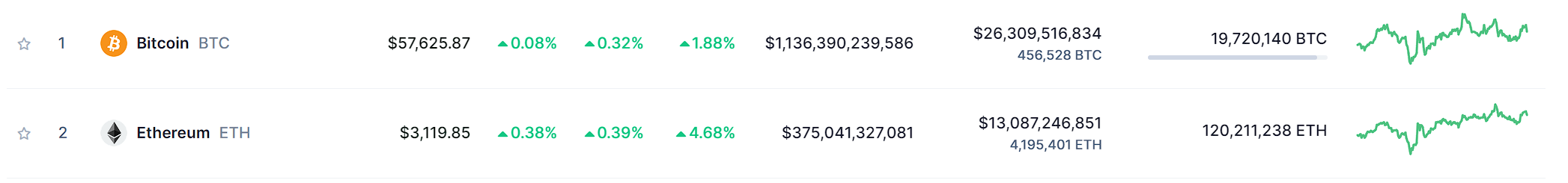

Bitcoin ETFs and Inflows

Analysts predict that billions of dollars could flow into ETH ETFs in the months following their listing, potentially driving up ETH’s price.

According to cryptocurrency analyst Mark Dunleavy, ETH’s exchange supply is lower compared to BTC. This could trigger a price increase due to potential ETF demand. Despite low supply, high demand could positively impact ETH.

With the listing of spot ETH ETFs, the list of publicly traded crypto funds, including spot Bitcoin ETFs that began trading in January, will expand.

As of today, Bitcoin (BTC), valued at over $50 billion, is held by ETFs based on investor demand. Dunleavy suggests that ETH ETFs could also see significant activity, potentially hosting $10 billion in inflows in the months following their launch.

Additionally, multiple applications have been made for spot Solana ETFs, which could soon join BTC and ETH.

Türkçe

Türkçe Español

Español