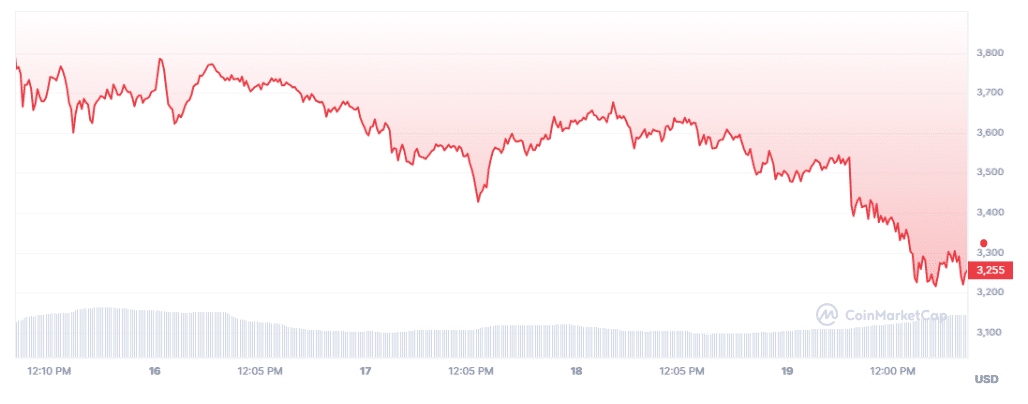

Cryptocurrency market’s downward trend has not spared any digital currency today. The likelihood of seeing Ethereum (ETH) around $3,000 is no longer significant as the cryptocurrency has fallen by 18% within a week.

Excitement for Ethereum’s Upgrade Fades

Following a 7% drop from yesterday, Ethereum is currently trading at $3,244.67 and continues to trend lower. Ethereum’s trading volume has increased by 66% since yesterday, reaching a value of $31,064,685,795. This unexpected decline occurred after Ethereum’s price reached a peak of $4,066 on March 13th, instead of continuing an upward trend, the price fell. The anticipated Ethereum Denison Upgrade, expected to drive Ethereum’s price to its all-time high (ATH), did not succeed.

The cryptocurrency is only 33% away from its ATH, and significant progress is needed for it to reach its best value. The overall cryptocurrency market is following a downward trend, and even Bitcoin has not escaped the decline. There are two main reasons affecting the general crypto market, including Ethereum’s price: the Federal Reserve meetings and the slump in the Indian market. Federal Reserve meetings have a significant impact on the cryptocurrency market as they discuss interest rates and new policies for the US economy.

The Federal Reserve’s Impact on ETH

Significant price drops in the cryptocurrency industry occur before each of these meetings. There are eight such meetings planned each year. The SEC has not yet given a clear answer regarding the approval of an Ethereum Spot ETF. According to Polymarket predictions, the chance of the ETF being approved by May is only 28%, which is too low to carry further expectations. This is a disappointment for investors, as the approval chance has dropped from 75% in January to 28% in March.

Compared to the Bitcoin Spot ETF, the SEC does not seem very favorable towards an Ethereum ETF, especially since the SEC has never explicitly stated whether Ethereum is a security or a commodity. There appears to be political pressure on the SEC through Senators Jack Reed and Laphonza Butler. They have hindered the SEC from approving more spot ETFs. The approval of the Bitcoin ETF is considered a correct decision to protect investors from fraud and manipulation.

Türkçe

Türkçe Español

Español