The largest altcoin, Ethereum (ETH), is once again under strong selling pressure and trading below $1,600. While ETH struggles to keep up with upward momentum, certain network parameters such as gas fees are showing signs of cooling down.

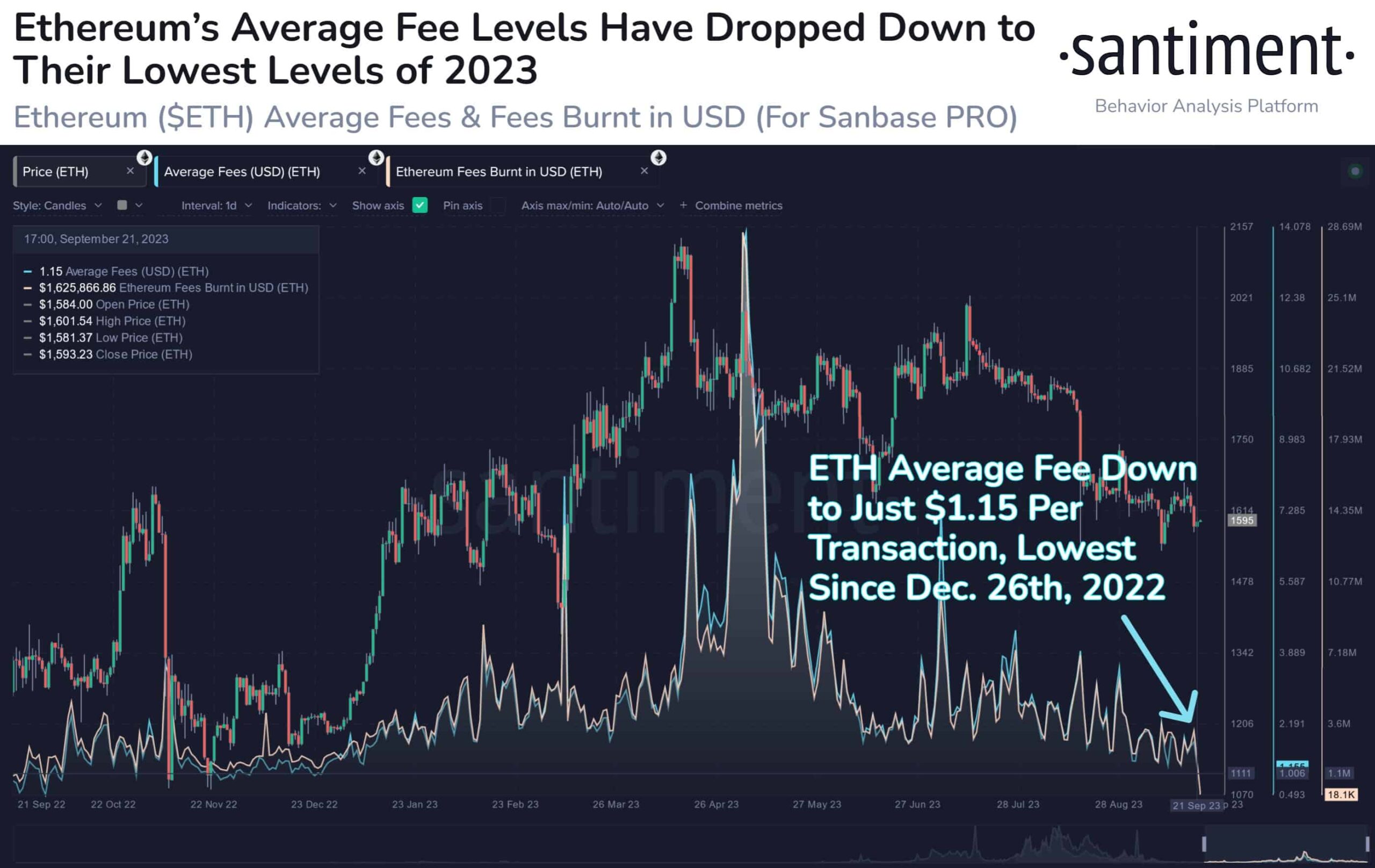

Gas Fees on Ethereum Network Reach an All-Time Low

Data provider Santiment reported that transaction fees on the Ethereum network have reached their lowest level since the beginning of the year, currently standing at only $1.15. This decrease in transaction fees historically corresponds to an increase in Ethereum usage, as lower fees make the network more cost-effective to use. Increased usage could pave the way for price recovery.

While this development is positive in terms of on-chain metrics, the price of ETH continues to be under selling pressure. On September 19, the price of the altcoin made its third rebound from the descending trendline, forming consecutive lower highs on the daily chart, indicating a strong bearish sentiment.

In the past three days, the price of the largest altcoin, ETH, has dropped by 3.8% and is currently priced at $1,596. The continuation of this downward trend suggests a further 4% drop in the price of Ethereum, potentially targeting the support level at $1,460. Furthermore, a massive transfer of $31 million worth of ETH through Ethereum co-founder Vitalik Buterin’s wallet address has unsettled the Ethereum community, and on-chain data indicates that crypto whales are not supporting any upward moves that could result in a buying pressure.

Concerning Trend Regarding Ethereum Staking

Members of the Ethereum community are expressing concerns about a significant decrease in staking entries, coinciding with the widespread adoption of Ethereum staking. The total number of staking entries, which measures unique wallet addresses that transfer ETH to the official Beacon Chain deposit wallet address for staking, recorded a consistent increase from approximately 5,952 on April 3 to 404,704 on June 1.

This notable increase was triggered primarily by the Shapella update on April 12. For example, between April 12 and June 1, the total staking entries increased from 16,736 to 404,704, representing an astonishing increase of over 25 times. However, as can be seen from the image below, the total amount of ETH staked has been steadily decreasing since May.

Since the Shapella update, there has been a decrease in various on-chain metrics, including network activity for Ethereum. Additionally, several liquid staking protocols, such as Lido Finance (LDO), have significant ETH staking dominance.

Türkçe

Türkçe Español

Español