Developments continue to unfold for Ethereum, which has maintained a strong stance since its inception. After more than two years, the altcoin surpassed the $3,000 mark, but then experienced a sharp price pullback influenced by a decline in Bitcoin‘s value. So, what’s the current situation with Ethereum?

What’s Happening with Ethereum?

On February 20th, just after Ethereum’s (ETH) price exceeded $3,000, an ICO participant who had been inactive for 8.5 years transferred 1,732 ETH, worth $5.15 million at the time of writing, to the Kraken exchange.

It was revealed that this wallet owner had purchased 3,465 ETH at approximately $0.31 each during Ethereum’s Genesis, which would have been worth around $10.3 million. This sudden movement could potentially have a negative impact on Ethereum’s price, which is currently just above the $2,900 level.

This could trigger an increase in the supply and liquidity in the market and potentially affect the existing sentiment. On the positive side, the wallet owner’s return to activity can be interpreted as a sign of confidence in Ethereum’s current price levels.

This could attract the attention of other investors who perceive the market positively.

However, concerns may arise about potential sales or profit-taking strategies by long-term holders, especially if the participant decides to liquidate some of the deposited ETH, which could contribute to short-term selling pressure and temporarily affect the price.

Ethereum (ETH) Commentary

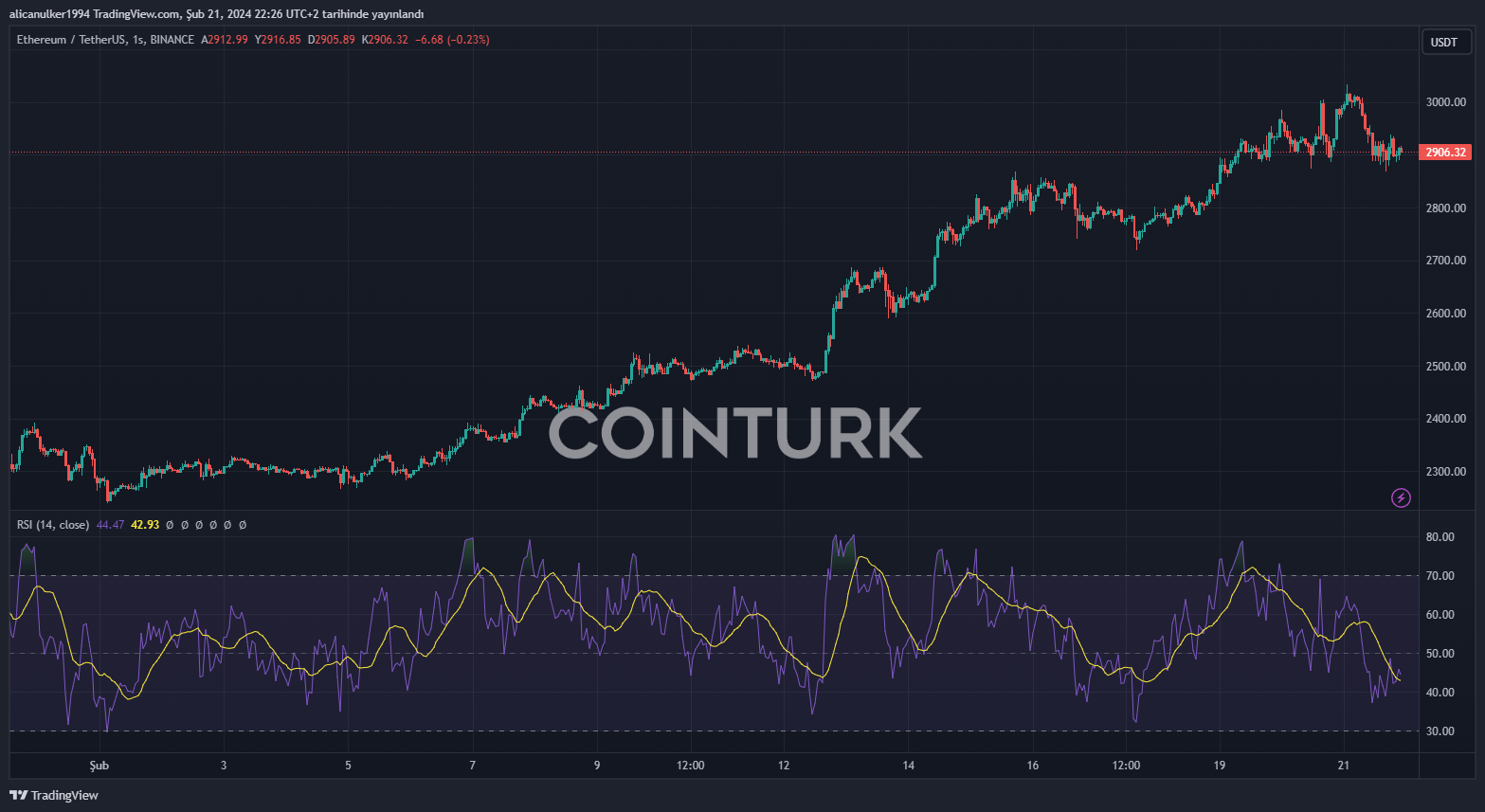

At the time of writing, the ETH price was trading at $2,906.32, significantly retreating from the $3,000 level. The rate of decline in the price of the leading altcoin in the last 24 hours was 3.62%.

Despite the recent correction, there was an increase in the number of addresses holding ETH, which could be interpreted as a growing general interest in ETH.

However, this increase in numbers did not seem to particularly help the situation of ETH. On the other hand, there was a significant decrease in the number of NFT transactions on the Ethereum network at the time of writing, which could also negatively affect the overall status of ETH.