The leading smart contract platform Ethereum (ETH) is among the altcoins significantly impacted by Bitcoin’s (BTC) decline. The potential approval of a spot ETF in Ethereum had triggered a price increase. While a similar rise was expected in Ethereum as seen in Bitcoin in recent months due to the spot ETF effect, what is the current situation with ETH?

Spot ETF in Ethereum

In recent months, there was curiosity about whether the approved spot ETF applications in Bitcoin would create a similar wave of increase in Ethereum. However, Ethereum is trading approximately $700 lower than its all-time high of $4,091. Addressing this situation, MN Capital’s founder Michael van de Poppe expressed his confidence in the ETH ecosystem and noted that this ecosystem has a very important support level.

Van de Poppe commented on the recent drop in Ethereum prices a few days after the spot Ethereum ETFs were approved by the United States Securities and Exchange Commission (SEC). ETH fell by 13% to $3,426, and the analyst suggested that as the momentum towards listing the Ethereum ETF starts to emerge, the upward trend will gradually increase.

Historical Data in Ethereum

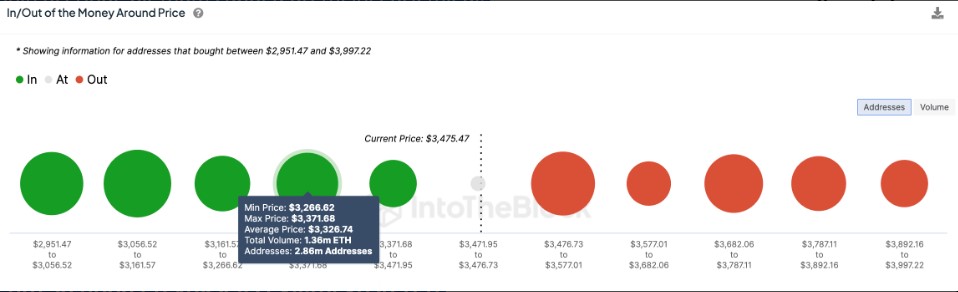

Data obtained from the cryptocurrency analytics company IntoTheBlock shows that ETH is at a support level below $3,400. Additionally, the cryptocurrency analyst known as Yoddha emphasized that based on the price movement in the 12-day timeframe in Ethereum, ETH recently produced a candlestick above its annual highs by bouncing off this support level.

According to the expert Yoddha, if history repeats itself in Ethereum, the token’s price will enter a parabolic upward trend with an upward target set around $20,000, making it one of the most bullish cryptocurrencies. He concluded his statements as follows:

Ethereum is currently one of the most bullish altcoins. It is already trading above the previous year’s high.

Türkçe

Türkçe Español

Español