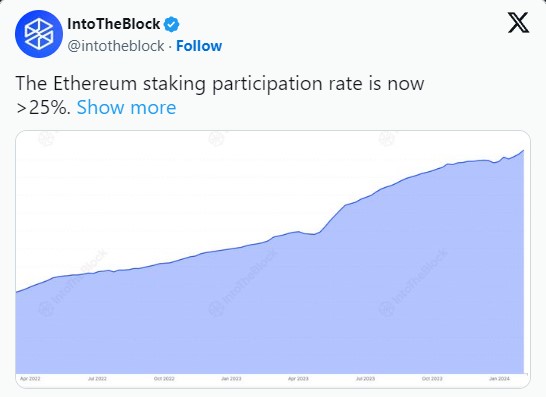

Market value shows Ethereum firmly holding the second spot after Bitcoin, with a staking rate exceeding 25%, satisfying investors. The data provided by the renowned analytics firm IntoTheBlock highlights the growing confidence in Ethereum’s proof-of-stake (PoS) mechanism following the recent “merge” event. The increasing amount of staked ETH indicates a growing confidence in Ethereum’s future among investors.

Ethereum Staking Craze Continues

Developments in the Ethereum network are ongoing. A noticeable increase in the stake participation rate has been observed among users who support the network by staking their ETH tokens, thereby increasing trust. As of February 11, the total amount of staked ETH surpassed 38.69 million, once again showcasing the investors’ trust in the network.

The increase in the amount of ETH staked by investors reflects the growing number of users and trust in Ethereum’s PoS mechanism.

At the core of staking in Ethereum is the locking of ETH tokens by users to support the network’s operation and security. Staking transactions reward investors, providing a passive income opportunity for those who choose to stake their ETH instead of selling it.

Dencun Upgrade Approaches

All preparations for the Dencun upgrade on the ETH network seem to be complete. Scheduled for March 13, this upgrade aims to increase the network’s efficiency and strengthen support for layer-2 scaling solutions through proto-danksharding.

One of the key aspects of the upcoming upgrade is its importance for Ethereum’s scalability and the support it will provide for the network to process more transactions at lower costs.

While all these developments are taking place, an increase in Ethereum’s price was also observed, with a 13.62% price increase over the past week, reaching levels of $2,611.62.

Prominent crypto analyst Michael Van de Poppe noted that Ethereum’s strong current support levels could pave the way for higher prices, describing ETH’s market stance as a waiting game under current market conditions.

According to Michael van de Poppe, a breakout in ETH could still make the $3,500 level a possibility. At the time of writing, ETH was smiling at investors at a price level of $2,628. The ETH market cap rose over 4% to $315 billion, while the 24-hour trading volume surged over 50% to $11.8 billion.

Türkçe

Türkçe Español

Español