Ethereum’s (ETH) price is influenced by many factors. One of these is whale sales, while another is the bearish market outlook. These events could cause Ethereum, the second-largest cryptocurrency after Bitcoin, to drop to its lowest levels in weeks.

Current State of Ethereum

Ethereum’s price has shown notable movements recently. Parallel to the cryptocurrency market, ETH investors have become pessimistic, losing significant support levels consecutively. Whale actions also significantly impact this situation.

Ethereum whales are known to have a significant influence on future events. When examining ETH under market conditions, whales do not appear optimistic about profits. Addresses holding between 100,000 and 1 million ETH sold nearly 700,000 ETH in the past two weeks.

Following the sale of 2.32 billion dollars worth of ETH, the total assets of these addresses dropped to 20.26 million ETH.

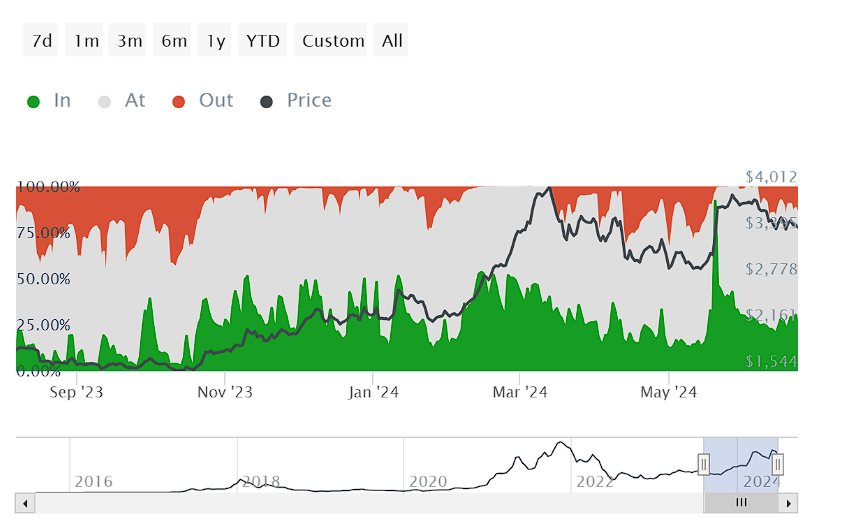

On the other hand, sales by individual investors have also visibly increased. When examining the profitability of currently active addresses, approximately 25% of ETH investors remain profitable.

If the mentioned indicator is below 25%, the likelihood of current ETH investors selling is considered very low. Conversely, if the indicator rises above this value, the profitability rate increases, significantly impacting investors’ desire to take profits and potentially triggering new sales.

ETH Price Prediction

Ethereum’s price continues to decline, moving within a falling wedge pattern known as a bearish model. According to this pattern, the altcoin’s upper target is well above $4,000, but this seems unlikely for now.

A potential sideways movement in Ethereum could keep the altcoin below $3,500, but it could also prevent significant declines.

If Ethereum fails to rise, its price could fall below $3,000. In this case, the profitability of current investors could further decrease.

Türkçe

Türkçe Español

Español