At the beginning of 2024, a weak performance for Ethereum was not anticipated, as the news flow was supportive. However, the SEC did its utmost to initiate action to classify Ether as a security. So, what are the expectations for ETH as May 23 approaches?

Ethereum and May 23

Spot Ethereum ETF applications have various final decision dates, and May 23 is the nearest. The SEC will make its decision on the spot Ethereum ETF just days or even hours before the weekend starts. The initial decision is expected to be a rejection of the related ETFs. The recent steps taken by the regulatory body and the lack of discussions with issuers support this view.

The crucial decisions will come in July and August concerning applications from BlackRock and Fidelity. However, if excessively negative statements are used in the rejection announcement due to fairness, we might see that applications not yet due for a final decision also get rejected. Moreover, while the SEC has taken action against the Ethereum Foundation, it hardly seems logical to overlook potential instabilities and allow ETH ETFs to trade on U.S. exchanges.

Ethereum (ETH) Price Commentary

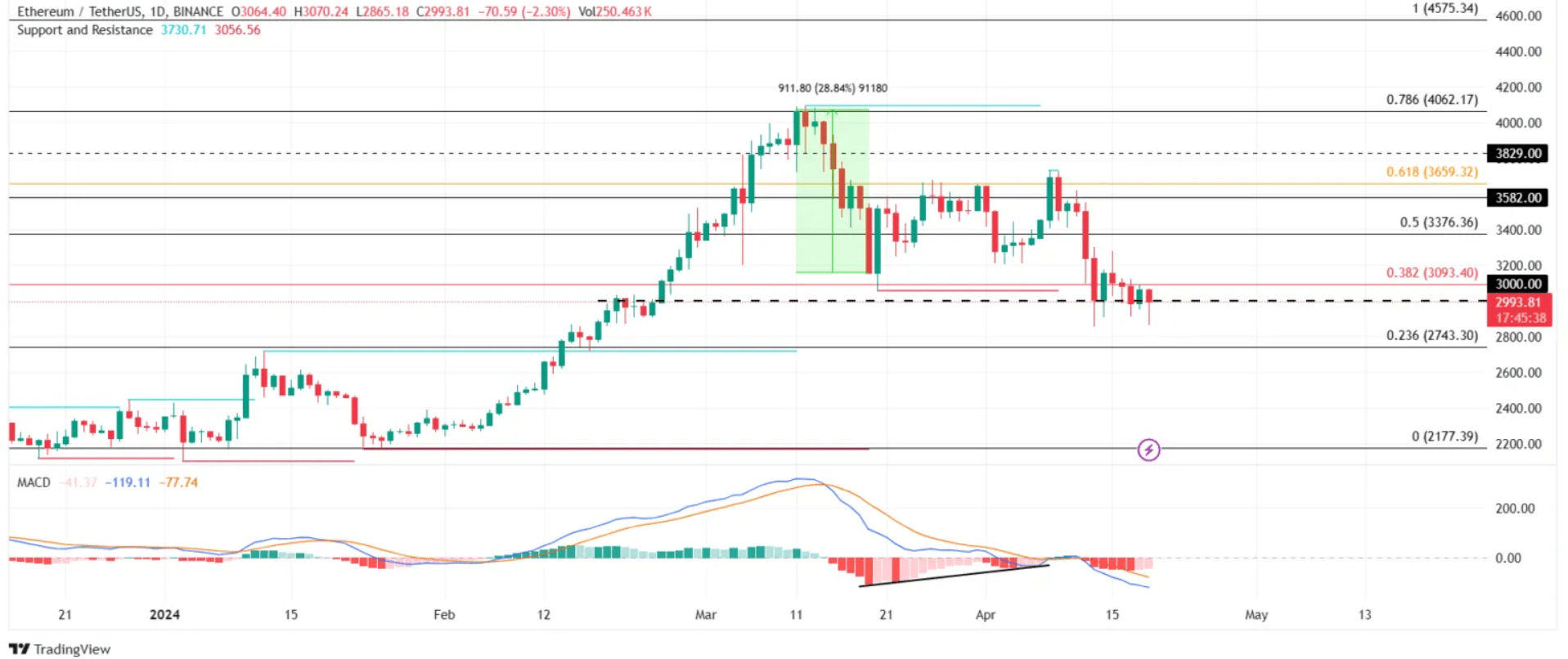

At the beginning of this year, a much better outlook was expected for ETH. Following the approval of BTC, everyone showed interest in Ether, and like BTC, its price was expected to reach all-time high levels. The latest network update was also supportive as it would reduce transaction fees. However, none of these provided the expected support to the bulls.

According to GIOM data, approximately 9.14 million ETH worth over $27.4 billion was purchased in the range of $3,537 to $3,118. Considering this large supply is part of a relatively smaller rally, it is likely that ETH holders will not rush to sell until this supply becomes profitable, keeping the region active.

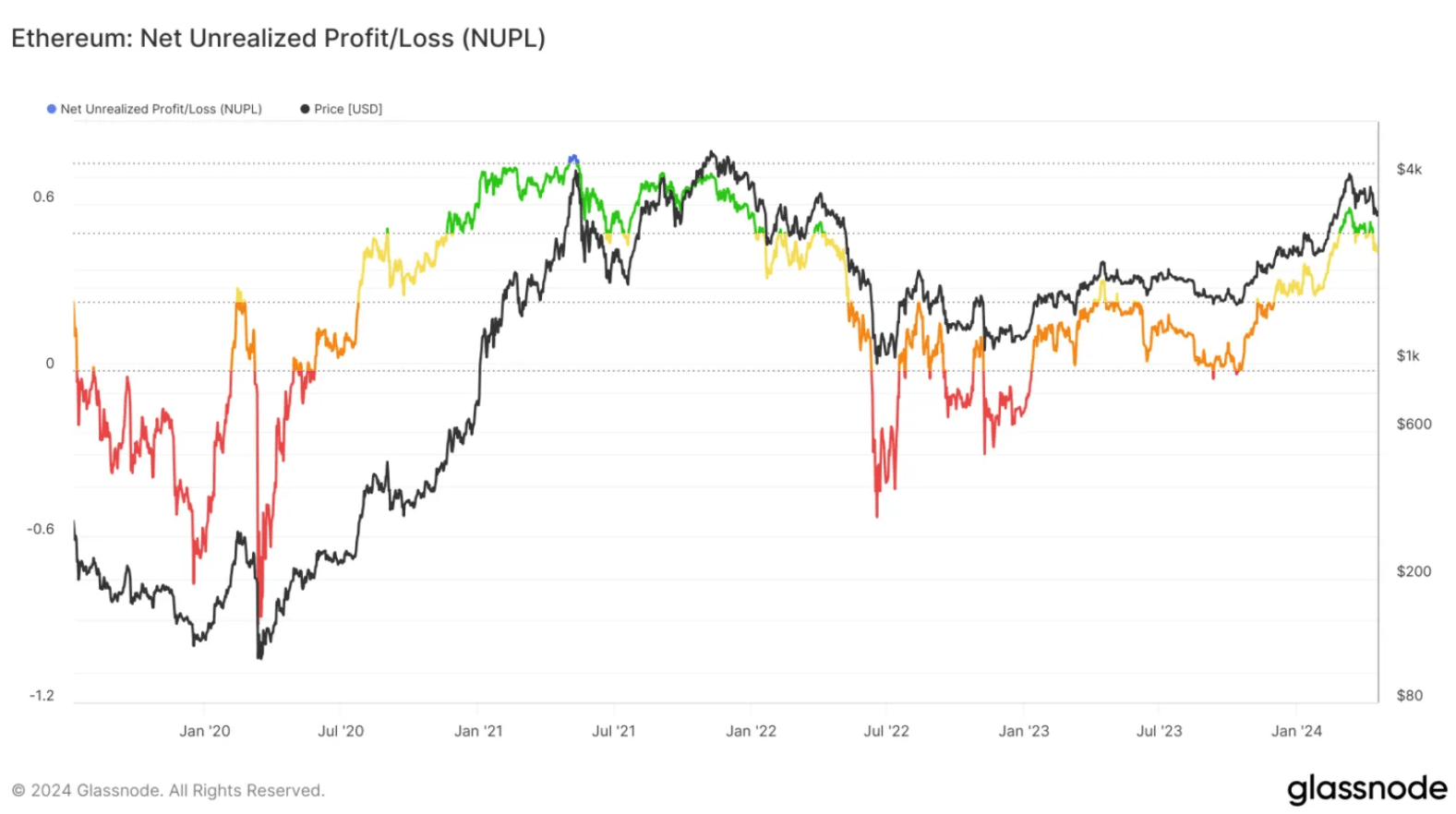

The Net Unrealized Profit/Loss (NUPL) indicator also looks very promising. The NUPL in the optimism zone suggests that demand could revive and herald a potential rally. Ethereum’s trading price around $3,000 could exceed $3,500, indicating potential for a rally.

Of course, for this to happen, it would be supportive if the BTC price remains above $64,000. About 10 hours ago, BTC began to give back the gains it made in half an hour as this article was being prepared.

Türkçe

Türkçe Español

Español