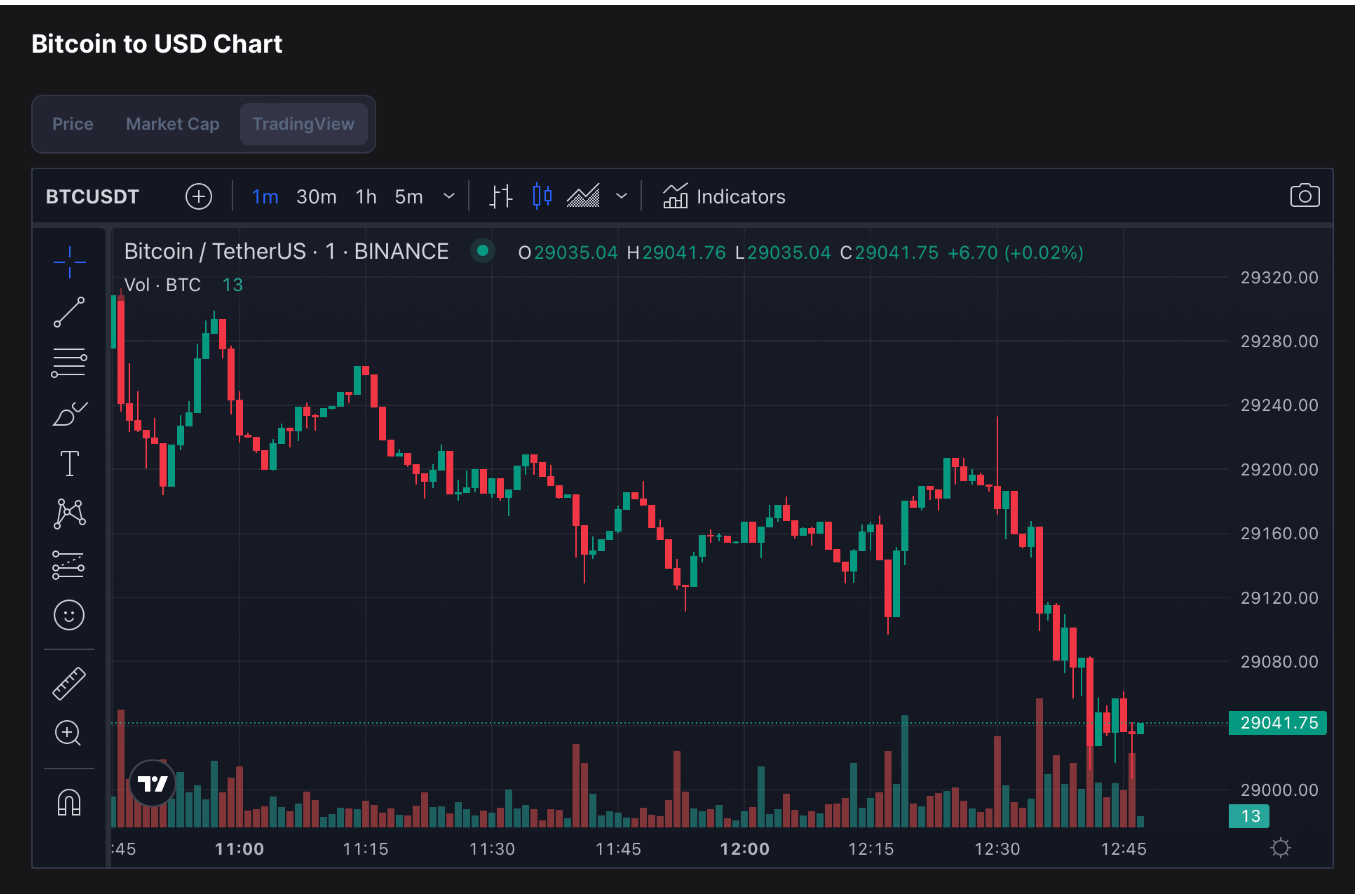

The cryptocurrency market has been stirred by the week’s unfolding events. The Federal Reserve declared a 25 basis point rate increment yesterday at 21:00 Turkish time. While the market remained comparatively subdued during the hours when the interest rate verdict was disclosed, Bitcoin recommenced its ascent with the value appreciations registered since last night. Concurrently, the European Central Bank’s interest rate decision incited further market movement.

European Central Bank (ECB) Proclaims Interest Rate Verdict

At the week’s outset, the FED’s interest rate decision commanded attention. The Federal Reserve persisted in elevating interest rates, augmenting the policy rate by an additional 25 basis points. The cryptocurrency market exhibited relative stability during the hours surrounding the rate increase; however, the leading cryptocurrency Bitcoin (BTC) surpassed $29,000 once more, owing to value appreciations since last night. Simultaneously, the European Central Bank’s interest rate verdict provoked further market activity. Aligning with expectations, the European Central Bank (ECB) raised interest rates by 25 basis points to 3.25%. In the ECB’s statement, persistent high inflation was noted, while underscoring the medium-term 2% inflation target.

Cryptocurrency Market Roused Again

Bitcoin (BTC), experiencing modest value depreciation since midday, declined from $29,300 to $29,000 price levels following these losses within hours. At the time of writing, the cryptocurrency market’s total value hovers around $1.19 trillion, according to CoinMarketCap data.

Throughout the day, volatility within the cryptocurrency market escalated once more. Coinglass data reveals that, on average, $100 million worth of short and long positions were liquidated within the last 24 hours.