ETC Group Research Director Andre Dragosch made notable statements about the increase in volatility in the futures market. According to the famous analyst, Bitcoin futures market investors are preparing for significant price movements this week, and these preparations are in response to the potential uncertainties that could arise during the possible spot Bitcoin ETF process.

What to Expect for Bitcoin?

Andre Dragosch pointed out the steep premium for options that expired on January 5th due to the uncertainty surrounding the possibilities in ETF applications. Dragosch stated the following:

“This high premium also indicates that futures market investors are preparing for higher uncertainty this week, suggesting that most investors expect a definitive decision from the SEC by the end of this week, not the following week.”

According to cryptocurrency futures market investor Gordon Grant, volatility increases when more people enter the market and buy options. The famous figure made the following remarks:

“When we examined the increase in volatility in illiquid market conditions over the weekend, we saw that demand outpaced supply. The spot price of Bitcoin was not moving, but options surged rapidly with a volatility score of over 10% in anticipation of an event that could occur this week.”

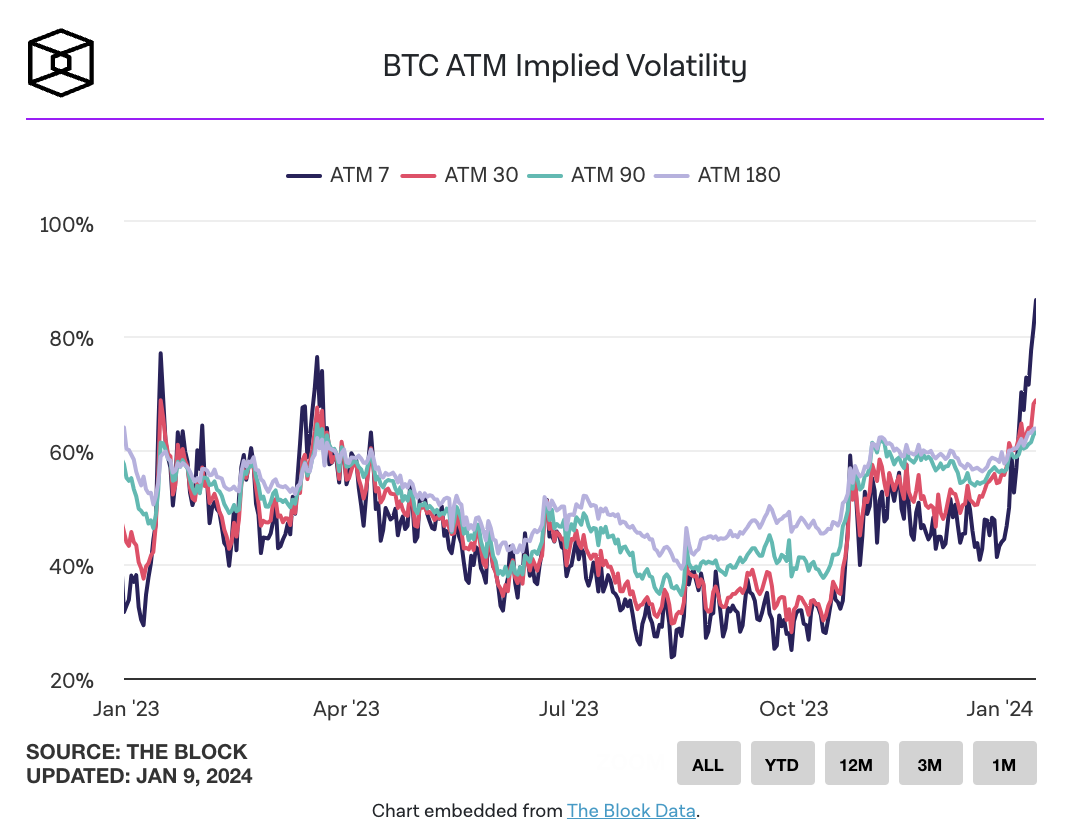

According to the data analysis platform The Block’s Data Dashboard, the implied volatility for Bitcoin price movement prediction reached its highest level of the year at 86.3%.

Significant Statement on Volatility

YouHodler Market Chief Ruslan Lienkha suggests that the increase in volatility is a result of the market’s expectation of significant capital inflow into the Bitcoin market if ETF applications are approved:

“Bitcoin is still not very liquid compared to fiat currencies or commodity markets; a few hundred million dollars can slightly raise the price. At the same time, we expect a capital inflow of billions of dollars following the SEC’s decision. Such an amount of money could cause the price of Bitcoin to rise by 50% to 100% in a short period.”

Volatility represents the market’s expectation of how much the price of a traded asset can rise or fall in the future. When volatility increases, it indicates that futures market participants expect larger price increases or more uncertainty for the asset.

Türkçe

Türkçe Español

Español