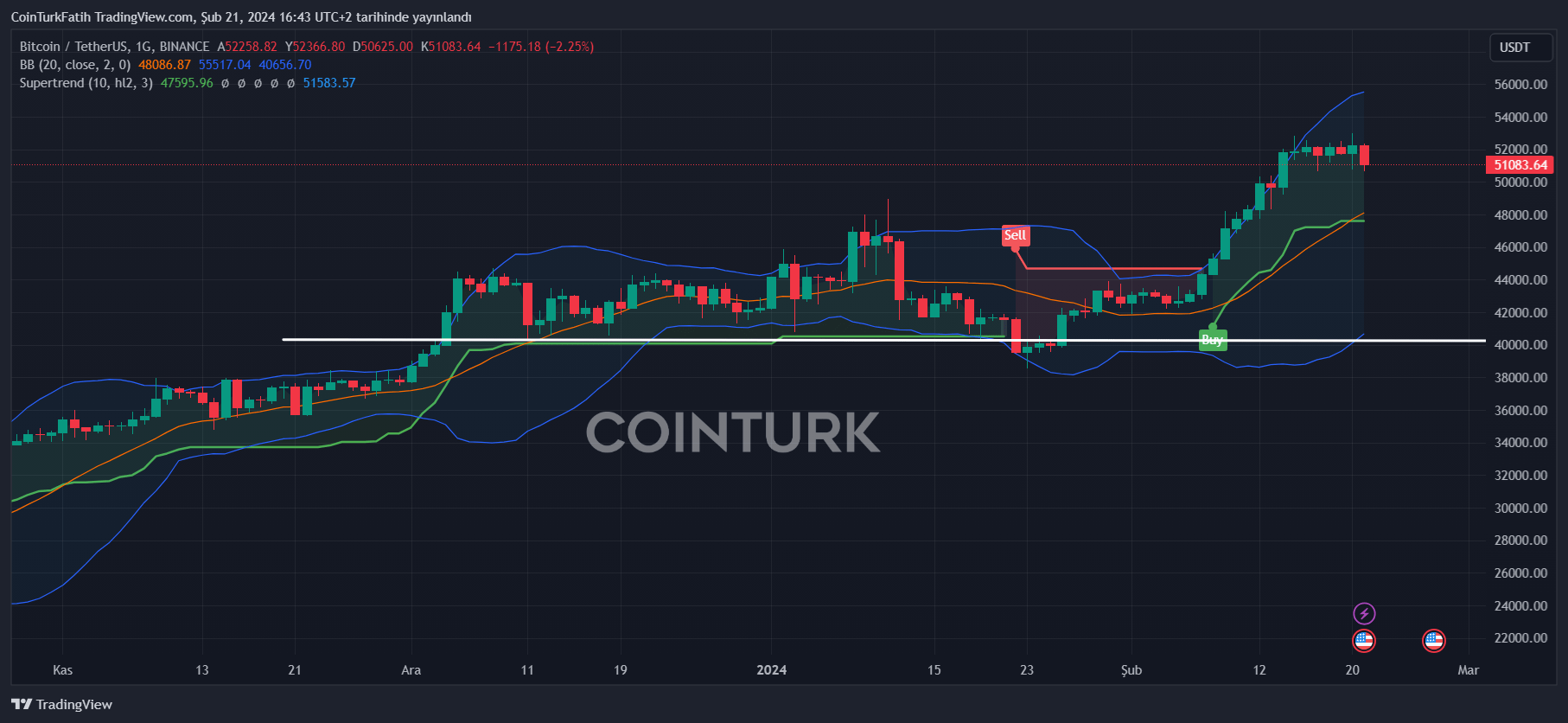

Bitcoin‘s price has returned to the $50,800 region at the time this article was prepared, with the Federal Reserve’s meeting minutes set to be released in a few hours. Altcoins have turned their direction downward again following the recent BTC drop. Meanwhile, QCP analysts have just published their latest predictions for the cryptocurrency markets. So, what are the experts’ current predictions as Bitcoin weakens?

Cryptocurrency Expert Commentary

Bitcoin recently set a new yearly high at $53,000 but failed to sustain beyond that level, leading to a drop to $50,600 due to excessive selling in the region. This development happened swiftly, and altcoin investors could not resist panic selling. A few hours ago, QCP analysts wrote the following regarding the current situation:

“BTC touched $53,000 yesterday, creating new highs, and ETH climbed to $3,033, closing the gap. The funding rate for altcoins increased significantly. BTC and ETH forward curves were also very high, with some points of the curve yielding up to 17%.

Generally, such speculative rotation in altcoins is a mid-cycle event. Maintaining funding at these levels is usually difficult, which means there could be a pullback in prices after such a strong rise. We have already started to see some selling pressure in Asia before noon.

Today, an important event that could trigger a broader correction is Nvidia’s earnings, to be announced after the US market closes. Nvidia’s performance, being a significant part of the S&P500 Index, could set the tone for US stocks in the near term.

NVDA is currently trading at a 90x P/E ratio, and the expectations for Q4 earnings have been adjusted higher recently. At these valuation multiples and high earnings expectations, any disappointment could see a sell-off. This will definitely put pressure on US stocks and crypto prices.”

Potential Downtrend for Bitcoin and Altcoins

Last week’s rapid rise was triggered by spot Bitcoin ETF volumes seeing an average of $450 million daily. Billion-dollar net inflows increased excitement and naturally led to rising prices. However, we are not seeing volumes close to half a billion dollars these days, and sellers were eager to take profits at the $53,000 level.

Experts were saying that with the balancing of ETF volumes, a market correction could begin. If today’s Fed minutes contain bad surprises and net inflows remain weak compared to the previous week, BTC could see a new correction to $38,500. However, this will be gradual, and the $48,800 region is of key importance.