Bitcoin price had reclaimed the $71,600 mark and closed the day at a good level after testing the recent bottom as the article was being prepared. Moreover, liquidity was shifting to higher market cap cryptocurrencies like BNB, SOL, AVAX as the Asian markets were about to open (at the time of writing). So, what are the current predictions of the experts?

Cryptocurrency Expert Opinions

Predictions from individuals who have gained sufficient experience in the markets and have reached respected titles are much more valuable. Their past accurate predictions or their influential positions today make their forecasts significantly important. Let’s now take a look at the predictions of three expert names.

Willy Woo Bitcoin Prediction

According to famous analyst Willy Woo, the king cryptocurrency is on the verge of catching the growth trajectory of the internet from 1997 to 2005. This comparison has been made many times, but it sounds much more convincing after the approval of a spot Bitcoin ETF, which is an undeniable fact.

Woo believes that this seismic shift in adoption has been ongoing for years. Therefore, Woo claims that “At the end of this cycle, 1 billion people will own Bitcoin.” If this scenario comes true, a six-figure Bitcoin price could become a very familiar thing by 2025.

Adam Back BTC Prediction

Adam Back, a well-known name in the crypto world, says that today’s $100,000 BTC price is a much-delayed event. According to him, the current peak of $73,000 did not create the expected excitement because these were very delayed prices.

“Bitcoin reached $73,000 on Tuesday. No one said anything. It spent most of Wednesday above $73,000. I think the silence is because $100,000 has looked very delayed for a few years, so there’s not much bull market excitement as $1,000 to $5,000 green candles progress”.

He believes that the Bitcoin price will soon surpass $100,000, and the real FOMO and excitement will start after this threshold, pushing the price to its peak.

CryptoQuant Bitcoin Prediction

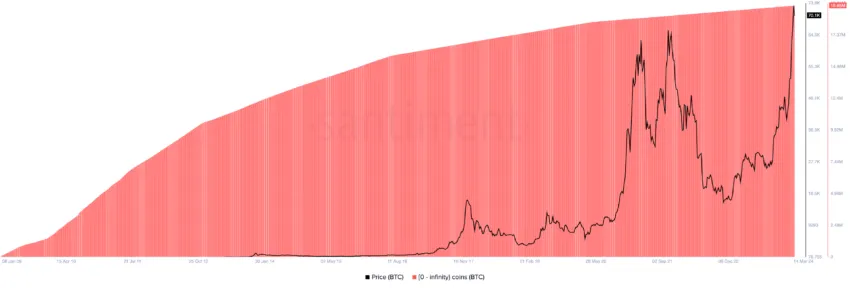

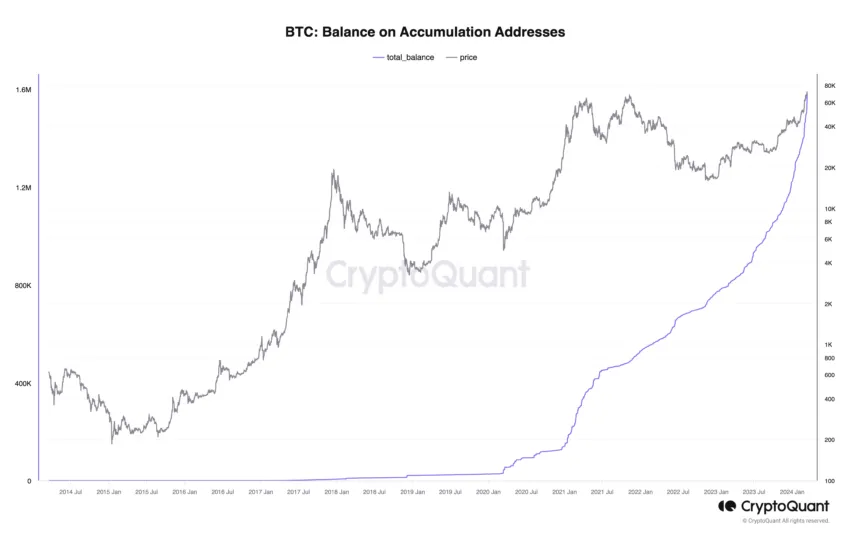

Ki Young Ju suggests that if institutional entries continue as they are, we will enter a period where it’s hard to find sellers. This increase in demand was triggered by the ETF approval, and whether the US likes it or not, it has legitimized Bitcoin as an investable asset. This approval (legitimization) is creating a paradigm where demand could soon outstrip supply.

Spot Bitcoin ETFs quickly gathered $30 billion, marking the most successful ETF launch in history. This was the best-case scenario everyone dreamed of, and it happened.

Last week we saw the beginning of the aforementioned event with a net inflow of 30,000 BTC. Considering there is roughly $140 billion worth of BTC on exchanges, the story becomes even more appetizing. Of course, no one can see the future, and a world where investors who have reached high profitability through the ETF channel make net sales of $5-8 billion weekly is not an impossible scenario.

Türkçe

Türkçe Español

Español