Famous crypto analyst Justin Bennett made a bold prediction about the potential price trajectory of Bitcoin (BTC) and its impact on altcoins, particularly Ethereum (ETH). While the analyst is optimistic about altcoins, he warned that there could be a sharp decline in the largest cryptocurrency.

Altcoins Could Experience a Major Uptick at Any Moment

Crypto analyst Bennett, through his personal account on social media platform X, suggested that altcoins could follow a historical model reminiscent of events seen in 2021, which could lead to a significant price increase. According to Bennett’s analysis, if Bitcoin repeats the price movements of 2021 with sudden sell-offs over a two-month period, altcoins could bring substantial gains as they did in March-April.

Pointing specifically to Ethereum, Bennett highlighted its remarkable 182% increase within just 48 days during the April-May 2021 period, coinciding with Bitcoin’s peak. Although the analyst believes the time to accumulate altcoins is approaching, he advised caution, indicating that the right moment has not yet arrived.

Examining Ethereum’s weekly chart against Bitcoin, Bennett mentioned that the ETH/BTC trading pair could be preparing for a significant rally, potentially reaching the 0.15636 level, which corresponds to 8,062 dollars at the time of his analysis. Currently, the ETH/BTC trading pair is at the 0.05773 level (2,980 dollars), showing an increase of over 1% in the last 24 hours.

According to Bennett’s assessment, even if the ETH/BTC trading pair returns to its previous peak level of 0.08597 from 2021-2022, Ethereum could rise again to its all-time high of around 4,878 dollars, provided that Bitcoin maintains its position in the 50,000 dollar range. The analyst’s forecast points to the potential for significant gains in altcoins if certain conditions in the crypto market converge.

Bitcoin Could Target the $30,000 – $35,000 Range

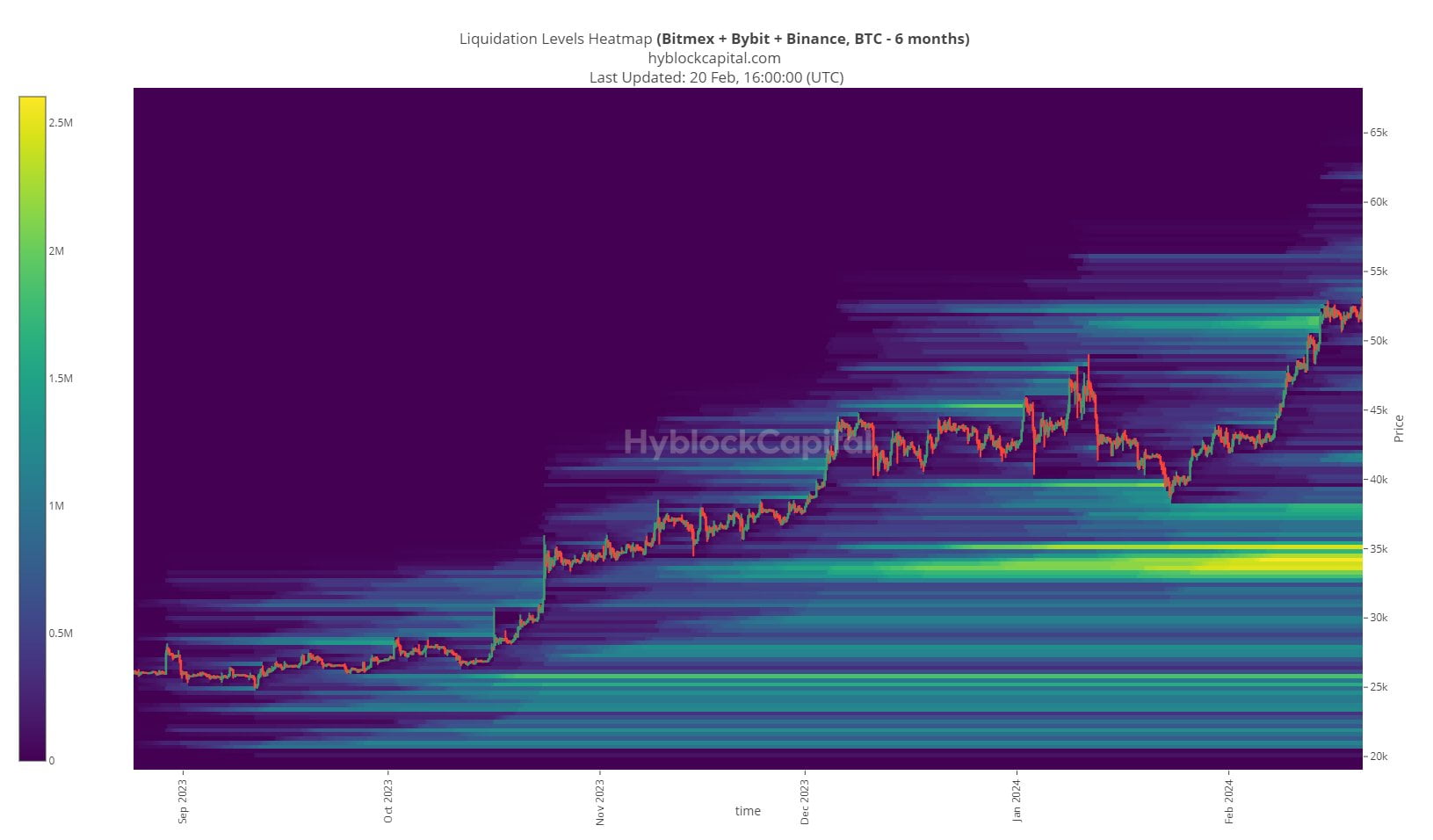

Despite his optimistic forecast for altcoins, Bennett warned that Bitcoin’s price could fall to the 30,000 to 35,000 dollar range. The key factor contributing to this potential scenario is the liquidation heat map, a tool used in technical analysis to predict price levels where large-scale liquidations could occur and to identify critical support levels.

The liquidation heat map shared by the analyst indicates a significant accumulation in the 30,000 to 35,000 dollar range for Bitcoin. Bennett believes that market makers could drive the price into this range to capture the liquidity there.

Türkçe

Türkçe Español

Español