Recently, we witnessed activity in the crypto currency market. Many experts questioned whether there was a relationship between Bitcoin’s (BTC) price performance and Republican candidate Donald Trump’s chances in the US presidential elections. However, data from the market showed no expected connection between these two variables.

What Are the Expectations and Realities?

Since Trump’s meeting with Bitcoin miners in mid-June, many experts in the crypto market tried to link the Republican candidate’s performance in betting markets with Bitcoin’s price movements.

Especially after the assassination attempt on Trump in July, with Democratic candidate Kamala Harris regaining strength in betting markets, the pressure on BTC increased. However, FalconX analyses revealed no significant correlation between these two variables.

Three-Day Change Analysis Revealed No Relationship

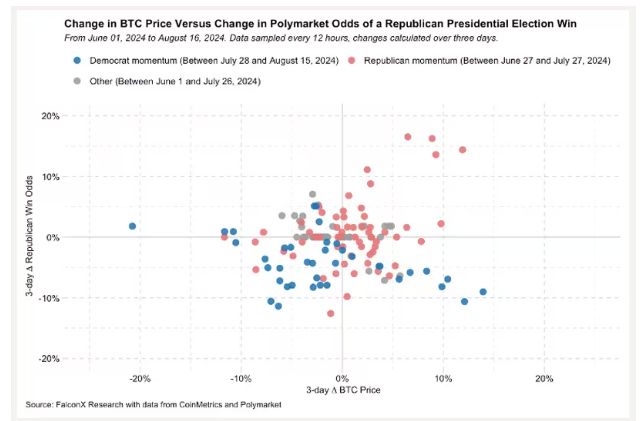

FalconX’s analysis between June 1 and August 15 showed no clear relationship between the three-day change in BTC price and Trump’s election chances. According to the analysis, no noticeable connection was found between the Republicans’ success chances in the election and the BTC price during this period.

The analysis indicated that the relationship between Trump’s rising chances of entering the White House on Polymarket and the BTC price remained weak. During this period, no significant connection could be established between Bitcoin price movements and changes in the Republicans’ chances.

What Are the Other Factors Affecting Prices?

There are much stronger influences on Bitcoin price than Trump’s election chances. These include expectations of US monetary policy and the anticipated large supply of Bitcoin.

For example, aggressive Bitcoin sales in Germany’s Saxony state and fears of the release of supply held by Mt. Gox creditors are among the factors limiting the upward movement of BTC price. David Lawant emphasized the lack of relationship between election probabilities and BTC price during this period, noting that this situation could change in the coming weeks. As election day approaches, market data might show election news as a key factor affecting BTC price.