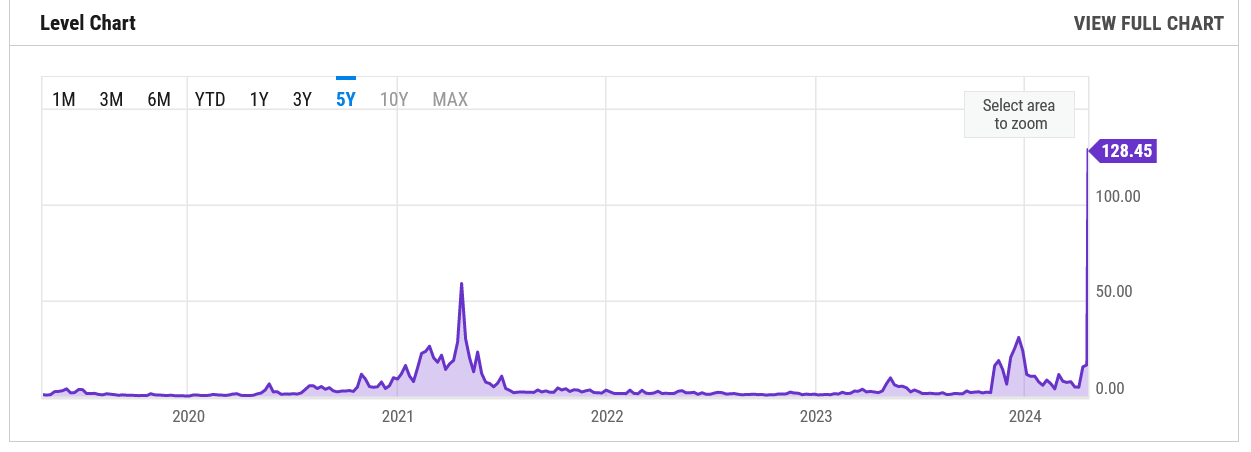

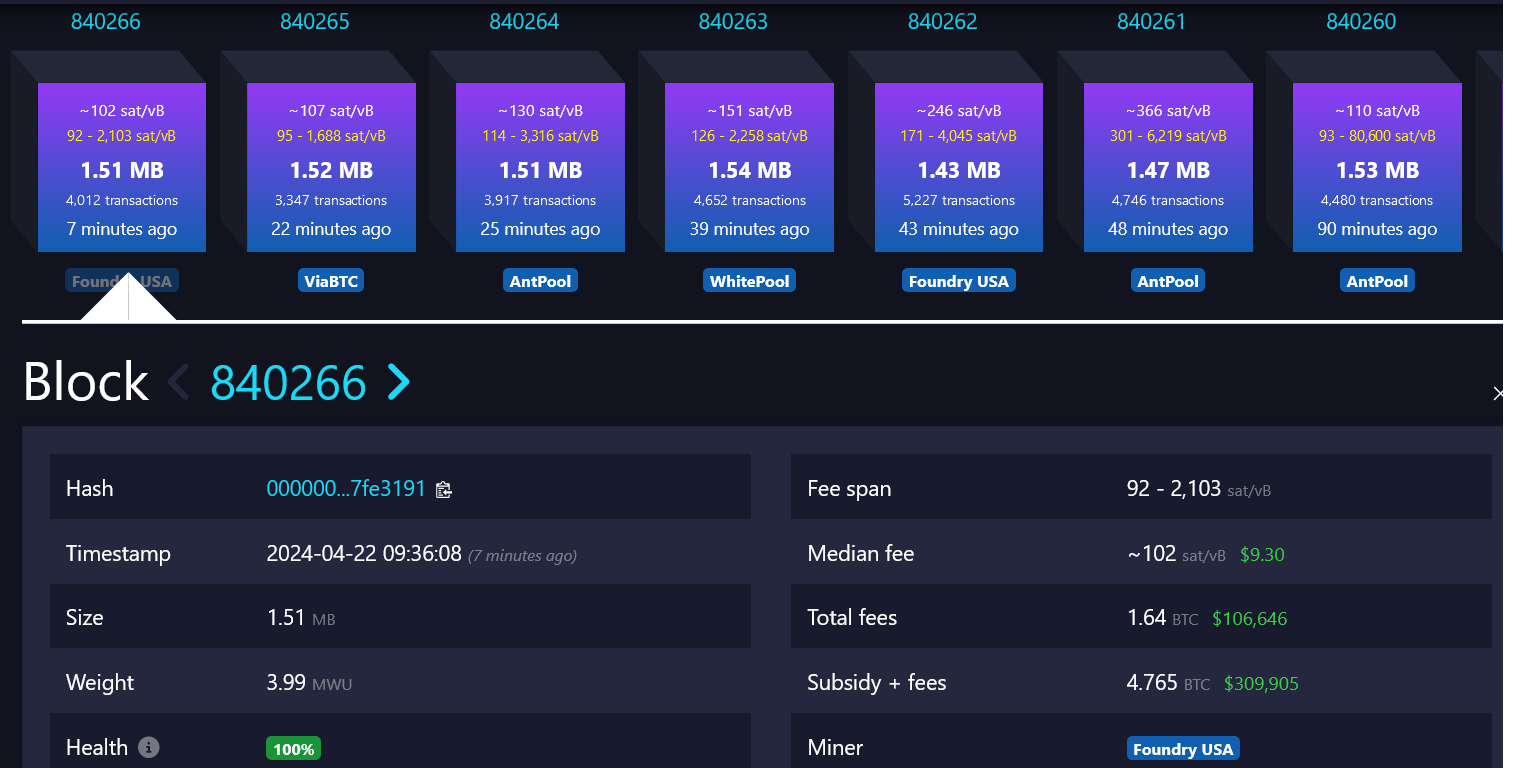

Bitcoin saw a sharp decrease in average transaction fees the day after the fourth Bitcoin halving event on April 20, which had peaked at an average of $128. According to mempool.space data, by April 21, fees for medium-priority transactions had fallen to between $8 and $10.

High Interest in the Bitcoin Ecosystem

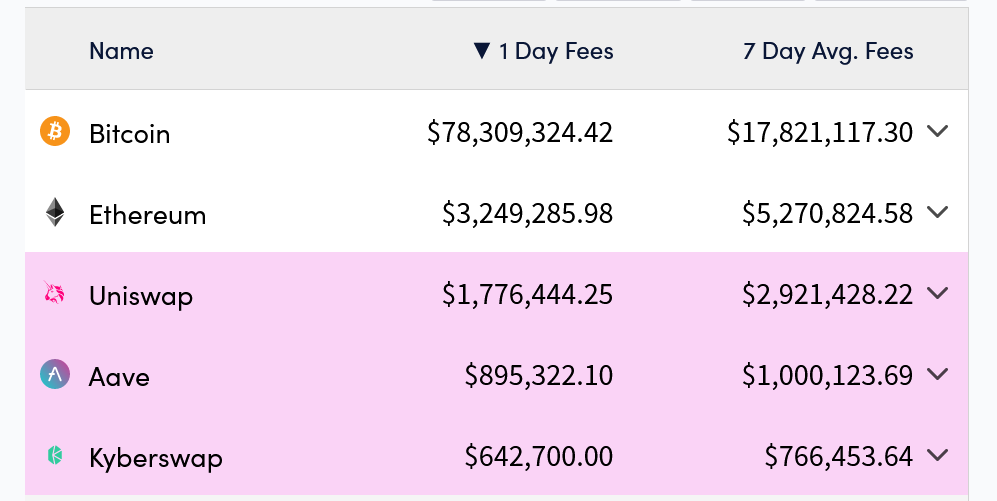

Just a day earlier, Bitcoin, according to Crypto Fees data, had left Ethereum far behind by more than 24 times in total fees, reaching $78.3 million. That same day, Bitcoin miner ViaBTC included 37.7 Bitcoins worth $2.4 million in the 840,000th block, the Bitcoin halving block, making it the most sought-after piece of crypto real estate in the network’s 15-year history.

Much of the demand in the 840,000th block came from memecoin enthusiasts and unique token aficionados racing to write and mine rare satoshis through the Runes protocol, a new token standard initiated in the halving block. This block included 3050 transactions, meaning the average user paid just under $800.

The Bitcoin Front and Mining Sector

According to mempool.space data, unusually high block fees continued until about block 840,200, but have since dropped to around 1-2 Bitcoin. The large block fee payments to miners on halving day meant that the initial reduction in block subsidy from 6.25 to 3.125 Bitcoins was not immediately impacted. However, the average block fee is now well below 3.125.

Meanwhile, from April 15-20, Bitcoin fees consistently outpaced Ethereum‘s, with a 7-day average fee currently at $17.8 million. According to CoinGecko, the price of Bitcoin, which has risen by 1.5% since the halving event, now stands at $64,840, showing no significant impact from the event.

However, since January 2023, many developers and users in the Bitcoin ecosystem began engaging in token and NFT trading transactions, facilitated by the introduction of Ordinals. This process, along with the accompanying hype, enabled mining companies to secure significant revenues and mitigate potential post-halving revenue declines.

Türkçe

Türkçe Español

Español