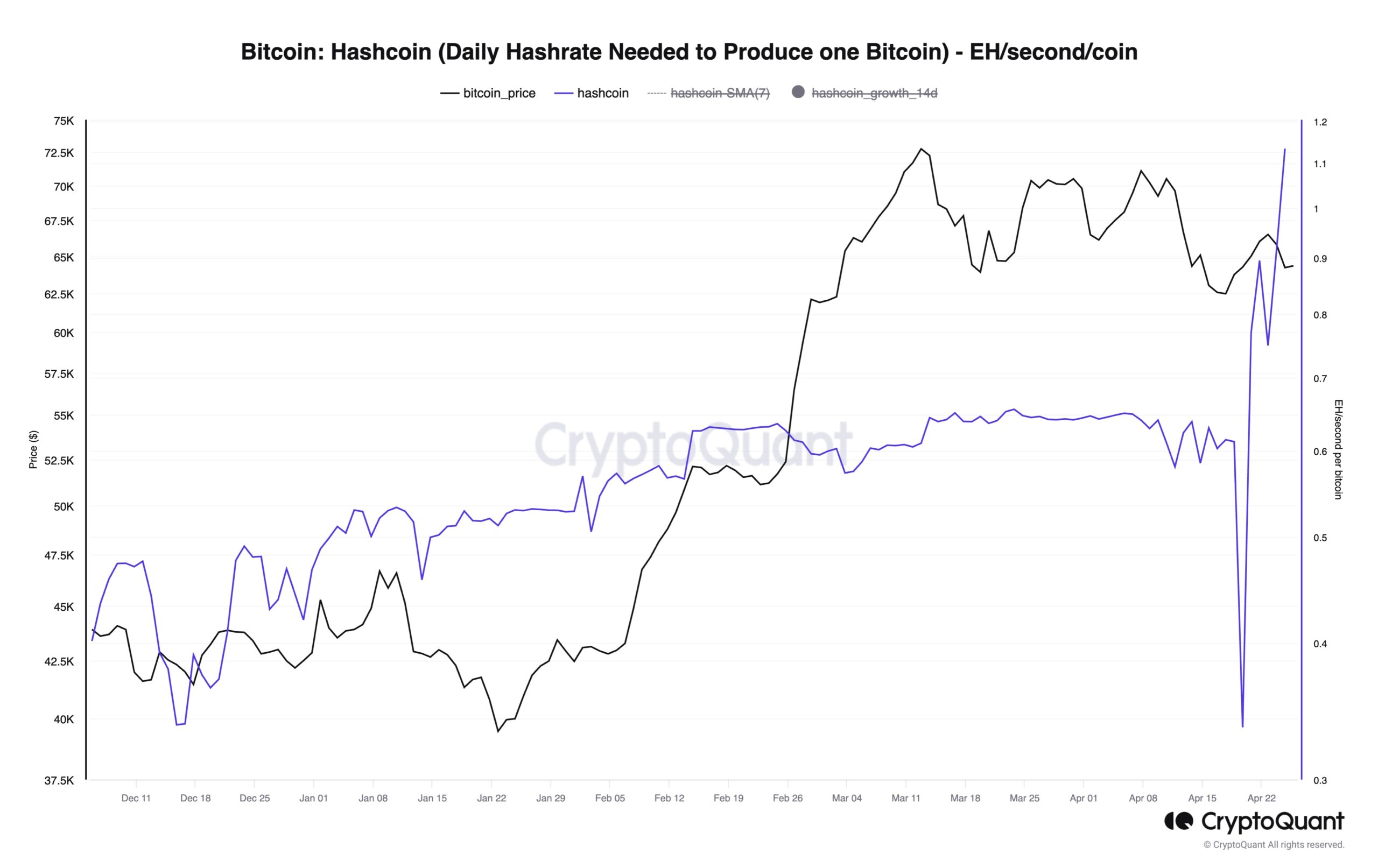

Bitcoin ecosystem saw transaction fees plummet from $80 million to $6 million since the halving day on April 26. The portion of income Bitcoin miners receive from transaction fees significantly decreased following the surge on the day of the last halving event. A CryptoQuant report revealed that transaction fees now represent only 35% of total miner revenue; this is a substantial drop from the 75% recorded on April 19.

What’s Happening in the Bitcoin Ecosystem?

The fourth Bitcoin halving event on April 19 halved miner block rewards to 3.125 Bitcoins, causing the daily issuance rate to drop from an average of 900 Bitcoins to 450 Bitcoins.

On halving day, daily miner revenue from transaction fees surged to $100 million. Daily fees recorded in the Bitcoin network reached an unprecedented level of 1,258 Bitcoins worth $80 million, representing 75% of the total revenue for that day.

One of the main drivers of high transaction fees was the Runes protocol, which was initiated in the Bitcoin halving block and increased network activity. Runes allows for the issuance and transfer of tokens over the ecosystem by storing data in OP RETURN codes. On halving day, the use of these codes reached a record level of 512,000 due to users flocking to the Runes Protocol.

Halving Event and the Bitcoin Ecosystem

Shortly after the halving event, transaction fees returned to lower levels and remained there. Fees now make up 35% of the total miner revenue, which currently hovers around $50 million; this is a 35% decrease from the pre-halving record level of approximately $78 million.

YCharts data shows Bitcoin transaction fees dropped from $80 million on April 20 to $6 million. Last week, they averaged around $16 million, with the lowest figure seen on April 26. Higher transaction fees and rising Bitcoin prices, due to halved block rewards, help miners stay afloat. As fees continue to decrease and Bitcoin struggles to surpass $64,000, some miners may soon have to quit.

However, CryptoQuant mentioned that it is too early to see the long-term effects of the halving event on the network’s hash rate, considering miners were operating at the same rate before the halving. The Bitcoin network’s hash rate is currently at 617 EH/s, while the hash price is at its lowest since October at $0.07 per TH/s.

Türkçe

Türkçe Español

Español