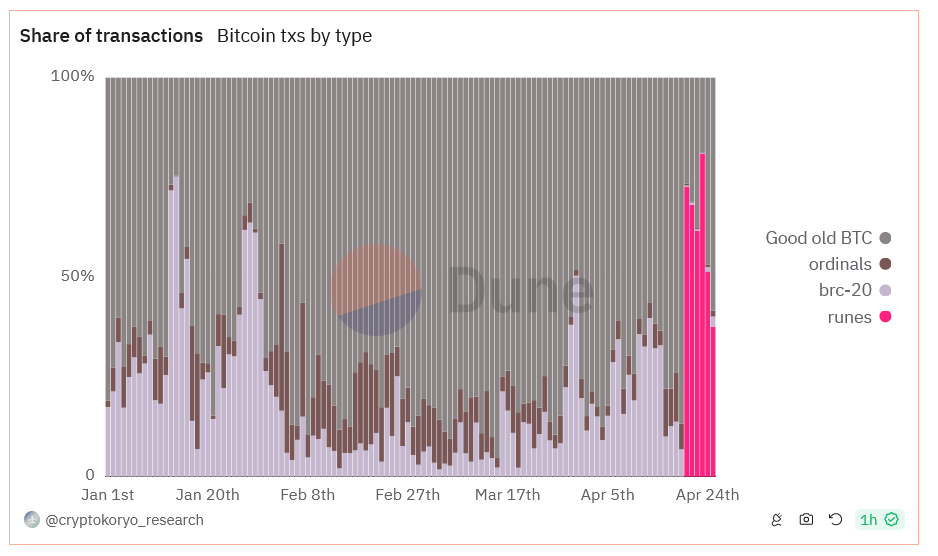

Bitcoin introduced a new token standard called Runes, which since its launch post-April 20th halving event, has accounted for over two-thirds of the transactions on the Bitcoin ecosystem. According to the Dune Analytics dashboard shared by blockchain research firm Crypto Koryo, since its release on April 20th, there have been over 2.38 million Runes transactions, making up 68% of all Bitcoin transactions.

What’s Happening in the Bitcoin Ecosystem?

Crypto Koryo shared data including total transaction numbers covering ordinary Bitcoin peer-to-peer transactions, BRC-20 assets, Ordinals, and Runes. Runes experienced its busiest day on April 23, with over 750,000 transactions, but the number fell by more than half the following day, closing with 312,000 transactions.

The initial demand at block 840,000 came largely from memecoin enthusiasts and NFT aficionados racing to write and mine code on rare satoshis through the Runes protocol. Consequently, Runes transactions contributed to about 70% of the mining fees on the day of the halving event. Since then, the daily figures have varied between 33% and 69%, indicating a gradual decline in the hype within the Bitcoin ecosystem. These developments could also be linked to the recent drop in Bitcoin prices.

Prominent Critic Raises Concerns

With these developments, industry experts are divided on whether Runes can provide a sustainable income stream for Bitcoin miners, as there is already a disparity between the number of Rune transactions and the mining fees earned on Runes.

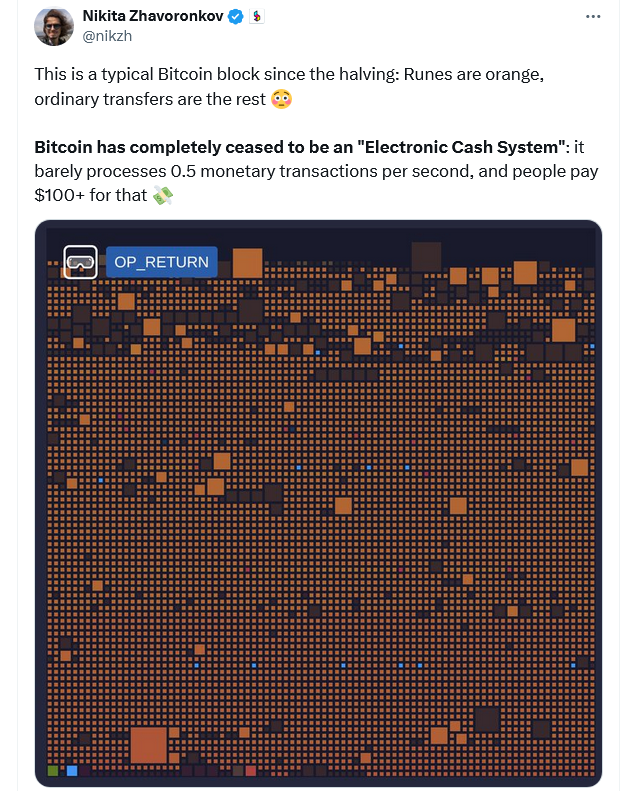

The new protocol initiated by Ordinals’ creator Casey Rodarmor, which is used to create Bitcoin-based tokens, is presented as a more efficient way to create new tokens on the Bitcoin network compared to the BRC-20 token standard, an Ordinal-based method. However, not everyone is pleased with the amount of block space Runes transactions occupy lately.

Among these critics is the lead developer of the blockchain search engine Blockchair, Nikita Zhavoronkov, who believes that Bitcoin has completely abandoned its original purpose as a peer-to-peer electronic cash system, a view that aligns with the initial vision of Bitcoin’s creator, Satoshi Nakamoto.

Türkçe

Türkçe Español

Español