The renowned Bitcoin Greed and Fear Index by Matrixport, a cryptocurrency financial services company with a strong track record of identifying trend reversals, is signaling a rise in the price of Bitcoin (BTC). Here are the details of the index’s bullish signal for BTC.

Famous Bitcoin Greed and Fear Index Gives “Rise” Signal

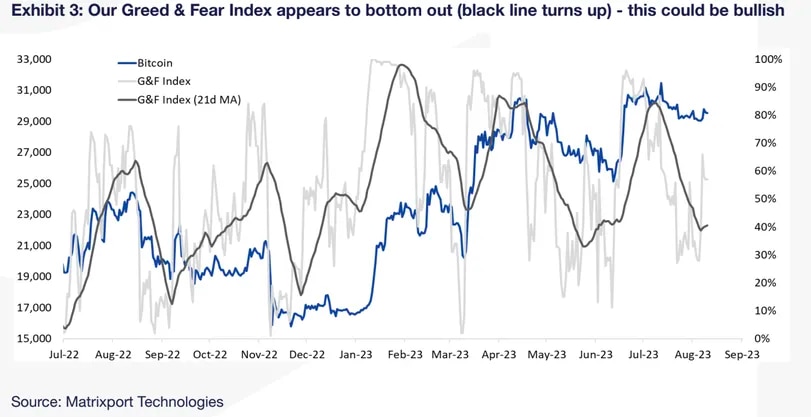

When the value derived from Matrixport’s Bitcoin Greed and Fear Index, which measures investor sentiment, exceeds 90%, it indicates greed or excessive optimism, while values below 10% indicate fear or pessimism. These indicators are closely monitored because excessive optimism or greed is often seen at market peaks, while fear is seen at market bottoms.

Recent data shows that Matrixport’s index recently rose from 30% to 60% and hit bottom after reaching over 90% in July. Markus Thielen, research and strategy manager at Matrixport, stated in a note sent to the company’s clients on August 10th, “The daily signal (gray) suggests upward pressure, so the index appears to have bottomed out.” He added that after four weeks of consolidation, this indicator has tactically turned bullish, suggesting that Bitcoin’s price may continue its upward trend.

When looking at Matrixport’s Bitcoin Greed and Fear Index, it is clear how successful the index is in detecting BTC’s price increases and decreases based on the peaks and troughs of the index and its 21-day simple moving average (SMA – dark gray line). The 21-day SMA is currently indicating bottoming signals, suggesting the possibility of a new upward movement in Bitcoin’s price.

Market Awaits SEC’s Spot Bitcoin ETF Decision

Despite the outlook in traditional markets and expectations of a Fed interest rate cut early next year, the leading cryptocurrency has been stuck between $28,000 and $30,000 for over two weeks. According to some analysts, the upcoming decision of the U.S. Securities and Exchange Commission (SEC) on spot exchange-traded fund (ETF) applications for Bitcoin will be an important catalyst for increased volatility, and this consolidation will be disrupted once the decision is announced.

The U.S. federal regulatory agency will announce its decision on Ark Invest’s spot Bitcoin ETF application on August 13th, either approving or rejecting it. Some experts expect the decision to be announced today due to August 13th falling on a Sunday.