Fed continues to walk a tightrope. The latest employment data has raised recession concerns. As the inflated graphs by temporary workers start to normalize, Fed members are beginning to face the negative consequences of excessive tightening. By September, the Fed was compelled to start cutting interest rates, leading to a significant market crash last week.

Fed and Interest Rates

The Fed has two main tasks. These dual tasks, often mentioned by Powell in his speeches, are price stability and maintaining a certain level of employment. For over a year, the institution has kept interest rates at their peak to bring inflation down to 2%. They quickly reduced inflation from over 9% to 2.9%, but Powell remains extremely cautious.

Employment data is terrible, but the inflation data over the last three months is excellent. However, the Fed Chair still talks about making decisions based on data from meeting to meeting. This situation highlights the risk of excessive tightening.

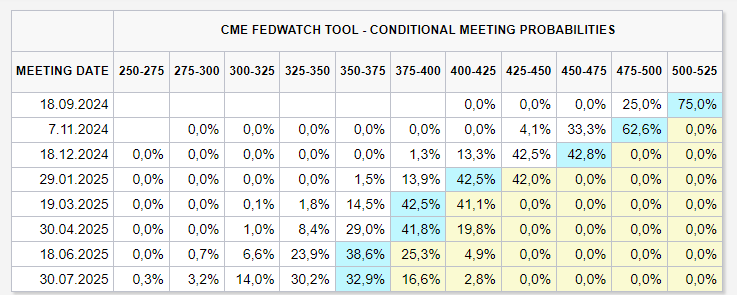

Markets are almost certain of a 25bp cut in September. The annual cut target is about 100bp, much higher than the average expectation in the previously announced dot plot.

Fed interest rates cuts should lead to more capital flow into risk markets. However, the speed of this action is uncertain. The institution wants to ensure that conditions after the first cut don’t force them to raise rates again, avoiding a loss of confidence. This is one reason for their extreme caution.

Advice from a Famous Economist

One of the world’s most well-known financial writers, Robert Kiyosaki, made another post on his social media account. In it, the famous author mocks the Fed and even criticizes it with pity, repeating his previous advice:

“Why do people look to the Fed for guidance? The problem lies with the Fed.

People ask, ‘Are we in a recession?’ All one has to do is go shopping and look at stores offering 60% discounts.

Even a nearby used clothing store is offering discounts. The Fed is made up of highly educated poor people, like my poor dad. My rich dad often said, ‘PhD stands for Poor, Helpless, and Desperate.’ The Fed can’t save you. It’s time to save yourself. Buy more gold, silver, and Bitcoin and stop listening to highly educated poor people.

Take care of yourself.”

Türkçe

Türkçe Español

Español