Federal Reserve (Fed) officials have indicated that interest rate cuts may pause due to recent inflation trends. The main reason for this potential pause is the reversal of declining inflation rates. Today, the release of the Fed’s minutes has led market participants to search for signals regarding market conditions.

Release of Fed Minutes

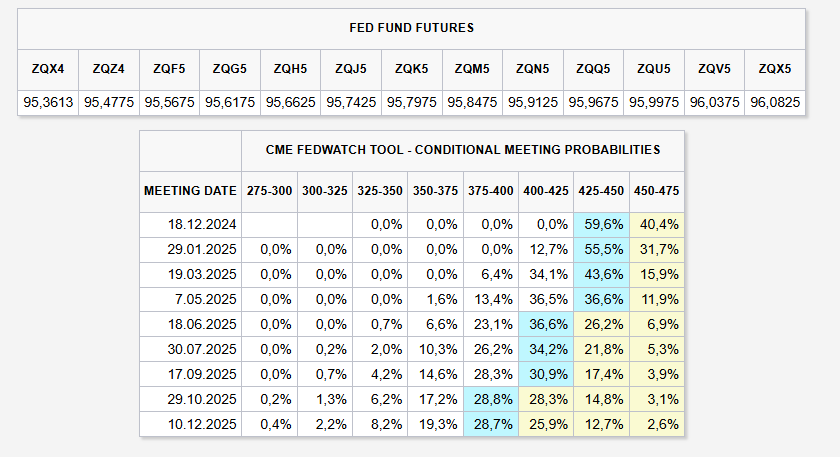

One contributing factor to the recent decline in Bitcoin (BTC)  $109,656 prices, particularly today, is the anticipation surrounding the Fed’s minutes. The inflation data for October came in higher than previous months after a long period, prompting the Fed to signal a possible pause in interest rate cuts. Currently, expectations for the December 18 interest rate decision show a 55% probability of a 25 basis point cut.

$109,656 prices, particularly today, is the anticipation surrounding the Fed’s minutes. The inflation data for October came in higher than previous months after a long period, prompting the Fed to signal a possible pause in interest rate cuts. Currently, expectations for the December 18 interest rate decision show a 55% probability of a 25 basis point cut.

While the Fed does not anticipate reaching its 2% inflation target in the coming months, the current situation raises concerns about inflation possibly rising again. Any increase in inflation data over the next one to two months could be seen as a deviation, leading the Fed to refrain from making an immediate pause decision. However, if these data points continue confirming a trend, interest rate cuts may be halted in upcoming meetings in the new year.

Key points from the Fed minutes include:

- Some participants indicated that if inflation remains high, the Fed may pause easing and keep policy rates restrictive.

- During the November 6-7 meeting, many participants stated that uncertainty about the neutral interest rate level justified gradually reducing policy constraints.

- Some participants noted that easing could be accelerated if there is weakness in the labor market or a slowdown in economic activity.

- Others assessed that downside risks to the labor market and economy have decreased.

- The staff forecast continues to predict that economic conditions will remain robust, with a higher GDP growth projection for 2024.

Short-term interest rate futures fell after the release of the November FOMC minutes, but losses were reduced later.

Türkçe

Türkçe Español

Español