In the cryptocurrency world, everyone focused on the Fed’s interest rate decision and Jerome Powell’s statements yesterday. The Fed did not make any cuts and kept the interest rate steady. Bitcoin, the flagship of cryptocurrencies, had started a journey towards the $70,000 band before the decision. However, it then pulled back and fell below the $68,000 band again. An important development was the curiosity about spot Bitcoin ETF figures in the US. Let’s take a look at how the numbers turned out.

Spot Bitcoin ETFs See Inflows

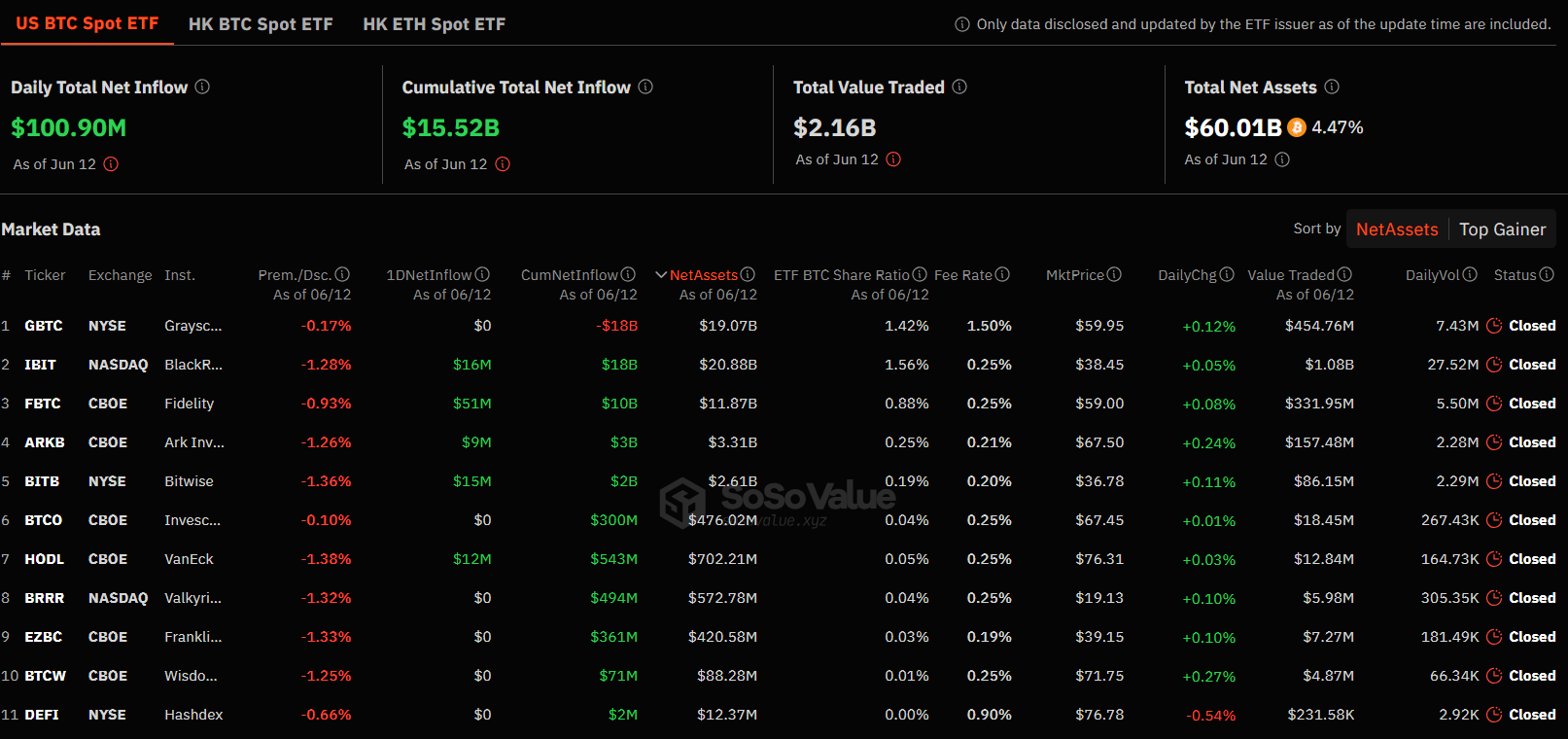

Yesterday, the Spot Bitcoin ETFs in the United States attracted significant inflows totaling $100.9 million. This increase clearly demonstrated the growing interest and confidence of investors in Bitcoin.

The largest inflow was into Fidelity’s Bitcoin ETF with $51 million. Fidelity, a well-known financial services provider, is a leading player in the crypto space. Another financial giant, BlackRock, also attracted attention with a $16 million inflow. BlackRock, known as the world’s largest asset manager, garnered significant interest with its entry into the Bitcoin ETF space.

Bitwise was another company that drew attention with a $15 million inflow. VanEck made a significant mark with a $12 million inflow. VanEck, which has been advocating for the approval and adoption of Bitcoin ETFs for years, is reaping the fruits of its persistence in this area. The $12 million inflow is a testament to the company’s ability to attract investor interest.

Ark Invest Stands Out with $9 Million Inflow

Ark Invest, managed by renowned investor Cathie Wood, secured a $9 million inflow. Ark Invest is known for its focus on innovative and disruptive technologies. Its Bitcoin ETF aligns with this investment philosophy.

While there were inflows, it should be noted that no Bitcoin ETF experienced outflows yesterday. Companies like Grayscale, Invesco, Valkyrie, Franklin, WisdomTree, and Hashdex reported zero inflows. Various factors such as competition, investor preference, or timing might be behind this.

At this stage, we observe that inflows into spot Bitcoin ETFs increase during periods when Bitcoin prices rise. On the other hand, a decline in Bitcoin can result in outflows from spot Bitcoin ETFs. It remains to be seen how a potential stagnation in BTC prices will be reflected in the ETF front in the coming days.