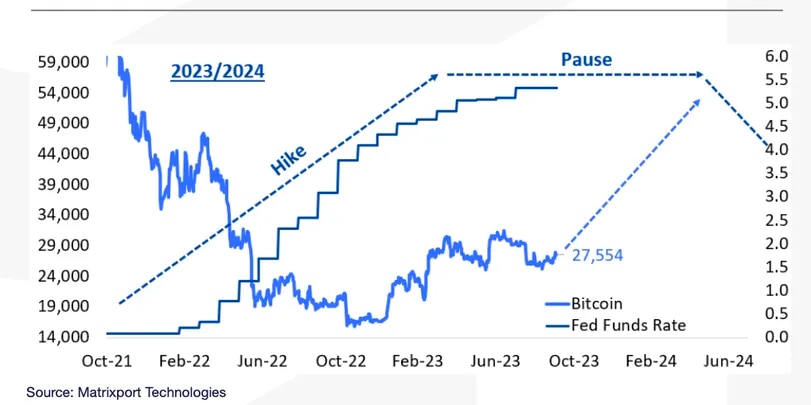

The Federal Reserve (Fed) officials, by taking a stance towards the pause of the interest rate hike cycle, have strengthened hopes that the monetary tightening cycle has come to an end. In early 2019, in a similar Fed environment, the price of Bitcoin (BTC) had quadrupled to reach $13,880. The recent more dovish statements by Fed officials have reminded us of the period when Bitcoin had surged over 300% at the beginning of 2019. Since the beginning of 2022, the Fed has raised interest rates by 525 basis points to control inflation, and the resulting monetary tightening cycle has led to a challenging period for all risky assets, including Bitcoin.

Deja Vu Period in Bitcoin

This week, Fed policymakers have started making dovish statements. Atlanta Fed President Raphael Bostic and Minneapolis Fed President Neel Kashkari stated on October 10 that there may not be a need for the central bank to raise interest rates further. Dallas Fed President Lorie Logan and Fed Governor Christopher Waller argued that rising Treasury yields have done the job for the Fed and prevented the need for another interest rate hike.

These comments by Fed officials have increased the possibility that the feared monetary tightening cycle ended with the 25 basis point increase in July and that the central bank will now wait to see how the macroeconomic situation develops in the coming months.

During the previous interest rate hike cycle, the Fed’s interest rate peaked at 2.5% in December 2018, and then the central bank adopted a wait-and-see approach for seven months. During this period, Bitcoin hit bottom in December 2018 and rose to $13,880 by the end of June 2019. If history repeats itself, Bitcoin could surpass $80,000 until the expected interest rate cut starting in 2024.

Second Parallel with the Past: Block Reward Halving

The recent pause in the Fed’s monetary tightening cycle also presents another important parallel with today, as it occurred a few months before the halving of Bitcoin’s mining reward. As it is known, the next halving of the largest cryptocurrency’s block reward is expected to take place in April 2024.

This trend indicates that, as in the past, Bitcoin’s price could rise and lift altcoins as well. On the other hand, the Fed’s interest rate cut initially leads to a decrease in the price of the largest cryptocurrency. Therefore, investors need to closely monitor the phase of the Fed’s pause period and the possible interest rate cut. Historical data reveals that interest rate cuts implemented in the event of economic weakness and low inflation lead to a decline in Bitcoin’s price.

Türkçe

Türkçe Español

Español