Fetch.ai (FET) price reached an all-time high earlier this month and has been consolidating since that time. Although the Altcoin has attempted to reach new peaks several times, FET might have a chance to succeed this time. Fetch.ai’s price was on an upward trend the previous day, approaching the critical resistance level of $2.85, which could lead to a move towards its all-time high of $3.07 if turned into support.

Major Investors in FET

In the process of charting high levels, the support a token receives from its investors is crucial. Optimism triggers rallies, while negativity leads to corrections. Currently, the majority of FET investors are optimistic about further price increases. One of the biggest signals of this comes from whale addresses.

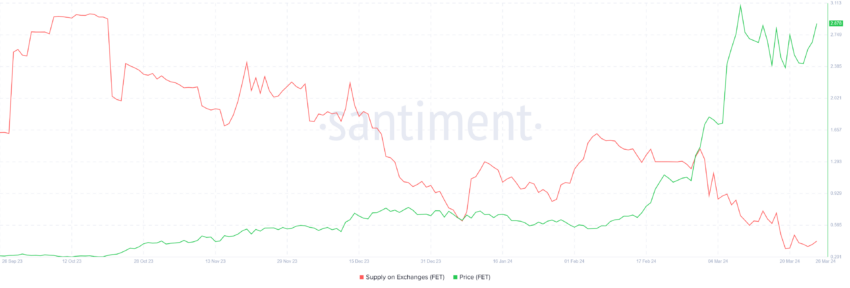

FET holders include some of the largest wallet investors, and their actions tend to influence the price direction. At the time of writing, addresses holding between 1 million and 10 million FET tokens are significantly accumulating. These investors have added over 21 million FET since the beginning of the month, despite selling nearly 26 million FET in a single day last week. Additionally, individual investors also seem to be waiting to profit from the price increase, as evidenced by the continuous decline in exchange supply.

FET Price Prediction

Net flows indicate that more than 8 million FET have left exchanges, suggesting that accumulation is preferred over profit booking. FET holders are adding more tokens to their wallets as they anticipate a near-term jump in Fetch.ai’s price. Fetch.ai’s price was trading at $2.83 at the time of writing, testing the barrier that the altcoin has failed to pass three times this month.

FET could be closer to reaching its all-time high of $3.07 if it succeeds this time. If this happens, a new all-time high could likely occur before the end of the month due to only a 7% price increase. In the past, overbought conditions for FET have resulted in sudden and significant corrections. This could potentially invalidate the bullish thesis and lead to a correction towards $2.26.

Türkçe

Türkçe Español

Español