Several challenges are weakening Filecoin’s position as a leading project in the DePIN sector. Despite reaching an annual peak of $11.46 in June, FIL’s value has since dropped nearly fourfold, showing significant price volatility. On-chain analysis indicates that FIL remains a risky choice for investors. So, what’s happening on the FIL front? Let’s explore together.

What’s Happening on the FIL Front?

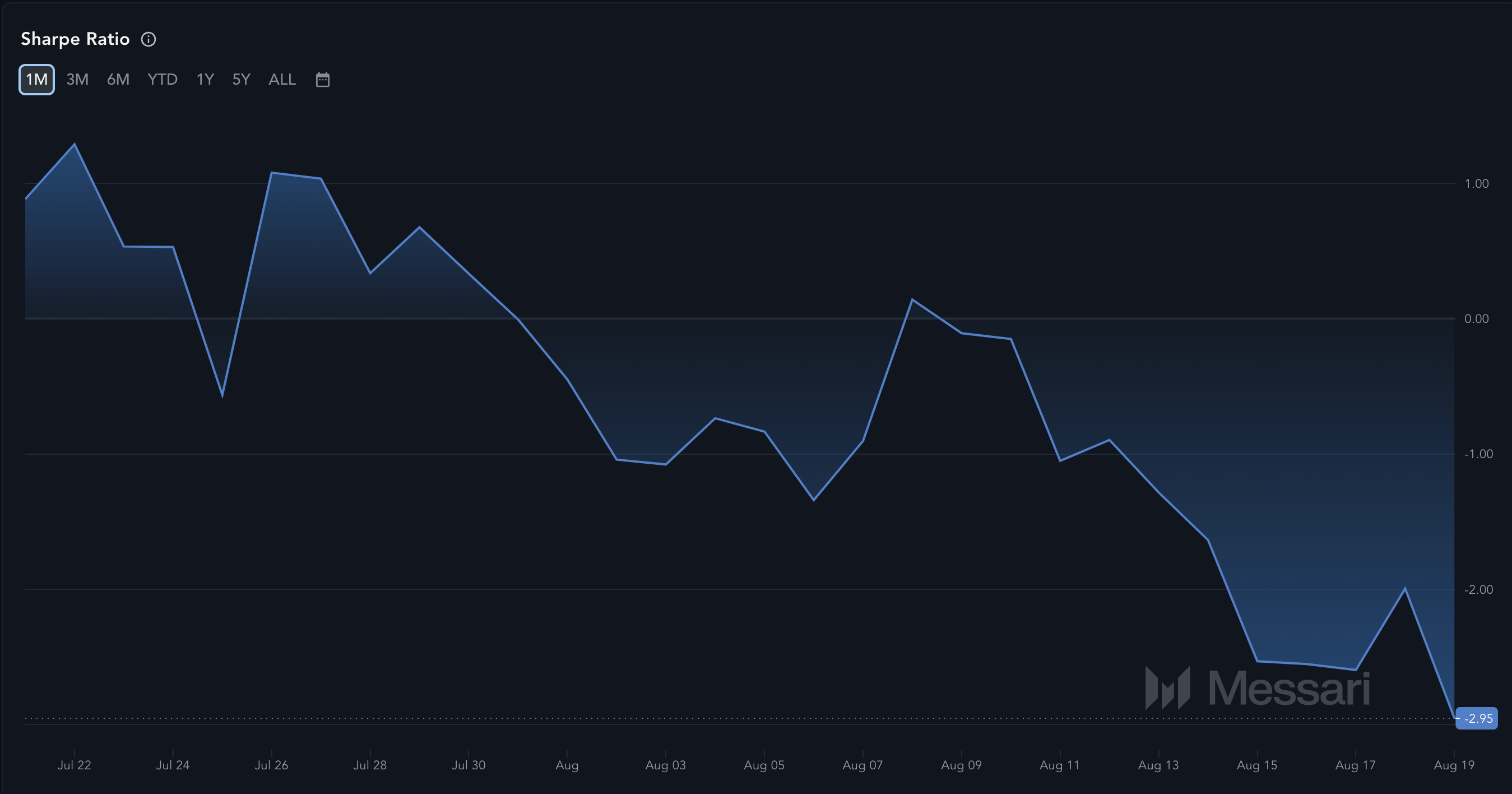

Trading at $3.57, Filecoin’s price may imply that the token is undervalued. However, according to Sharpe ratio data from Messari, the token may not be worth investing in the short term. This ratio measures risk-adjusted returns for a cryptocurrency.

In non-technical terms, a positive ratio means investors have a high chance of getting higher returns than they spent on an asset. However, a negative ratio indicates an extremely low risk-reward chance. At the time of writing, Filecoin’s Sharpe ratio was -2.95, suggesting that buying the cryptocurrency at its current price may not provide a good return on investment.

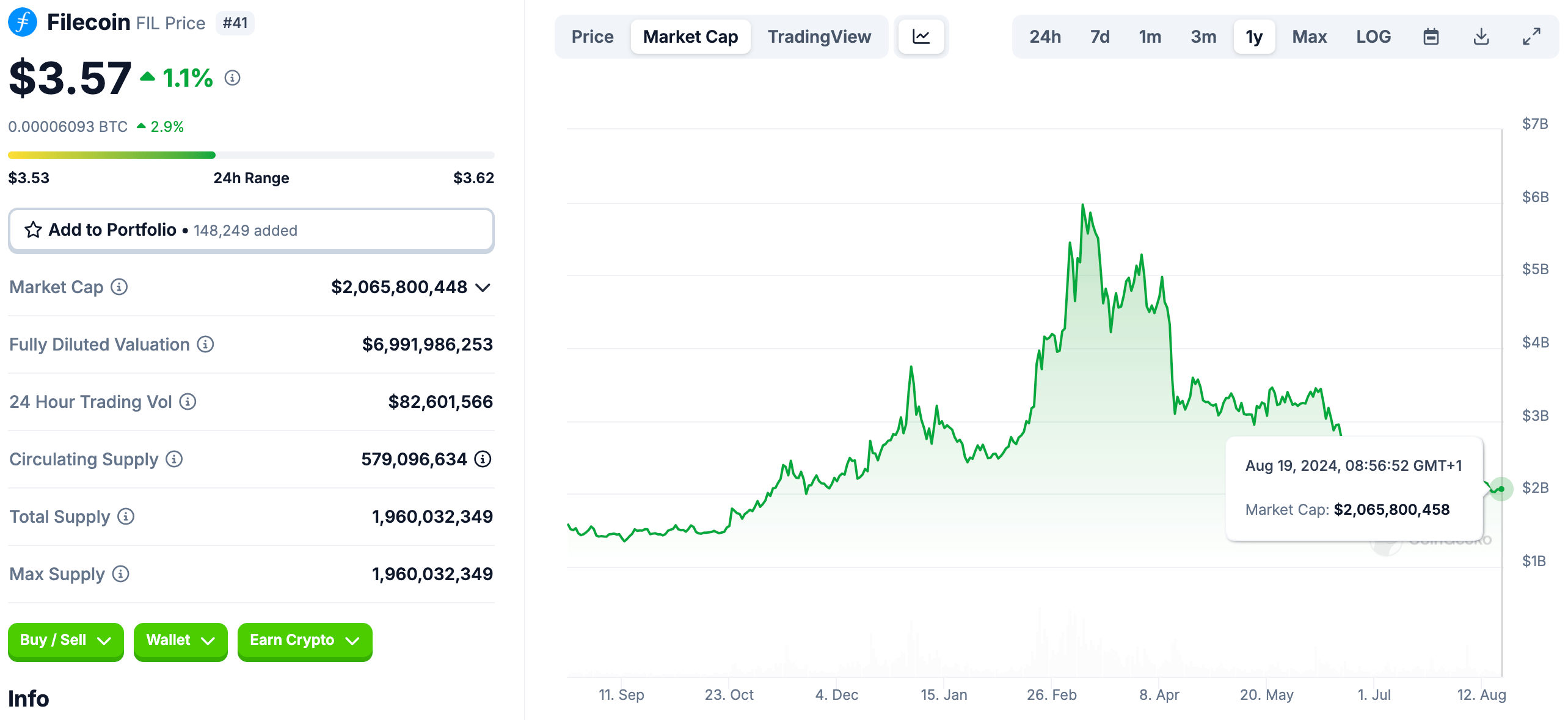

Despite this, Filecoin remains the most valuable DePIN project in terms of market capitalization. According to CoinGecko data, FIL’s market cap is $2.06 billion. However, it is important to note that this value has dropped threefold since March. Market capitalization is determined by multiplying the circulating supply by the price, and thus the decline in FIL’s market cap is directly related to the significant correction the token has experienced in recent months.

FIL Chart Analysis

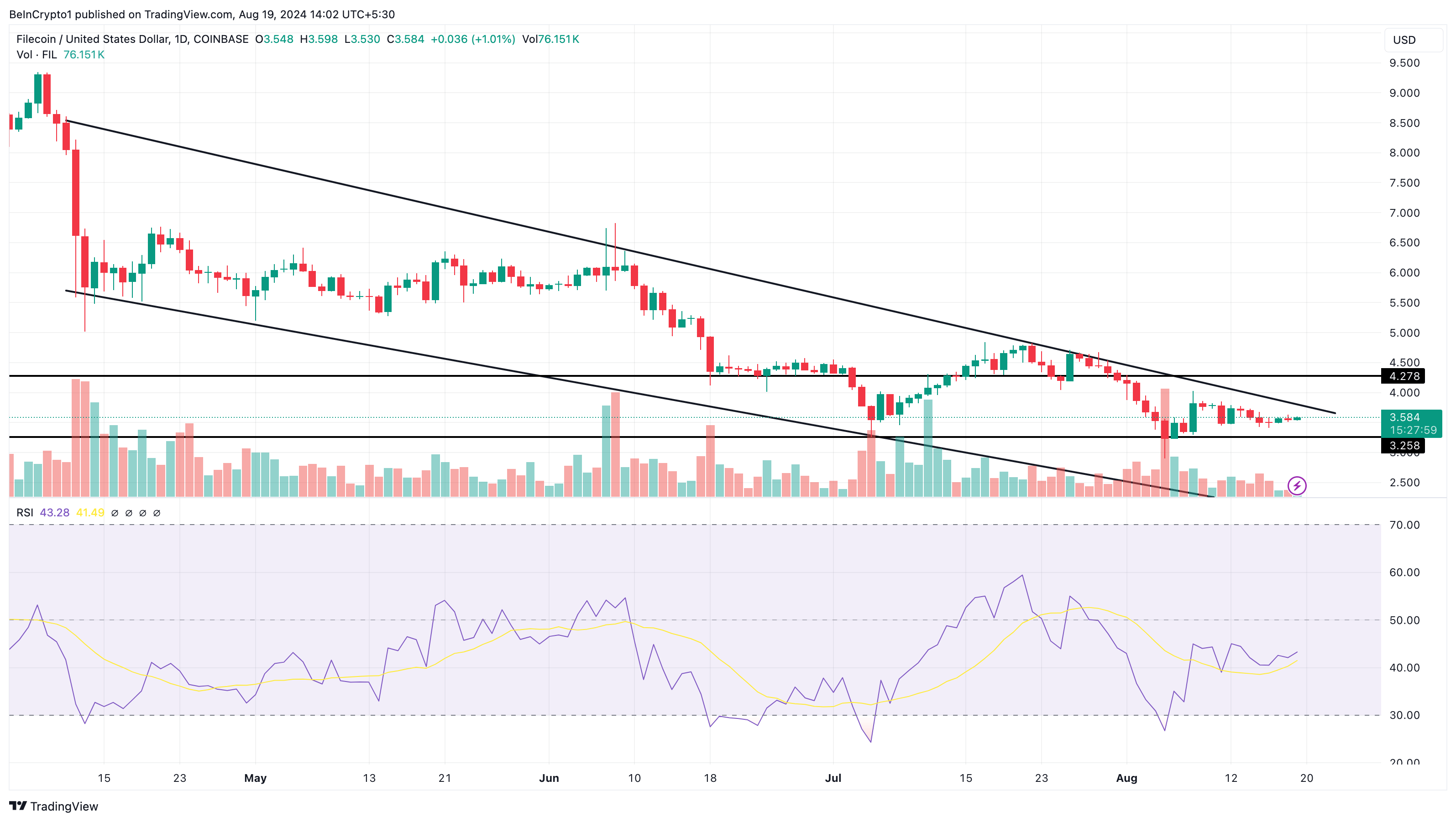

According to the daily FIL/USD chart, the token has been trading in a descending channel since April, indicating a bearish trend. In this pattern, two downward trend lines form during correction and consolidation phases, with the upper trend line acting as resistance and the lower trend line as support.

This aligns with the low risk-reward outlook for FIL, especially since it has not yet broken above the channel. Additionally, the RSI is below the neutral 50.00 line, indicating that bearish momentum remains dominant due to the lack of control by the bulls.

According to the above analysis, FIL’s price risks falling further below its current level. If momentum remains flat, the token could drop to around $3.25 support. However, if there is an increase in buying pressure, FIL could rise towards the resistance at $4.27.