After a process and excitement that lasted for about 10 years, investors finally got their hands on the first spot Bitcoin ETF funds approved by the United States Securities and Exchange Commission on the night of January 11, and ETF trading began less than 24 hours later with the opening bell.

First Bell Rings for ETFs

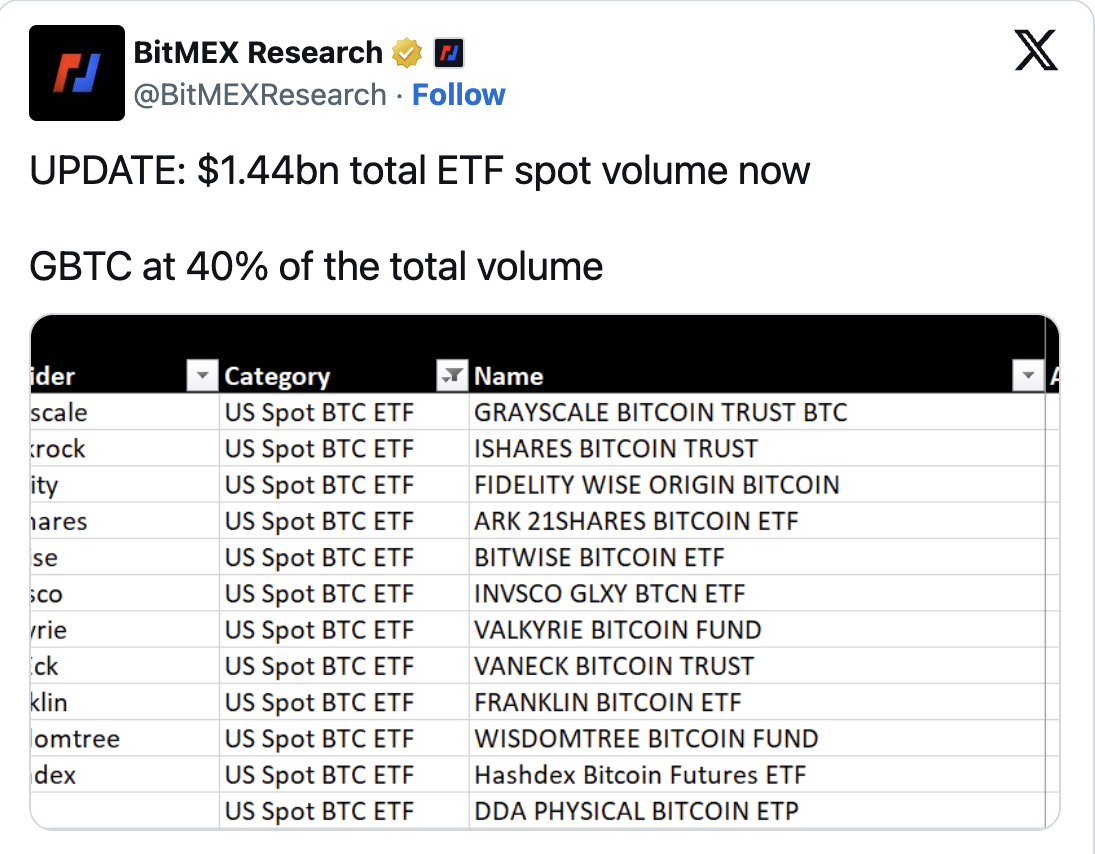

On January 11, BlackRock’s iShares Bitcoin Trust (IBIT), Grayscale Bitcoin Trust (GBTC), Valkyrie Bitcoin Fund (BRRR), Bitwise (BITB), and ARK 21Shares Bitcoin ETF began trading. The high trading volume in the first few hours caught everyone’s attention. Bloomberg Bitcoin ETF analysts also made a similar observation, sharing the following statement:

“It should be noted that almost all of the volume in the first few days will turn into inflows.”

In pre-market transactions, Grayscale Bitcoin Trust rose by about 6%, while iShares Bitcoin Trust showed an increase of more than 4%. At the time of writing, GBTC became the group’s largest ETF product, surpassing the $1 billion mark within the first two hours of trading and constituting 40% of the total volume.

The regulatory body approved 11 spot Bitcoin ETFs, paving the way for investment in the world’s largest cryptocurrency by market value without the risk of direct holding.

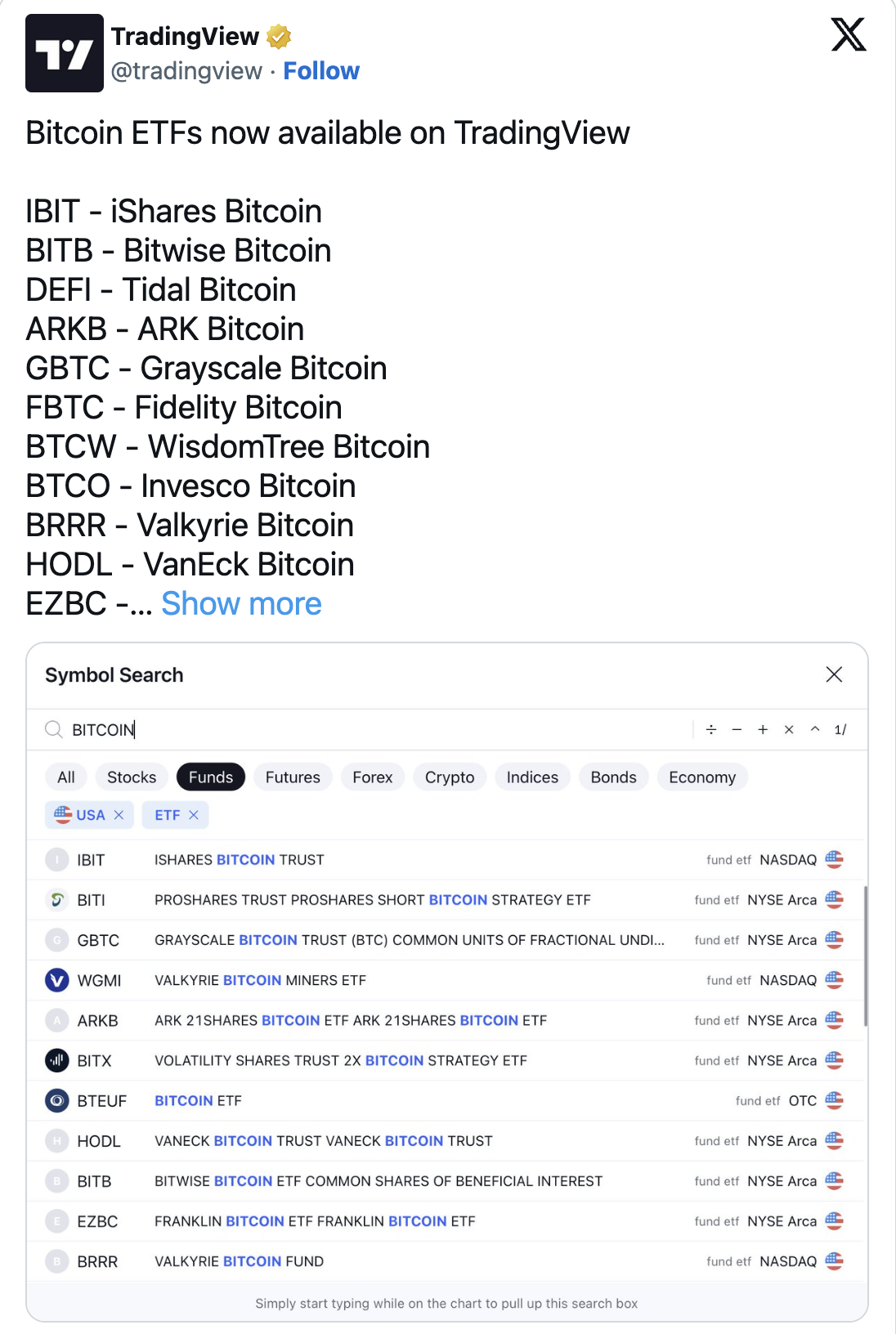

Meanwhile, the data platform TradingView added support for spot Bitcoin ETF products using issuers’ price tags, enabling investors to easily track and analyze their performance.

What Happened on January 11?

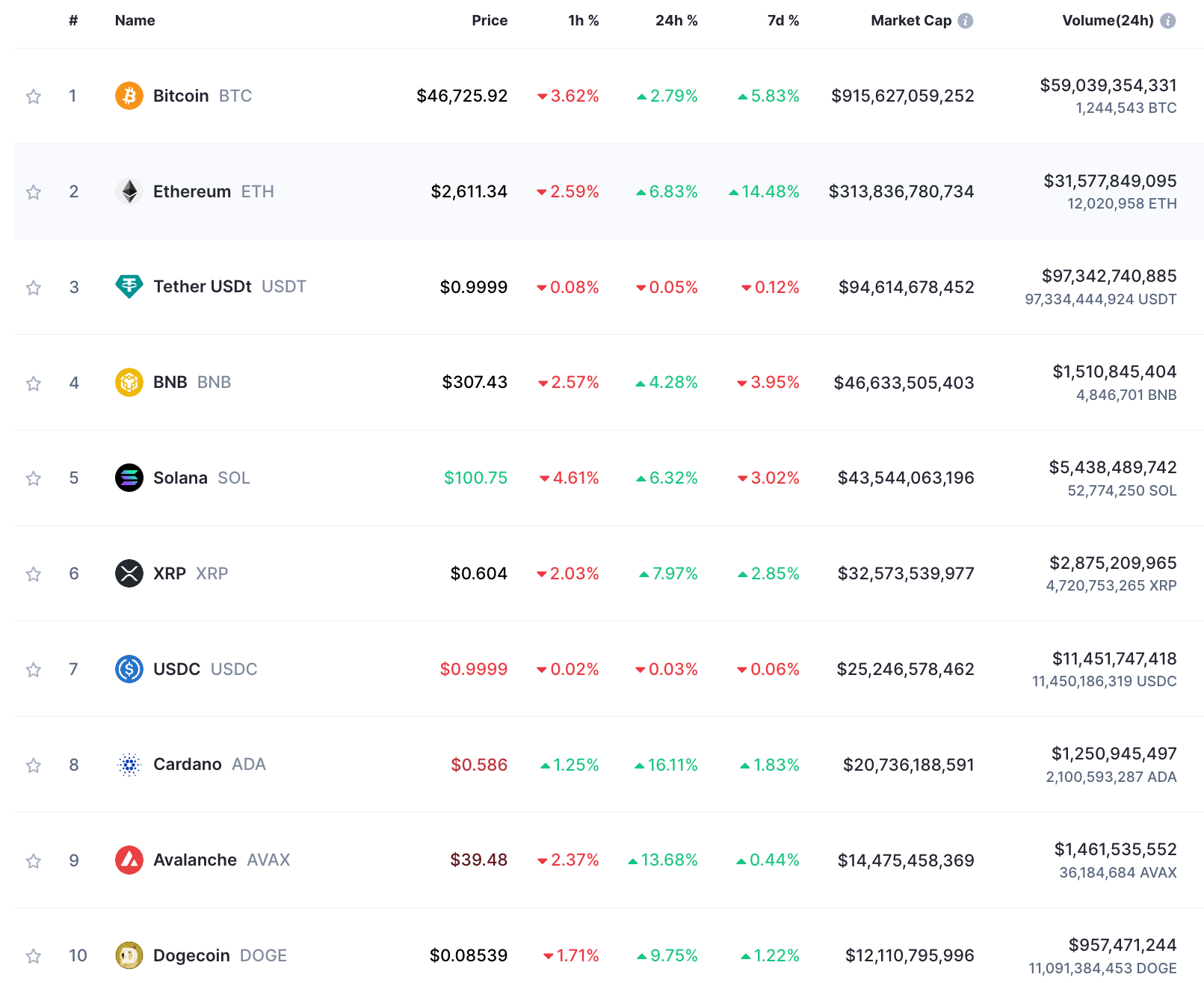

According to CoinMarketCap’s data, when spot Bitcoin ETF products began trading, crypto prices started to rise with Bitcoin increasing by more than 2.7% during the day, and Bitcoin managed to reach the $49,000 level within the day.

Market participants will continue to closely monitor Bitcoin ETF products to see how they perform and how well they correlate with the price of Bitcoin. A few days of negative correlation between the price of a fund and the price of its underlying assets could be a sign of weak trading volume or structural issues with the ETF. This situation could deter potential buyers even if the fund is temporarily outperforming spot Bitcoin.

Türkçe

Türkçe Español

Español