Ethereum price continues to linger below $3,500 as the likelihood of ETF approval diminishes day by day. BTC once again exceeded $69,000 in the last 24 hours but encountered selling pressure at this level. Investors are feeling the pressure of macroeconomic data that could influence the Fed’s decision, alongside concerns about Silkroad, Coinbase, and KuCoin FUD from the US.

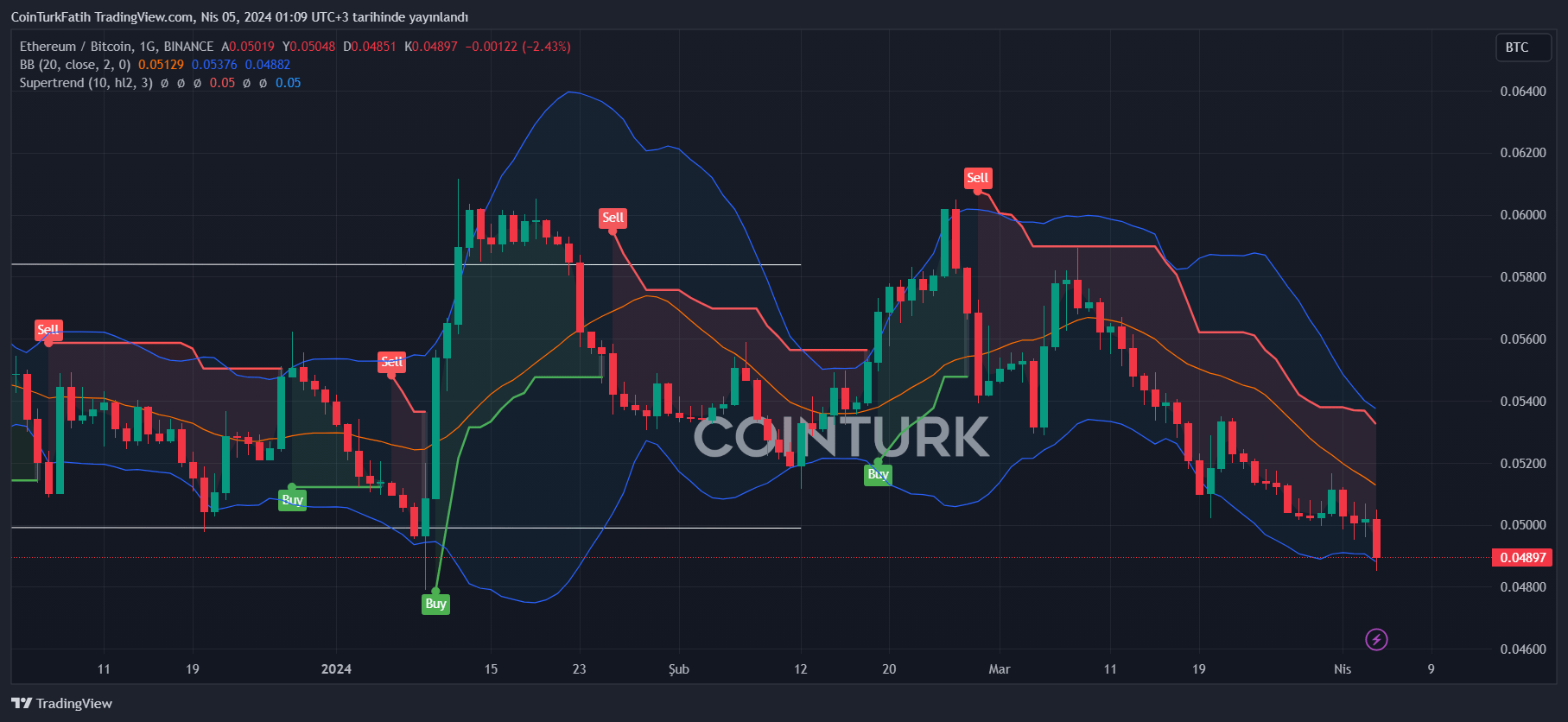

Ethereum Chart Analysis

BTC ETF approval process saw many meetings between issuers and the SEC prior to the current phase. Now, the SEC is only collecting public comments and wants to see defenses against their reluctance to approve an ETH ETF. Experts say that since issuer meetings have not yet started, approval is unlikely to come by May 23.

Looking at the chart, the ETH price is struggling to maintain $3,200 as support. If this support is lost, we could see losses deepen below $3,076. A scenario where sales continue down to $2,729 and $2,478 is possible. The ultimate support is at $2,300.

The ETHBTC chart looks even more negative. The loss of the 0.05BTC support has led to a drop to 0.048. This area was last tested during January 9, 2024, and June 2022. Even on the worst days, ETHBTC did not weaken this much, and if losses deepen, a collapse to 0.043 and 0.039 could continue. This corresponds to $2,000 when calculated with the current BTC price.

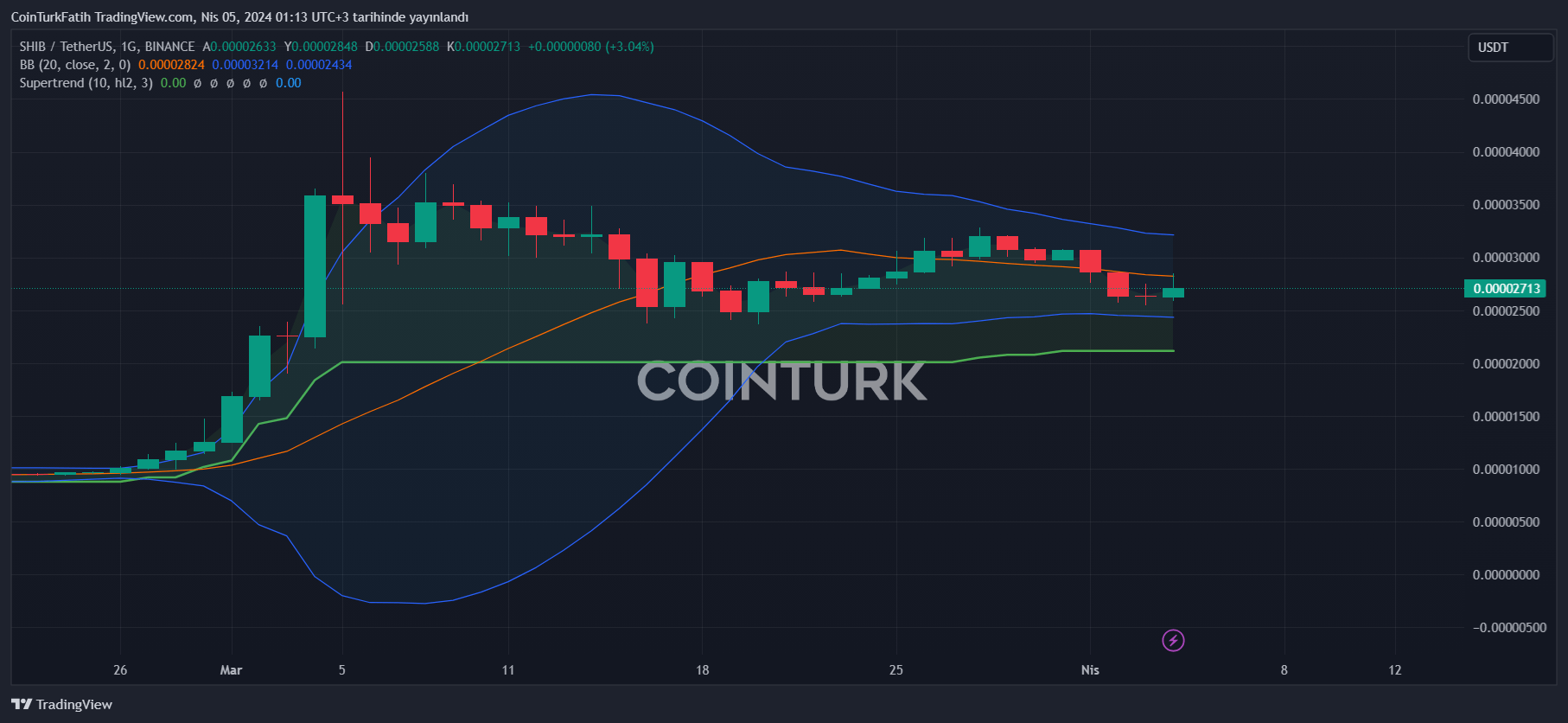

Shiba Coin Commentary

Buyers tried to push the price to $0.0000283 in the April 4 candle but were unsuccessful, and the Shiba Coin team needs to do more than suggestive posts. The key support is at $0.0000238. Below this, there are supports at $0.0000215 and $0.0000164. BTC price performance will be decisive here as well.

Chiliz (CHZ) Analysis

With its price touching $0.14, CHZ Coin continues the day with nearly 8% gains. Although this period should be positive for fan tokens, the situation is not quite so. After starting a recovery from $0.126, CHZ Coin price faced rejection in the last 24 hours at $0.144.

If this level is surpassed, resistance at $0.154 and $0.167 could be targeted. In the opposite scenario, a loss of support could lead to a drop to $0.115.

Türkçe

Türkçe Español

Español